The year 2022 was marked by a slew of macroeconomic factors that elevated the prospects of certain sectors while considerably diminishing the outlook for a few others. The unprecedented war led to a rise in oil and gas prices, which tremendously brightened the prospects of the Energy sector. However, the same inflationary environment dug a hole in consumers’ pockets, leading to a steadfast decline in the Retail industry.

Further, the slowing economic growth caused a decline in corporate earnings, which had a number of unintended consequences. Corporations led the rally of hiring freezes and employee layoffs, while also lowering their advertising budgets to cut costs, which ultimately befell the technology sector and social media companies.

To make things worse, the Federal Reserve increased interest rates five consecutive times this year to combat inflation. The domino effect of the war has challenged the scenario of 2023, but there are a few companies that still show promising prospects. Combined with the TipRanks Smart Score Rating system, we have discovered ten gems that could add sheen to your portfolio in 2023.

Wall Street analysts are highly optimistic about these companies’ stock trajectory and have allotted high price targets that display impressive upside potential for the next 12 months. Let’s take a closer look at these companies and why analysts remain bullish on them.

Fortinet, Inc. (NASDAQ:FTNT)

Market Value- $42.40 billion; Smart Score- “Perfect 10”

California-based Fortinet (FTNT, $54.27) is an end-to-end cybersecurity solutions provider. The company earns subscription-based revenue by offering services including physical firewalls, antivirus software, intrusion prevention systems, and endpoint security components. Year to date, FTNT stock has lost 18.5%.

Recently, Robert W. Baird analyst Shrenik Kothari had an interesting and enlightening meeting with Fortinet’s top brass. “We came away with a better understanding of FTNT’s present demand drivers, technology, and platform strategy and a higher conviction that the company is well-positioned to navigate the tough macro environment,” Kothari added.

Kothari has a higher price target on FTNT stock at $70, which implies a nearly 29% upside potential. Meanwhile, on TipRanks, the average Fortinet price forecast is $65.59, implying 20.9% upside potential from current levels. In the last three months, 16 analysts have recommended a buy on FTNT, while only one has recommended a hold.

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Market value- $9.92 billion; Smart Score- “Perfect 10”

Ireland-based Jazz Pharmaceuticals (JAZZ, $157.50) is a specialty biotechnology company focused on the identification, development, and commercialization of pharmaceutical products in the areas of narcolepsy, oncology, pain, and psychiatry. Year to date, JAZZ stock has grown 20.2% thanks to continued demand momentum for its drugs.

Analyst Madhu Kumar of Goldman Sachs is encouraged that Jazz was able to meet its 5% adjusted operating margin improvement this year, well ahead of its plan to do so in 2025. Notably, Kumar believes that “management will be able to maintain these operating margin improvements into 2025, even without substantial top-line growth from key franchises.”

The five-star analyst has a Buy rating on JAZZ stock with a price target of $190 (20.6% upside potential). Meanwhile, on TipRanks, the average Jazz Pharmaceuticals price target is pegged higher at $195.20, implying 23.9% upside potential from current levels. All ten analysts tracking JAZZ have a unanimous Buy rating on the stock.

Apple (NASDAQ:AAPL)

Market Value- $2.28 trillion; Smart Score- 8

Here comes the trillion-dollar company, Apple (AAPL, $143.21), which has rolled out several beloved products that unfailingly make it into every home. The iPhone maker has seen the demand for its products soften owing to inflationary trends and shifting consumer preferences. Year to date, AAPL stock has lost 20.9%.

Additionally, the worker unrest at Foxconn, the Zhengzhou manufacturing hub for iPhones in China, has also put a strain on the supply. Apple is mulling over shifting its manufacturing base and over-dependence on China to other countries, and India may be a potential landmark.

Further, the passing of the Digital Markets Act (DMA) by the European Union may hurt Apple’s revenues to a small extent. Through the DMA, Apple will be required to allow third-party apps on its iOS App Store, to combat anticompetitive practices.

Having said that, Evercore ISI analyst Amit Daryanani does not believe the DMA ruling will have a significant impact on Apple’s app store revenues. The analyst remains highly optimistic about Apple’s future prospects and recommends a Buy rating on the stock. His price target of $190 (32.7% upside) is also above the average Apple price target of $179.71, which implies 25.5% upside potential from current levels. Also, the analyst consensus is a Strong Buy based on 24 Buys and four Hold ratings.

