Much has been made of the major near term catalyst for Apple (AAPL) — the iPhone 12 supercycle. The anticipation is for a big chunk of Apple’s global fanbase to upgrade to the new 5G-enabled handsets over the next few years.

However, J.P. Morgan analyst Samik Chatterjee says expectations might be a tad optimistic.

“While checks indicate robust demand for 5G iPhones, particularly with lead times expanding for iPhone 12 Pro, upside to aggregate volume expectations relative to bullish buy-side expectations appears limited, which have been primed for a strong 5G cycle,” the 5-star analyst said.

In fact, heading into the new year, Chatterjee tempers investors’ expectations for Apple stock to deliver the same returns investors have grown accustomed to during the last few years’ bull run. The analyst says shareholders should expect “modest returns in 2021.”

That’s not to say Chatterjee thinks Apple’s issues run any deeper. These “modest returns” are in the 20% region (vs. this year’s 74% gain). Moreover, the analyst believes there are other causes for optimism.

In contrast to lowered 5G expectations, checks are “indicating better consumer demand for legacy iPhones (particularly iPhone 11),” and there are “WFH tailwinds for Mac/iPad, and anecdotal evidence on strength in Wearables.”

The latter, in particular, could be a source of upside in FY21.

“Recent promotional activity as well as consumer preference relative to Apple Watch and Airpods suggests upside to consensus estimates for the Wearables segment,” Chatterjee said. “For example, latest IDC forecast estimates Apple Watch volumes to increase +20% y/y in CY21, a mid- to high-single digit increase over forecast earlier in the year.”

Overall, Chatterjee reiterated an Overweight (i.e. Buy) rating on Apple shares along with a $150 price target, which implies an 18% upside from current levels. (To watch Chatterjee’s track record, click here)

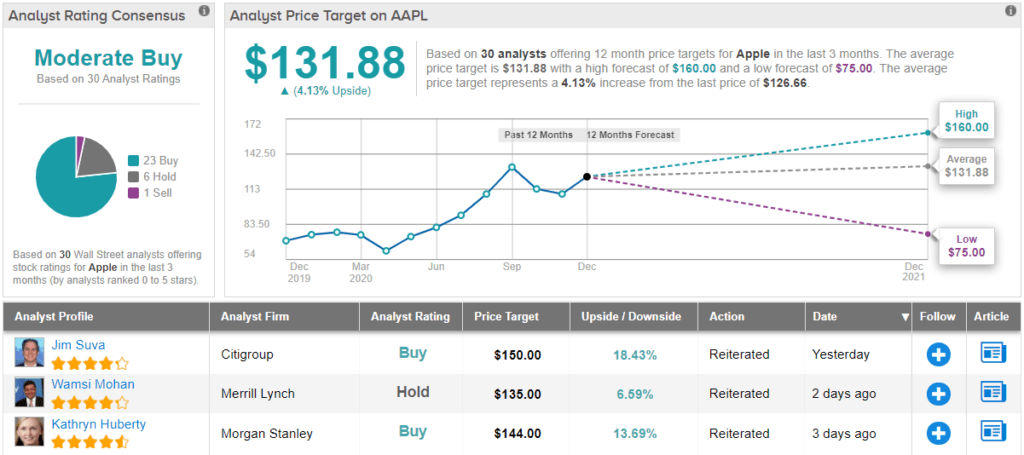

Where does the rest of the Street side on Apple? It appears mostly bullish. Apple’s Moderate Buy consensus rating is based on 30 reviews breaking down to 23 Buys, 6 Holds and a single Sell. However, the majority expect shares to stay range bound for now, as the current $131.88 average price target indicates. (See Apple stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.