The year is only up and running but Thursday, January 7, will already see the release of an intriguing quarterly financial statement. Micron (MU) will report F1Q21 earnings after finishing off last year on a high.

The year’s final quarter put a layer of gloss on the chip giant’s 2020. After a difficult period, the company shook off earlier woes as overall memory chip demand improved. The stock picked up steam too – up 63% over the past three months.

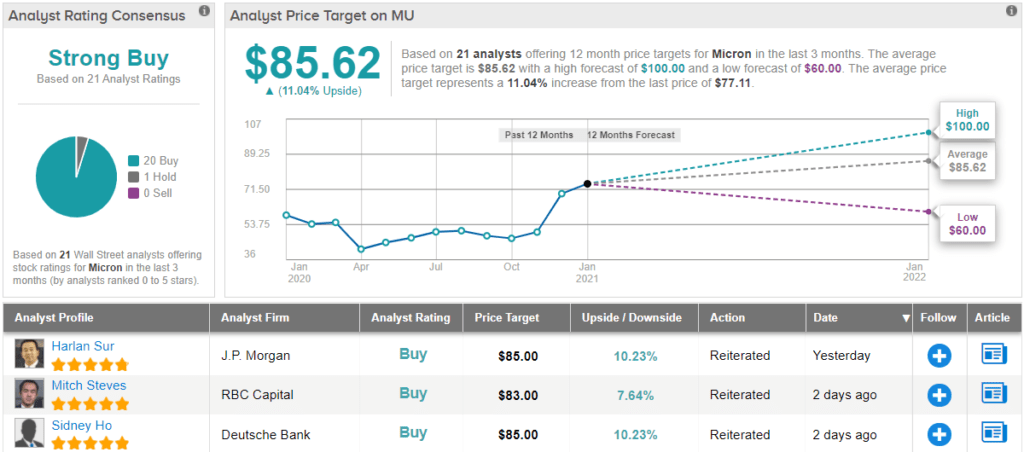

Heading into the print, Rosenblatt analyst Hans Mosesmann expects Micron to deliver the goods. The 5-star analyst rates MU a Buy along with a $100 price target. This figure implies ~30% upside from current levels. (To watch Mosesmann’s track record, click here)

“We see the November quarter being driven by strength across the board (in mobile, auto, industrial, PC, and cloud), with the exception of enterprise which we see continuing to be weak. In addition, we believe both DRAM and NAND saw strength in terms of both pricing and volume,” Mosesmann commented.

Mosesmann’s estimates are in line with the company’s guidance, which called for revenue of $5.73 billion and EPS of $0.71.

Looking ahead to the February quarter (F2Q21), the analyst sees “bias to the upside versus current consensus revenue estimates of down low single-digits q/q.” Although, the period is “seasonally weak,” Mosesmann anticipates improving trends in DRAM “on the heels of mobile, cloud, PC, graphics, and auto/ industrial.”

In fact, the analyst remains resolutely buoyant on all things Micron in the upcoming year.

“We reiterate MU as a top pick for 2021, as Micron’s 1α DRAM and 176-layer NAND help the company maintain a competitive position against the competition and benefit the company in F2H21 and the memory cycle continues its upswing on traditional supply/ demand dynamics,” the analyst said.

Overall, almost all of Mosesmann’s colleagues agree. The stock currently has a Strong Buy consensus rating, based on 20 Buys and 1 Hold. At $85.62, the average price target could yield returns of 11%. (See Micron stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.