The carnage in the energy sector in the first half of 2020 didn’t spare a single company operating in this space. As lower demand and decline in average realized prices took a toll on their revenues and earnings, energy companies lost billions in value. Come 2021, and the rollout of the vaccine, steady improvement in the macroeconomic environment, and a steep recovery in commodity prices, have led to a solid rally in the shares of the companies operating in the energy sector.

Take the case of energy infrastructure company Enbridge (TSE: ENB). Its stock bounced back sharply (up about 60% from the lows in March 2020) and is trading close to the pre-COVID levels, reflecting higher global energy demand, increased commodity prices, and a ramp up in global economic activities. (See Enbridge stock charts on TipRanks)

Enbridge operates four core businesses: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, and Renewable Power Generation. It transports crude oil and natural gas, operates natural gas utility operations, and has ownership interests in about 30 renewable power facilities.

Strong Start to 2021

With the improving operating environment and ramp-up in economic activities, Enbridge had a solid start to 2021. Its CEO, Al Monaco, said that each of its businesses marked a higher utilization rate in Q1. He added that the Q1 performance reflects “resilient demand-pull franchises, top-notch customers and the ongoing recovery of global economic activity.”

The company delivered adjusted earnings of C$1.6 billion in Q1 compared to C$1.1 billion the previous quarter. Moreover, it delivered distributable cash flow (DCF) of C$2.8 billion, reflecting an improvement of C$0.6 billion on a quarter-over-quarter basis.

Enbridge projects higher utilization across its four core businesses in 2021. Meanwhile, it expects to deliver 5-7% growth in its cash flows through 2023.

Solid Dividend History for Enbridge

Dividend yield: 6.36%

Payout ratio: 81.93%

Enbridge has a rich history of consistently paying and increasing its annual dividend. It has paid dividends each year since it was listed on the exchange in 1953. Over the past 26 years, Enbridge’s dividend has grown by a CAGR (compound annual growth rate) of 10%. In Dec. 2020, it increased its dividend by 3% to C$3.34 a share, translating into a dividend yield of 6.36%.

With C$17 billion worth of capital projects to go into service through 2023, Enbridge has strong visibility over its cash flows, indicating that the company is in a solid financial position to grow the future dividend.

Enbridge Risk Factors

According to the new TipRanks Risk Factors tool for the company, Enbridge stock is at risk mainly from two factors: Production risk and Legal & Regulatory risk. Together, they account for 62% of the total risks to the company.

Enbridge stated that its liquid pipeline assets are exposed to throughput risk. Any decline in volumes transported, upheaval in the oil and gas industry, operational incidents, regulatory restrictions, commodity prices, or change in other market fundamentals can take a toll on its revenue and profitability. Furthermore, environmental risks are inherent to its operations.

On the other hand, Enbridge’s take-or-pay framework and cost-of-service arrangements are in place to mitigate the financial impact arising from the changes in commodity prices and demand. Moreover, its long-term agreement with shippers helps in lowering the competition and economic regulation risk. Also, it has appropriate policies and programs to manage environmental risks.

On June 30, Goldman Sachs analyst Michael Lapides upgraded Enbridge’s stock to Hold, citing lower regulatory risks to its Line 3 replacement project. Lapides has a price target of C$51 on the stock, implying an upside potential of 3.8%.

Another analyst, Robert Hope of Scotiabank, said on July 8 that he expects Enbridge’s valuation to improve as the construction of its Line 3 progresses. He reiterated a Buy rating on Enbridge and increased the price target to C$55 (11.1% upside potential).

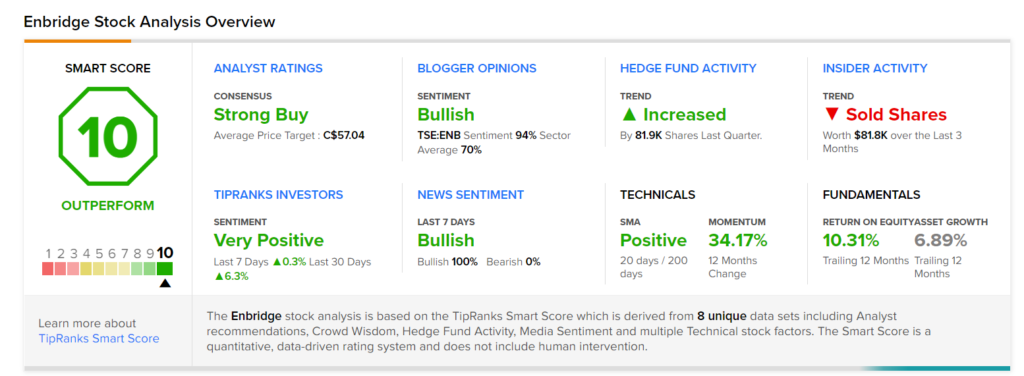

“Perfect 10″ Smart Score

Enbridge stock scores a “Perfect 10” on TipRanks Smart Score system. The Smart Score is a combination of eight unique data sets, including analyst rating, hedge fund activity, and media sentiment, to name a few. A high Smart Score indicates that the stock is likely to outperform the broader markets.

Furthermore, Enbridge stock has positive indicators from financial bloggers and individual investors, as well as from hedge fund managers. TipRanks data shows that financial blogger opinions are 94% Bullish, compared to a sector average of 70%. Furthermore, the Hedge Fund Trading Activity tool shows that confidence in Enbridge is currently positive, as hedge fund managers increased their cumulative holdings by 81.9K shares in the last quarter.

Overall, Enbridge stock has a Strong Buy consensus rating based on 10 Buys and 2 Holds. The average Enbridge price target of C$56.99 implies 15.2% upside potential from current levels.

The Takeaway

With its more than 40 diverse cash flow streams, a contractual framework, visibility over cash flows, and improving energy outlook, one can find Enbridge stock a solid long-term bet in the energy sector. Furthermore, the company has an impressive track record of consistently enhancing shareholders’ value through higher dividend payments.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.