2020 has seen a wave of chaos hit the stock market. Now, you can add the shenanigans surrounding bankrupt car rental company Hertz (HTZ) to the list, too.

After filing for bankruptcy last month, perplexingly, Hertz stock soared by more than 1,200%, mostly as a result of speculative investors piling in on a penny stock’s momentum play. However, since peaking on June 9, the volatility has been off the charts. Last week, in sequential sessions, the stock dropped by 24%, 40%, 18%, and then climbed 37% higher following news that Hertz had inexplicably received the go ahead to issue up to $1 billion in new stock.

Stunning Wall Street, Hertz was delisted from the NYSE, which has led to the coining of a new term: the IBO – Initial Bankruptcy Offering.

The volatility continued on Monday as Hertz shares dropped by 33% following management’s admission in an 8-K filing that the additional $500 million worth of common stock it plans on selling will probably be “worthless.”

As part of the 8-K filing, Hertz detailed its expected cash outlay for the period between May 25 and August 21, and based on a back of the envelope calculation, Deutsche Bank analyst Chris Woronka estimates the cash burn for the period will “probably be close to $1.2 billion.”

Along with the equity raise, Woronka estimates Hertz will try and sell between 25-30% of its fleet to raise additional cash. With no plans to use the money to replenish its fleet, this just raises more questions concerning Hertz’ future.

The analyst said, “At some point the company will need to ‘turn over’ its existing fleet and purchase new vehicles as replacements in order to offer customers a competitive product… We believe the natural cycle suggests this would likely need to occur ahead of the summer 2021 peak. It’s unclear to us whether HTZ will have ample liquidity (or borrowing power) with which to fund new fleet purchases, particularly since the existing fleet will have moved further down the depreciation curve relative to where a fleet on a ‘normal’ replacement cycle would be at that time (since HTZ did not replace those vehicles with new ones this summer).”

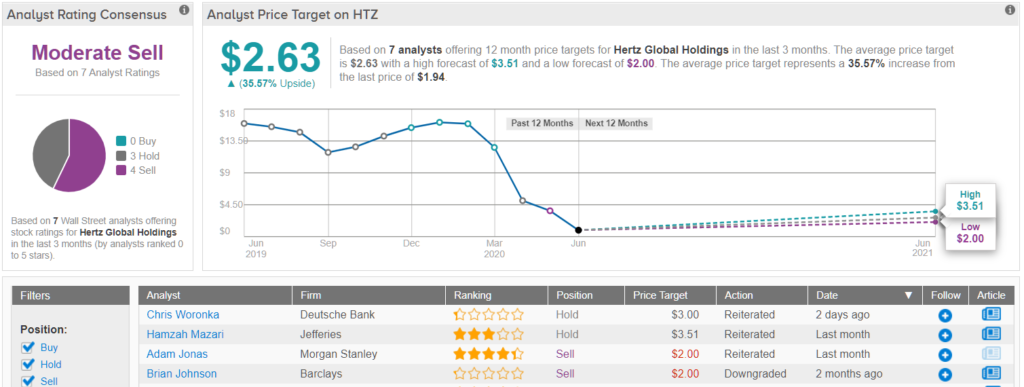

Woronka, therefore, remains on the sidelines. The Deutsche Bank analyst has a Hold rating on Hertz and “based on a 2022E free cash flow recovery scenario,” a $3 price target. Based on this target, the risk-tolerant investor could take home a 66% gain, should the target be met over the next 12 months. (To watch Woronka’s track record, click here)

Overall, the Street’s view on Hertz presents a strange conundrum. On the one hand, based on 3 hold ratings, and 4 Sells, the bankrupt rental car company has a Moderate Sell consensus rating. However, the average price target of $2.63 represents possible upside of nearly 35%. (See Hertz price targets and analyst ratings on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.