With the global semiconductor market expected to witness double-digit growth in 2022, it could be the right time to invest in semiconductor stocks. Nvidia Corp. (NASDAQ:NVDA), Intel Corp. (NASDAQ:INTC), Advanced Micro Devices, Inc. (NASDAQ:AMD), Broadcom Inc. (NASDAQ:AVGO), and Qualcomm, Inc. (NASDAQ:QCOM) are the five semiconductor stocks that could help investors pocket exceptional returns as the market expands.

According to the World Semiconductor Trade Statistics (WSTS), the global semiconductor market is expected to rise by almost 14% this year to $633 billion, riding on strong chip demand. This follows a 13.3% year-over-year increase in worldwide semiconductor sales to $152.5 billion in the second quarter of 2022, data from the Semiconductor Industry Association (SIA) showed.

Elaborating on the second-quarter figures, John Neuffer, the President and CEO of the SIA, said that semiconductor sales rose “across all major regional markets and product categories” year-over-year.

In 2022, WSTS expects the Logic semiconductor segment to lead all categories by surging 24.1%, followed by Analog at 21.9% and Sensors at 16.6%. It also projects semiconductor sales to rise 23.5% in the Americas, 14.2% in Japan, 14% in Europe, and 10.5% in the Asia Pacific region.

WSTS has also provided a worldwide semiconductor sales forecast for the next year. It anticipates the global semiconductor market to be valued at $662 billion in 2023, up 4.6% year-over-year, driven by mid-single digit growth across all categories. The Logic segment is expected to rise the most next year to reach $200 million and account for around 30% of the total market.

Now, let’s learn more about the five companies mentioned above that could receive a major boost as the demand for semiconductor chips rises.

Before we proceed any further, here is a pictorial comparison of the five stocks, NVDA, INTC, AMD, AVGO, and QCOM, for you to consider.

Nvidia (NASDAQ:NVDA)

Founded in 1993, Nvidia offers computer graphics and artificial intelligence services to industries including transportation, gaming, and healthcare. Based in the Californian city of Santa Clara, the company boasts of a market cap of over $430 billion.

Nvidia recently reported financial results for the fiscal second quarter, which were hit by supply chain constraints and a challenging macro environment. While several analysts reduced their price target for Nvidia, following the release of its results, they continued to maintain a Buy rating on the stock. This signifies that they expect the company to overcome the headwinds and continue to grow.

Is Nvidia a Buy?

On TipRanks, the stock has a Strong Buy consensus rating based on 25 Buys and seven Holds. Nvidia’s average price forecast of $220 implies 22.8% upside potential. Bloggers are also positively inclined toward the stock, as they are 81% Bullish on the company, compared to the sector average of 66%.

Intel (NASDAQ:INTC)

With a market cap of almost $140 billion, Intel is one of the oldest technology companies in the world. It offers Internet of Things (IoT), data center, cloud computing, and PC solutions to power today’s digital world. The California-headquartered company recently signed a $30 billion deal with Canada-based Brookfield Asset Management (NYSE:BAM) to set up a semiconductor fabrication plant in Arizona.

The deal forms a part of Intel CEO Pat Gelsinger’s plan to make the company a leader in contract chip manufacturing. It would also help the tech giant save cash to continue paying dividends. Bernstein analyst Stacy Rasgon believes the deal would rid Intel of the need to borrow funds to implement its expansion plans.

Is Intel a Buy, Sell or Hold?

Based on five Buys, 16 Holds, and nine Sells, Intel has a Hold consensus rating, as per TipRanks. INTC’s average price target of $40.50 suggests 16.1% upside potential to current price levels. Meanwhile, bloggers and retail investors are convinced about Intel’s future growth, which is visible from their positive stance on the stock.

TipRanks data shows that 77% of financial bloggers are Bullish on the stock, compared to the sector average of 66%. Additionally, 1.8% of retail investors on TipRanks have increased their exposure to the stock over the past 30 days.

Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices manufactures and sells graphics, processors, Field Programmable Gate Arrays (FPGAs), Adaptive SOCs (system-on-chip), and software to the gaming and business computing industries. The $150 billion company reported upbeat second-quarter results at the beginning of this month. However, its third-quarter forecast fell slightly short of analyst expectations.

Is AMD a Buy Right Now?

Encouraged by strong second-quarter results, most Wall Street analysts reiterated a Buy rating on AMD recently and suggested that investors could consider buying the dip as the company is poised for long-term growth.

As of now, the stock has a Moderate Buy consensus rating, which is based on 19 Buys, eight Holds, and one Sell. AMD’s average price target of $123.17 implies upside potential of 26.7%.

As per TipRanks, as many as 19 hedge funds that were active in the last quarter increased their stakes in AMD by 1.9 million shares.

Broadcom (NASDAQ:AVGO)

Based out of San Jose, Broadcom designs, manufactures, and sells semiconductor and infrastructure software solutions. Its offerings include motor drive & control solutions, broadband access solutions, enterprise security solutions, financial services solutions, data center solutions, and broadband Wi-Fi AP solutions.

The $222 billion company is scheduled to release its fiscal third-quarter results next week. The Street anticipates earnings to come in at $9.56 per share, compared to $9.07 reported in the second quarter and $6.96 per share reported in the fiscal third quarter of last year. Broadcom expects revenues to total around $8.4 billion in the third quarter.

Is Broadcom a Good Stock to Buy?

All nine analysts that have provided coverage on the stock have a Buy rating on Broadcom, which makes AVGO stock a Strong Buy. Broadcom’s average price prediction of $702.50 mirrors 27.7% upside potential.

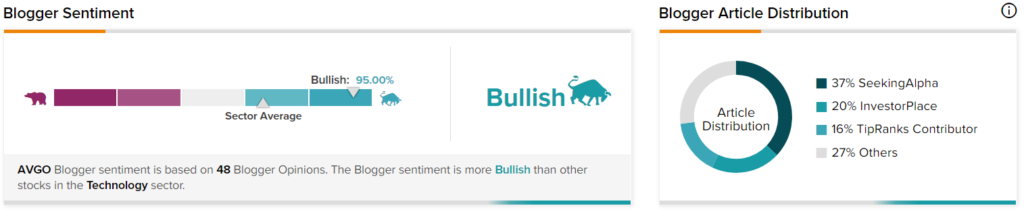

Bloggers and retail investors have a positive stance on the stock. TipRanks data shows that 2.1% of retail investors increased their exposure to the stock over the past 30 days. Further, 95% of financial bloggers are Bullish on AVGO, compared to the sector average of 66%.

Qualcomm (NASDAQ:QCOM)

San Diego-based Qualcomm develops and sells wireless technology, semiconductor chips, IoT, PC computing, and 5G solutions, among others. Last month, the $164 billion company reported outstanding fiscal third-quarter results, driven by record QCT (Qualcomm CDMA Technologies) Automotive and IoT revenues.

However, it lowered its fiscal fourth-quarter outlook to account for the impact of macroeconomic headwinds and lower-than-expected global demand for smartphones. Following the results, John Vinh of KeyBanc said that Qualcomm will be able to boost its share in markets like automotive, augmented and virtual reality devices, and computers.

What Is Qualcomm’s Price Target?

Qualcomm’s average price target stands at $189.85, implying almost 30% upside potential. The stock has a Moderate Buy consensus rating on TipRanks, which is based on 11 Buys and five Holds. Further, QCOM scores a nine out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock has strong potential to outperform the market.

Are Semiconductor Stocks a Good Long-Term Investment?

Semiconductor stocks could prove to be a good long-term investment option as demand for semiconductor products is bound to rise on the back of technological advancements and increased global digital connectivity. Smartphone and computer manufacturers are not the only clients of semiconductor companies anymore. Makers of electronic devices like TVs, refrigerators, washing machines, and LED bulbs have also started using semiconductor products and devices in their offerings.

Additionally, analyst Vinh believes that “deteriorating demand for smartphones” is a short-term phenomenon and is not likely to have any significant impact on the profitability of semiconductor companies.

Read full Disclosure