Alibaba (BABA) has a lot of things going right for it. It is the largest e-commerce player in China, with a 69% market share in 2020, according to Goldman Sachs. Almost 53% of all Chinese digital sales in 2020 were on Alibaba, aka the Amazon (AMZN) of China. Its revenues for FY21 came in at $717.29 billion, up from $509.17 billion in FY20. It had 912 million active annual customers as of June 30, 2021. These numbers make a very good case for the stock.

However, investors are wary about the stock. It has had its fair share of troubles in the last 12 months but it is slowly clawing its way out of a hole.

Investors are worried that the Chinese government is not done with Alibaba, once a stock-market darling, and one of the biggest corporate giants in the country. The company has taken multiple hits over the last year, and it has been hurt. Alibaba stock has fallen from $304 levels in October 2020 to $157 as of this report. It has been battered a little too much, and this could be a perfect opportunity for savvy investors to become bullish on the stock. I am bullish on this stock.

Right now, everyone’s focus in China is on Evergrande (EGRNF). The real estate behemoth was a victim of China’s “three red lines” policy for real estate companies to prevent them from over-leveraging themselves. It lost access to debt, the engine on which it built its business, and Evergrande now seems to be falling apart.

While everyone is focusing on Evergrande, Alibaba stock looks like it is making a comeback in October after falling to $144 levels on September 27.

Charlie Munger certainly seems to think so. The Daily Journal (DJCO), of which Munger is the chairman holding 3.6% of the company’s shares, increased its share in Alibaba to 302,060 shares at the end of Q3 2021 from 165,320 shares at the end of Q1 2021. This takes the company’s total stake in Alibaba to $45 million.

Getting Over a Rough Time

Alibaba stock has been on a sticky ground since October 2020, when founder Jack Ma criticized China’s regulatory system. The repercussions were severe. Within a month, Chinese authorities put paid to a planned $37 billion IPO by the company’s finance arm Ant Financial.

The State Administration for Market Regulation (SAMR) announced an antitrust probe into the company in December. Alibaba was then fined a record $2.75 billion in April this year. Ma has been lying low and pursuing painting as a hobby.

In early September, Alibaba announced that it would invest $15.5 billion (100 billion yuan) by 2025 to create a “common prosperity” fund. There are two ways to look at the move by the e-commerce giant which became the latest corporate to support Chinese Premier Xi Jinping’s social initiative to alleviate social inequality in the country.

One is that the company has caved, since it is unlikely that this fund will ever turn a profit. The other perspective is that Alibaba has paid an unofficial tax in order to take the pressure off its back.

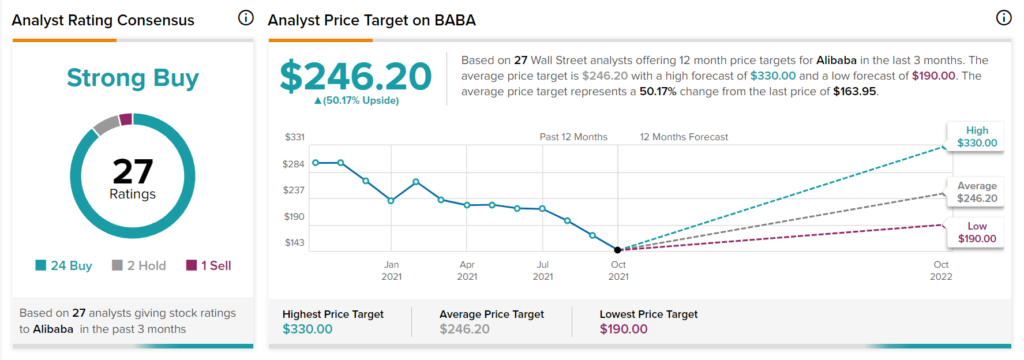

Tipranks’ Stock Investors Tool indicates that analysts think it’s the latter, with 23 out of 27 analysts recommending a Buy on Alibaba. The highest price target for the stock is $330, which is a potential upside of a little over 101% from its October 11 closing price of $163.95. The average Alibaba price target is $246.20, which is a healthy 50.17% upside on the stock.

Valuation Metrics

Comparing Alibaba and Amazon, the benchmark for the industries in which Alibaba operates, shows that the Chinese company’s financials are in good health.

| Alibaba | Amazon | |

| PE Ratio | 19.41 | 57.3 |

| Price/Sales Ratio | 3.8 | 3.8 |

| Gross Margin | 39.68% | 27.65% |

| Operating Margin | 21.91% | 6.88% |

| Current Ratio | 1.76 | 1.2 |

| Total Debt/Equity | 0.15 | 0.93 |

Alibaba’s PE ratio is lower than Amazon’s, while the price/sales ratio is the same. It’s important to note that the stock price/sales ratio has fallen from around 8 to below 4 and it is severely undervalued. Its margins are a lot higher than the American company, as is its current ratio while its debt/equity is a lot lower than Amazon’s.

With numbers like these, it is not unreasonable to expect Alibaba stock give solid returns from its current levels.

Great Financials

Alibaba’s numbers for Q1 FY22 (quarter ended June 30, 2021) beat analyst expectations handsomely. Revenue came in at $32 billion, an increase of 34% year-over-year. Free cash and cash equivalents at the end of the June 2021 quarter amounted to $72 billion. The company announced an increase in its share repurchase program from $10 billion to $15 billion which will run through CY 2022.

Alibaba has such a great set of numbers coming in at a time when the Chinese government has tried its best to make life difficult for the company. Therefore, it’s hard to not see that the company might just prevail in a very tough environment. Investors might want to consider this stock.

Disclosure: At the time of publication, Hashtag Investing did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.