SPAC mergers were all the rage in 2020 and the trend looks likely to continue in 2021.

One merger anticipated to close early this year is that of Gores Holdings IV’s (GHIV) assimilation of United Wholesale Mortgage (UWM). The combined entity will operate under the UWM Corporation name and will go by the ticker of UWM.

Gores raised $425 million in its IPO which it is investing in UWM along with an additional $500 million raised via a private placement.

The deal means that, at its close, the combined company will have an equity value of approximately $16 billion, which to date, will make it the biggest business combination for a special purpose acquisition company.

Gores is no stranger to SPACs. Since 2004, the investment company has been taking companies public and has a solid track record. Hostess (TWNK) and Luminar (LAZR) are among some of the company’s recent efforts.

At the other side of the deal, UWM is a fast-growing mortgage lender, acting as a disruptor to the staid mortgage industry through its tech driven approach. The company is the #1 in the country’s wholesale segment, a point not lost on JMP analyst Steven DeLaney.

“UWM is the clear leader in the growing wholesale mortgage origination channel with first-nine-month 2020 volume of $127.9B, for a 34.3% market share, with only one other lender (Quicken at 16.9%) having more than a 7% share,” the 5-star analyst said. “Wholesale margins are materially higher than those seen in the Correspondent channel, and we believe UWM’s approach is ideally positioned for both growth and profitability.”

Meanwhile, Wedbush analyst Henry Coffey believes a “shift in the valuation paradigm” of mortgage companies has been on the table for a while. Coffey points out that “at least in selected cases, investors are willing to rely more on future earnings estimates and P/Es when valuing shares.”

Is UWM such a case? According to analyst, the company ticks all the boxes.

“We would argue that to move into this more elite camp, an independent mortgage company would need to bring to the table demonstrated success at generating consistent GAAP profitability, growth in market share within a respective channel, and some basic commitment to return of capital measures (we prefer dividends over buybacks…) UWM fits all three of these criteria,” Coffey wrote.

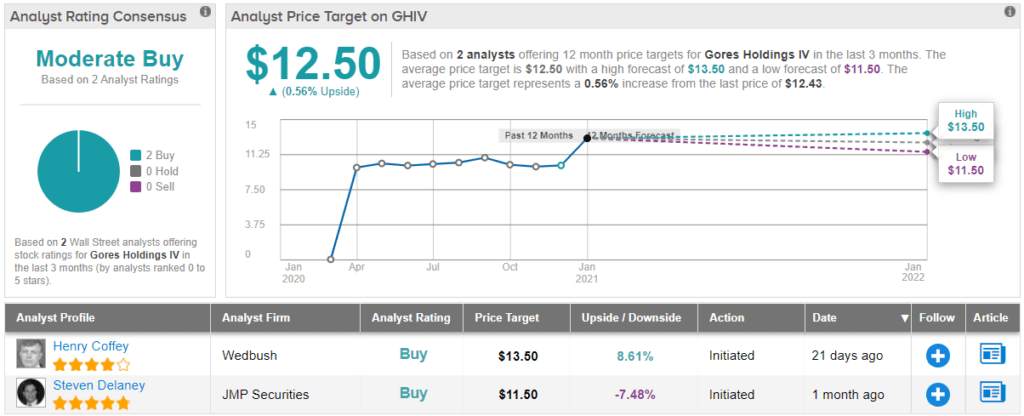

The two analysts are the only ones so far to pitch in with a review, and together provide GHIV with a Moderate Buy consensus rating. However, with an average price target of $12.50, the analysts expect the stock to stay range-bound until the merger is completed. (See GHIV stock analysis on TipRanks)

To find good ideas for SPAC stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.