2020 has been a hard slog for Lyft (LYFT). The ride sharing platform has suffered at the hands of Covid-19, with shares down by 30% year-to-date.

However, Lyft might be rising from its slumber. The stock is up 31% this week alone, buoyed by a recent overturn of a controversial California ruling passed at the start of the year.

On Tuesday, California voters approved Proposition 22, rolling back previous legislation which required companies to treat independent contractors as full-time employees.

Prop. 22 allows ridesharing and delivery companies to still consider drivers as independent contractors, although it has also set out certain pay requirements and several other benefits, including unemployment compensation and time off due to illness.

While Deutsche Bank analyst Lloyd Walmsley notes that part of Prop 22’s promises will result in higher costs, much of those “can be passed along to consumers.”

That’s not say 2020’s woes are firmly in the past.

“Lyft hasn’t disclosed September trends,” Walmsley noted, “But its July and August rides were both down in the -54% vicinity, and it is unlikely that September would have improved materially given the trends we have seen at Uber and from what we have heard in online travel from the likes of Expedia and trivago.”

So while Walmsley expects a “choppy recovery on the ride share business near-term given spiking COVID cases,” the analyst believes Lyft shares are “poised to see a continued recovery as vaccine news, improving success treating the virus and better testing capacity gets wider distribution.”

Additionally, when compared to archrival Uber, Lyft’s valuation looks like a bargain.

“We think Lyft shares look particularly cheap on EV/revenue and while we see some near-term risk to estimates around the spiking coronavirus cases, we think it is well positioned to see a strong revenue recovery in 2021 with improving profitability,” the 5-star analyst summed up.

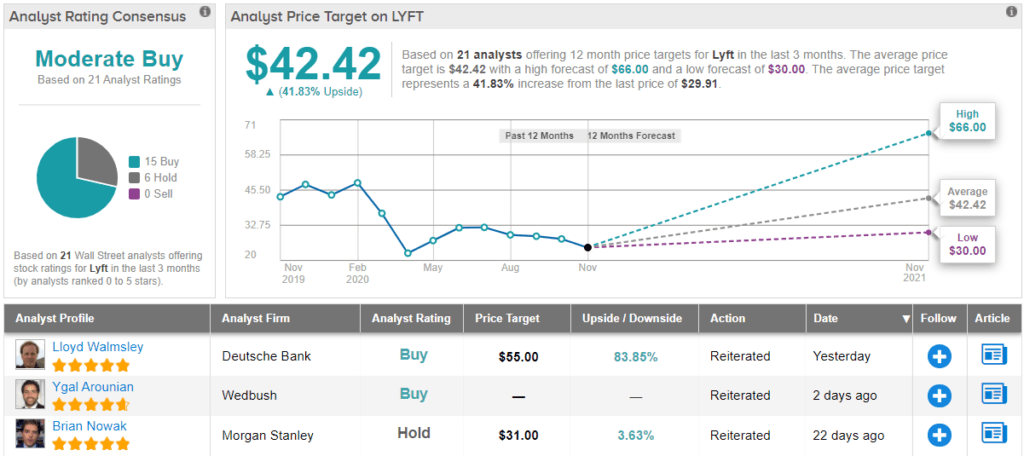

All in all, Walmsley rates Lyft a Buy along with a $55 price target. This figure implies a whopping 84% upside over the next year. (To watch Walmsley’s track record, click here)

There’s healthy upside according to the rest of the Street, too. Lyft’s average price target stands at $42.42 and suggests possible upside of 42%. The stock has a Moderate Buy consensus rating, based on 15 Buys and 6 Holds. (See Lyft stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.