China’s clampdown on technology companies, an economic slowdown, and heightened competitive activity have weighed on Alibaba’s (NYSE:BABA) stock. Given the challenges, this Chinese internet giant’s ADR (American Depositary Receipt) lost a considerable portion of its value and crafted a new low of 73.28 in March.

Nevertheless, the expected rollout of market-friendly policies from China and Alibaba’s record stock buyback plan led to a recovery in its share price. Notably, Alibaba’s stock has jumped about 59% from its recent lows.

Now What?

Alibaba recently announced an increase in its share buyback plan to $25 billion from $15 billion. Earlier this month, during the Q1 conference call, Alibaba announced that it had raised its share repurchase program to $15 billion from $10 billion.

The company stated that the new plan is effective for two years (through 2024) and represents management’s confidence in future growth prospects.

Citigroup analyst Alicia Yap views Alibaba’s new stock repurchase plan as a positive development. She stated that the expansion of the buyback plan reflects management’s views that Alibaba’s current stock price is “undervalued and attractive.”

Yap is bullish on Alibaba, and her price target of $200 indicates 71.6% upside potential from current levels.

Along with Yap, Goldman Sachs analyst Piyush Mubayi kept his Buy rating on Alibaba stock. Mubayi stated that Alibaba’s enhanced share buyback plan better aligns with shareholders’ and management’s interests.

Bottom Line

The recent developments are reassuring for Alibaba’s shareholders. While management’s expanded share repurchase program shows its confidence in Alibaba’s prospects, Chinese vice-premier Liu He’s positive commentary indicates the easing of regulatory pressure.

Another positive signal comes from TipRanks’ investors. It’s worth noting that 2.1% of investors holding portfolios on TipRanks have increased their stake in BABA stock over the past month.

However, macro concerns and competitive headwinds could continue to impact its near-term performance.

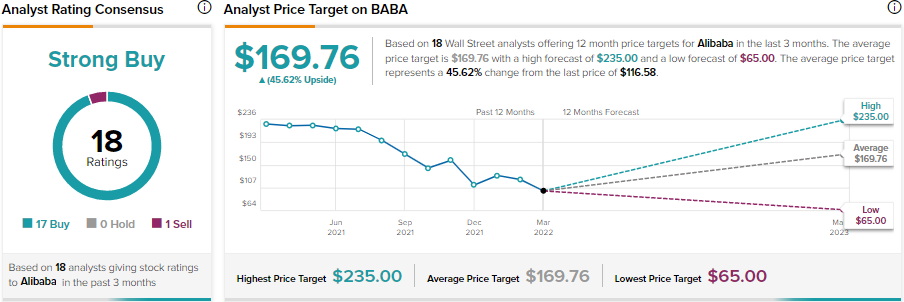

Nevertheless, Alibaba stock sports a Strong Buy consensus rating on TipRanks based on 17 Buy and 1 Sell recommendations. Moreover, the average Alibaba price target of $169.76 implies 45.6% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure