On Wall Street, some things never change. High inflation or not, the fact of the matter remains that healthcare stocks are the epitome of risk/reward plays. Why? It comes down to the nature of the industry itself.

Healthcare companies are unique in that their financial performances aren’t necessarily the most important piece of the puzzle. Rather, a few key factors like clinical data readouts or regulatory approvals indicate whether or not a particular name will be able to generate sustainable revenues in the long run. As such, any development, good or bad, can act as a catalyst that launches shares in either direction.

Against this backdrop, Credit Suisse analyst Richard Law released a series of reports on biotech firms. Law’s reviews sum up the Street’s wisdom on these stocks – they offer investors a triple-digit upside in the year ahead. So, for investors seeking to double their money or better, this may be the place to start. However, given the risk involved with healthcare stocks, due diligence is essential. Now let’s get into the details.

Kymera Therapeutics (KYMR)

First up is Kymera Therapeutics, a small-cap biotech researching new drug candidates to attack a variety of disease conditions, from autoimmune and inflammatory conditions to cancers with both liquid and solid tumors. Kymera’s research pathway uses the company’s proprietary platform, Pegasus, which is built to create small-molecule protein degraders. Every biological function revolves around proteins – including disease functions, making protein degradation a promising pathway for the creation on new therapeutic agents.

Kymera is at the beginning of the clinical stage, and has several drug candidate programs in its pipeline and entering clinical trials. The most advanced of these is KT-474, an IRAK4 degrader which the company is developing in partnership with Sanofi, for the treatment of IL-1R/TLR-driven autoimmune and autoinflammatory diseases. These conditions have high unmet medical needs, and KT-474 is currently undergoing early phase trials. The Phase 1 dose escalation trials were completed last year, and the company has selected a dose for the Phase 1 patient cohort (Part C). This 20 patient phase of the study will study the drug’s effect against hidradenitis suppurativa (HS) and atopic dermatitis (AD). Clinical data from this study is expected in 2H22.

The next major programs in Kymera’s pipeline are KT-413 and KT-333. These are both protein degraders and have demonstrated efficacy against target proteins as part of their anti-tumor activity. Kymera is transitioning these products from preclinical to clinical stages, and is looking to release proof-of-mechanism (POM) Phase 1 data by the end of this year. KT-413 is an IRAKIMiD degrader, and KT-333 is a STAT3 degrader; both are under investigation against a range of tumor types.

Finally, Kymera is on track to file its Investigational New Drug application for KT-253, an MDM2 protein degrader that has shown promise in preclinical studies as an effective agent against many classes of tumors.

The active pipeline, with plenty of possible wins, is the key point here for potential investors. As Credit Suisse’s Richard Law puts it: “[Kymera] has the capability to develop both heterobifunctional and molecular glue degraders. Through the mapping of ~600 E3 ligases and utilizing artificial intelligence (AI) algorithms, KYMR is able to construct degraders that are optimized to target proteins including those that are ‘undrugged and unligandable.’ Although KYMR is still in the early stages of development, we believe it has many shots on goal.”

Looking forward, Law believes that Kymera’s future will be “drive by these results for a derisked target in large immunology markets, along with a catalyst-rich calendar of near-term readouts that could further drive stock value.”

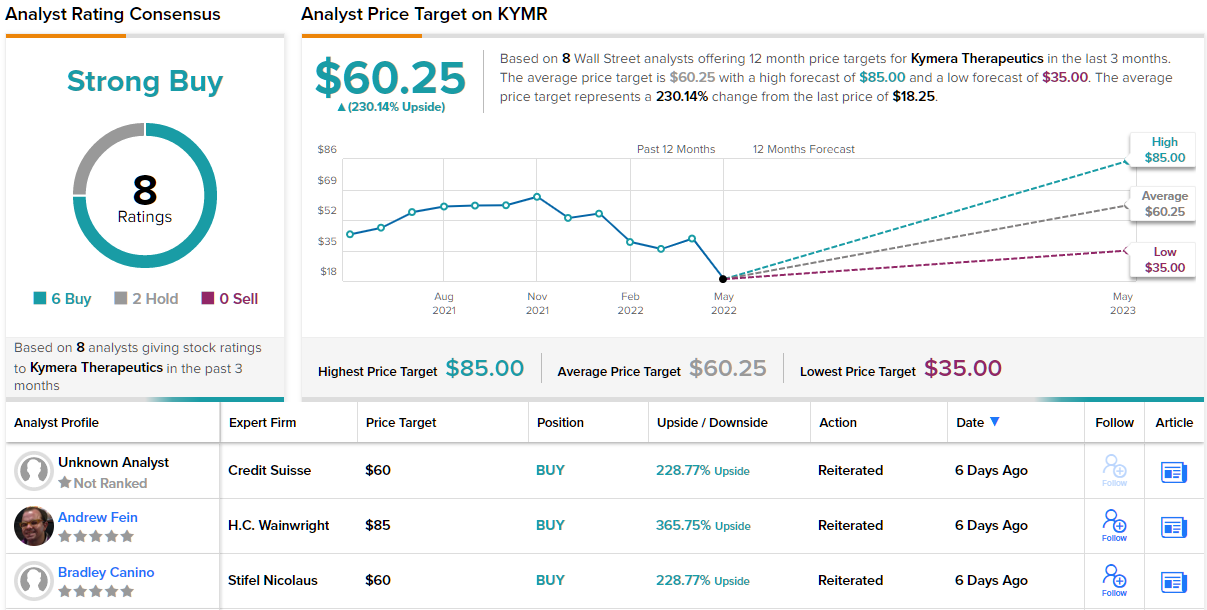

To kick off his coverage, Law issued an Outperform (i.e. Buy) rating on KYMR, and set a $60 price target, implying ~229% upside potential. (To watch Law’s track record, click here)

Credit Suisse’s stance is hardly the only bullish take on Kymera – the stock has 8 recent analyst reviews that break down 6 to 2 in favor of Buys over Holds, for a Strong Buy consensus. The average price target of $60.25 implies an upside of 230% from the trading price of $18.25. (See KYMR stock forecast on TipRanks)

Arvinas (ARVN)

The next Credit Suisse pick we’ll look at is Arvinas, another clinical stage researcher. Arvinas is also making moves in the field of protein degradation – this is a relatively new area in clinical research, and offers a wide field for companies able to get in. Arvinas has established its own drug development platform, the proprietary PROTAC platform, for the engineering of proteolysis targeting chimeras. Over the past several years of operations, Arvinas has brought three drug candidates to the clinical study stage.

Both of Arvinas’ leading candidates are designed to target a specific cancer. ARV-471, which was well-tolerated by patients in Phase 1 trials, is currently undergoing several clinical studies in the treatment of metastatic breast cancer. The company expects to release safety data from a Phase 1b combination trial, testing ARV-471 in conjunction with Palbociclib, during the second half of this year. Data from the Phase 2 VERITAC dose expansion trial is expected on a similar timeframe.

Arvinas’ other leading drug candidate, ARV-110, branded as bavdegalutamide, is a potential treatment for metastatic castration-resistant prostate cancer (mCRPC). Upcoming catalysts this year include discussions with the FDA on the possibility of an accelerated approval pathway for the drug, to be held in 2Q, and a pivotal trial for mCRPC patients with the specific tumor mutations, AR T878/H875. This potential trial is planned for 2H22.

In addition to these leading candidates, Arvinas has brought ARV-766 to the clinical stage. This drug candidate, like ARV-110, targets androgen receptor and is designed to treat mCRPC. The company plans to release Phase 1 data on dose escalation later this year and to initiate a Phase 2 expansion trial in the second half.

In his coverage for Credit Suisse, Richard Law notes that this company has been a leader in the protein degradation field, witting: “ARVN is differentiated from other protein degrader companies by its leadership, deep history, and extensive experience in protein degradation. Its founders are pioneers of protein degradation, and ARVN has continued in their footsteps leading the field by being the first to develop an oral PROTAC, cross the blood -brain barrier (BBB ), achieve positive proof of concept (POC) in humans, and advance into Phase 2 study.”

Law goes on to note that ARV-471 has “potential to become the best-in-class estrogen receptor-targeting therapy,” and describes ARV-110 as “a second pillar of value.”

With “many shots on goal and catalyst events in 2022,” Law rates ARVN an Outperform (i.e. Buy) along with a $104 price target. There’s plenty of upside – 170% to be exact – should the target be met over the next 12 months.

Law is no outlier with his bullish view of ARVN. The stock’s 13 recent analyst reviews include 11 Buys against 2 Holds, backing its Strong Buy consensus rating. Shares are priced at $38.54 and the $109.58 average target suggests a potential upside of 184% in the next 12 months. (See ARVN stock forecast on TipRanks)

Intellia Therapeutics (NTLA)

For the last biopharma on our list, Intellia, we’ll shift gears a bit and move over the to the field of gene editing. Intellia is working on new therapeutic drugs for the treatment of genetic diseases, making use of the CRISPR gene editing tech for both in vivo and ex vivo research programs. The company has several drug candidates in early-stage clinical trials, and several more on the cusp of moving from preclinical to clinical research.

The leading candidate is NTLA 2001, a potential treatment for ATTR amyloidosis. NTLA 2001 is intended as a single-dose therapeutic, and early clinical data from a 15 patient Phase 1 study showed clinically significant improvement after the dose. The drug was well tolerated at several dose levels, and the study results have led Intellia to begin consideration of implementing Part 2 of the Phase 1 study at an 80 mg dose. Further data on these studies will be released later this year.

Intellia is also evaluating NTLA 2002 at the early clinical stage. This drug, a treatment for Hereditary Angioedema (HAE), is undergoing a single-ascending dose Phase 1/2 study of safety, tolerability, and therapeutic activity. Dosing has been completed for the first patient cohort, and patient enrollment has begun for the second cohort. Interim data is expected for release on this study in 2H22.

Unlike most clinical-stage biopharmas, Intellia has a steady revenue stream, derived from partnership agreements. The company recorded $11.3 million in collaboration revenue during the first quarter, and ended the quarter with $994.7 million in cash and liquid assets. At current expenditures, the company can fund operations for another 6 quarters with the cash on hand.

All of this adds up to a company that, in Richard Law’s words, is ‘time to get excited about.’ He goes to say, “Clinical data already suggest ‘2001 could be effective in ATTR with polyneuropathy (ATTRv-PN) and potentially hereditary ATTR cardiomyopathy (ATTRv-CM) patients. The wild-type (wt) ATTR-CM is by far the largest opportunity, and success there is also possible but slightly less certain. NTLA’s approach seems plausible, and any positive indication shown in wtATTR-CM could unlock substantial value for NTLA.”

“Besides ATTR, preclinical data for hereditary angioedema (HAE) are impressive, and success in clinical studies could add value and further boast NTLA as the world leader in gene editing,” the analyst added.

These comments back up the analyst’s Outperform (i.e. Buy) rating, while his $98 price target implies ~136% upside potential. (To watch Law’s track record, click here)

All in all, the Strong Buy consensus rating on NTLA is supported by 15 Buy reviews, overwhelming the single Hold. The Street’s average price target of $123.69 indicates room for a 198% upside from the trading price of $41.45. (See NTLA stock forecast on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.