Before Thursday’s market action kicks off, Alibaba (BABA) will step up to the earnings plate and deliver F4Q22’s financials. The latest quarterly update comes against a backdrop of a contracting Chinese economy, supply chain woes and the recent zero-COVID lockdowns.

Taking these factors into consideration, ahead of the print, Baird’s 5-star analyst Colin Sebastian thinks some revisions are in order on the outlook for F23.

The analyst now anticipates F1Q23 (June) revenues will increase by 4% year-over-year to reach ¥214.7 billion, below the prior forecast of ¥228.4 billion. This factors in the China commerce and international commerce segments dialing in revenue of ¥144.8 billion and ¥15.9 billion, respectively, vs. the ¥157.4 billion and ¥16.7 billion expected before. Sebastian’s full year forecast now calls for revenue of ¥945.7 billion, below the previous estimate of ¥959.3 billion.

The new revised estimates “primarily reflect the deceleration in e-commerce and retail sales reported by China’s NBS for April.” “Additionally,” Sebastian explained, “we believe that additional headwinds from recent pandemic-related lock downs in certain cities could impact New Retail and advertising revenues.”

There are also respective reductions to the F1Q and FY23 EBITA estimates; these now stand at ¥45 billion (representing a 20% margin) and ¥149.8 billion (15.8% margin vs. the prior 18.6%).

Despite the “near-term headwinds,” the company’s continued focus on innovation and product development is encouraging and there have been signs the operating climate for Internet companies in China may be “normalizing.”

“If that proves accurate,” says the analyst, “we believe there could be material upside in shares over the long term. For now, however, we think management’s tone could remain cautious with respect to near-term growth and margins.”

Other things to look out for on the earnings call include the recent lockdowns’ effect on the supply chain, the state of the regulatory environment, the progress of Taobao Deals and Taocaicai, growth and margins of the Cloud segment and the company’s capex plans.

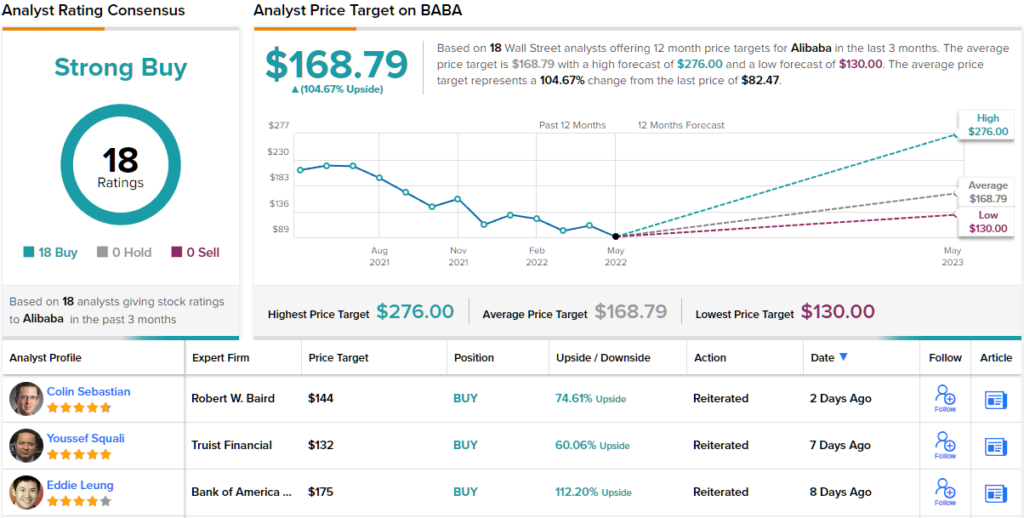

All in all, Sebastian reiterated an Outperform (i.e. Buy) rating on BABA shares along with a $144 price target. Should his thesis play out, a potential upside of ~75% could be in the cards. (To watch Sebastian’s track record, click here)

Overall, the analysts are fully behind Alibaba right now; based on Buys only – 18, in total – the stock boasts a Strong Buy consensus rating. Shares are priced at $82.47, and their $168.79 average price target suggests room for ~105% growth on the one-year time horizon. (See Alibaba stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.