Investing in biotechs can be a risky business. Success hinges mostly on two criteria; promising data from clinical trials or regulatory approval. Get either of these wrong and the push back from the Street can be brutal.

Fortunately, for investors of Aptose Biosciences (APTO), the latest update from the company resulted in the stock blasting higher. Specifically, Aptose disclosed last week that in the early-stage testing of luxeptinib (CG-806) for the treatment of relapsed or refractory AML (acute myelogenous leukemia), the drug generated one CR (complete response).

The r/r AML trial began last October with the first cohort receiving 450 mg BID (twice a day). So far, Luxeptinib (CG-806) has also displayed encouraging anti-leukemic activity and no safety issues have been reported.

For JonesTrading analyst Soumit Roy, the early results are a confidence booster.

“We believe these multiple indications of anti-tumor activity, including a CR, are clear indications of entering the therapeutic dose range – possibly between 600-750 mg BID,” said the 5-star analyst. “To be noted that these patients are late line r/r AML and potential duration of response of 3-5 months would significantly improve in earlier lines.”

In June, the ongoing trial’s updated data will be presented at EHA (European Hematology Association) and should include data from all 450 and 600 mg BID groups – probably from between 5 to 6-patients.

Luxeptinib is also currently in a Phase 1 a/b clinical trial for the treatment of B-cell Malignancies, including chronic lymphocytic leukemia (CLL) and non-Hodgkin’s lymphomas (NHL), for which updates will also be presented at EHA.

Roy thinks Aptose is developing a “potentially best-in-class reversible BTK inhibitor,” and pending validating data, the “leading small cap pure play,” could be an M&A target.

As far as the biotech’s cash position is concerned, Aptose saw out 2020 with $122.4 million, which Roy thinks will be enough to fund all planned operations including research and development into 1H23.

Aptose shares have raced ahead 70% over the past five trading sessions, but Roy believes the stock isn’t expensive and may have a lot further to run.

The analyst rates APTO a Buy along with a $14 price target. This figure implies a whopping 125% from current levels. (To watch Roy’s track record, click here)

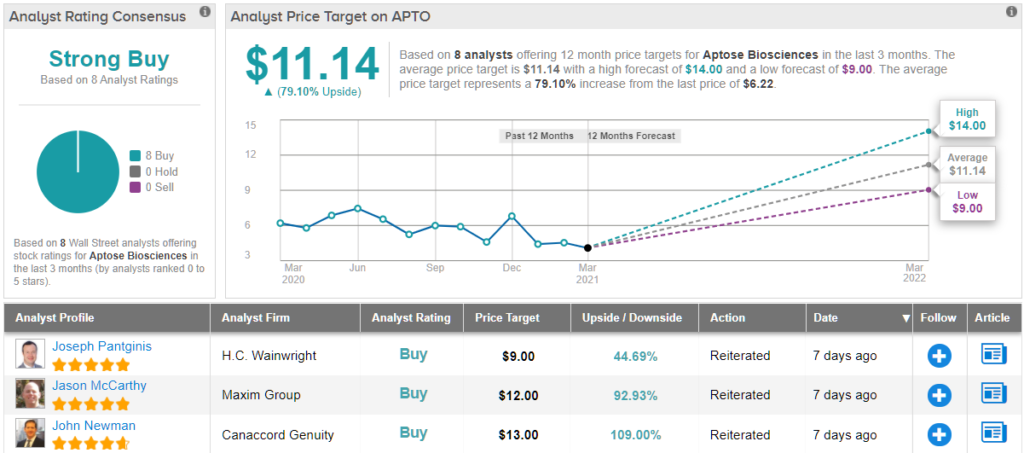

Seven other analysts have recently thrown the hat in with an Aptose review, and all are almost as enthusiastic as Roy. The additional Buys result in the stock’s Strong Buy consensus rating. At $11.14, the average price target suggests gains of 79% on the 12-month horizon. (See APTO stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.