T-Mobile US (NASDAQ:TMUS)

Market value- $177.12 billion; Smart Score- 8

T-Mobile US (TMUS, $142.36) is undoubtedly one of the most insulated stocks in the current macro backdrop. The company’s leading position as a 5G high-speed wireless service provider continues to drive customer growth and, thus, strong cash flow generation. The telecom behemoth has gained 24.4% so far this year.

TMUS registered record subscriber growth for the quarter ending September 30, 2022, with a whopping 1.6 million postpaid net customer additions and 578,000 High-Speed Internet net customer additions.

Impressively, TMUS recently announced that its Extended Range 5G network now covers 323 million people, accounting for more than 95% of Americans. Looking at the figures, there is no stopping the telecommunications giant from spreading its wings wider across the U.S.

Analyst Ivan Feinseth of Tigress Financial is highly motivated by “TMUS’s strong customer acquisition growth and services revenue momentum,” which will continue to drive meaningful business trends. Furthermore, Feinseth believes that the rapid adoption of 5G wireless technology positions the industry for significant growth in the future. The analyst views TMUS as a “very strong, nimble, and market niche-focused competitor.”

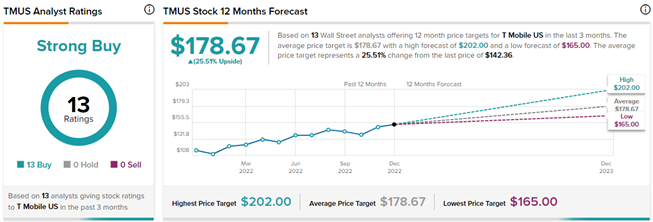

The five-star analyst’s price target on TMUS stock is higher than the average analyst price target of $178.67, implying 25.5% upside potential from current levels. Feinseth’s price target of $202 implies an impressive 41.9% upside potential for the next 12 months.

Analysts are highly bullish on T-Mobile US and have given 13 unanimous Buy ratings on TMUS stock over the past three months.

Southwest Airlines Co. (NYSE:LUV)

Market Value- $22.65 billion; Smart Score- 8

One of the big four airlines in the U.S., Southwest Airlines (LUV, $38.14), is a bellwether of the travel industry. The company recently hosted an Investor Day providing greater detail on the 2023 capacity outlook, which is expected to be 15% higher than in 2022. Most importantly, the carrier reinstated a quarterly common dividend of $0.18 per share, the first one in the lot, which was suspended during the pandemic.

Following the pandemic years of severe financial and labor deficits, US carriers are finally returning to profitability. Southwest expects its fourth-quarter revenues to jump more than 17% from its 2019 figures. Also, its capital expenditure is expected to increase to $4.5 billion, mainly to pay for new aircraft deliveries.

The investor update surely impressed Deutsche Bank analyst Michael Linenberg, who also increased his price target on LUV stock to $62 (62.6% upside) from $60 and maintained a Buy rating.

Six other Wall Street analysts agree with Linenberg and have assigned LUV stock a Strong Buy consensus rating. On TipRanks, the average Southwest Airlines price target of $51.14 implies 34.1% upside potential from current levels. Year to date, LUV stock is down 13.3%.

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)

Market Value- $1.23 trillion; Smart Score- 9

Next up is another trillion-dollar market capitalization company, Alphabet (GOOGL, $95.07) (GOOG, $95.31), which commands a wide moat in the sectors it operates. The technology conglomerate operates the widely used search engine, Google, along with its Android operating system, email service Gmail, and navigation services Maps and Waze. Also, it hosts the popular video-sharing and social media platform YouTube.

Analyst Jason Ader and his team at William Blair pick Alphabet as one of 2023’s Best One-Year Ideas. Although advertising spending has softened, Google’s search advertising business remains resilient to the macro environment. “MAGNA Global expects search to grow 12.6% in 2023, while it forecasts social to grow 6.4%,” the report cited. Plus, the analyst believes that non-advertising businesses such as Google Cloud (expected 11% revenue contribution in 2023) may offset the headwinds in the advertising sector.

On TipRanks, Alphabet Class A stock has a Strong Buy consensus rating with 29 unanimous Buys. The average Alphabet Class A price forecast of $127.83 implies 34.5% upside potential to current levels. Meanwhile, GOOGL stock has lost 34.4% so far this year.

Star Bulk Carriers (NASDAQ:SBLK)

Market Value- $2.08 billion; