Last week, fuboTV (FUBO) released Q4 preliminary revenue and subscriber metrics which once again beat prior guidance, keeping the growth story very much intact. However, as has been evidenced by the huge share price decline throughout the past year, the exceptional growth will matter little to investors so long as the company keeps on posting huge losses.

So, the onus is on FUBO to prove that it cannot only grow at a rapid pace but that it can also show it will be able to turn a profit eventually.

According to Needham’s Laura Martin, following chats with the company’s top brass, FUBO is taking meaningful strides in that direction.

Now that FUBO has attained more than 1 million subscribers (1.1 million subs as of the end of 2021), owing to volume discounts, Martin anticipates “visible gross margin expansion over the next 3 years.”

While the analyst had previously believed that as subs continue to grow, TV content costs “step down,” Martin was presented with new information during the conversation.

“What we learned during our fireside chat was that content costs only step down upon contract renewals. The average length of FUBO’s staggered contracts is 2.5 years, so content costs/sub should decline reliably over the next 3 years. If FUBO continues to grow subs, content costs/sub should decline again during the subsequent contract renewal cycle,” the 5-star analyst explained.

Margins will be the focal point in 2022. These should also get a boost from a decline in sales and marketing expenses as a percent of revs, while product innovation is “driving more upsell products per person.” As ad tech improvement is also on FUBO’s agenda, advertising CPMs and revs should also get a boost too.

Other “upside drivers” this year include the ramping of FUBO’s wagering product, and the pivot into purchasing direct rights – such as the recent deal to buy the Canadian rights to the English Premier League for the next 3 years – which could “lower content costs/sub over time.”

As for the profit bogeyman, Martin expects the cash losses to “mitigate” over time. “We don’t foresee FUBO losing money forever,” the 5-star analyst confidently said.

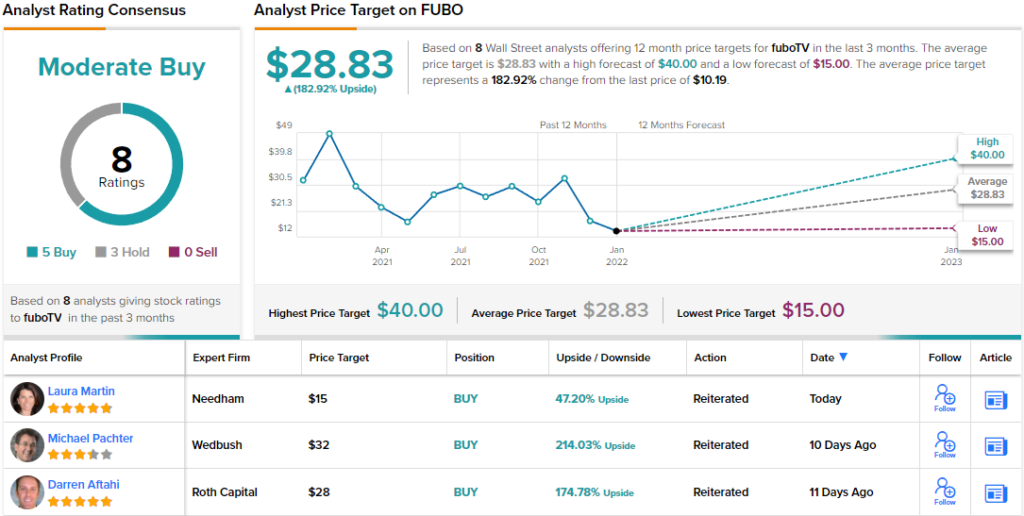

So, down to the nitty gritty, what does it all mean for investors? Martin rates FUBO shares a Buy, although she takes a somewhat more cautious stance on the price target — the figure is slashed from $60 to $15. Overall, there’s upside of ~47% from current levels. (To watch Martin’s track record, click here)

“Although we believe that fundamentals are improving, we lower our 12-month PT to $15 to account for increases to the RFR and ERP assumptions in our DCF,” Martin added.

Overall, FUBO shares hold a Moderate Buy rating from the analyst consensus, based on 8 reviews breaking down to 5 Buys and 3 Holds. The stock is selling for $10.17 and the average price target of $28.83 implies ~183% upside from that level. (See FUBO stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.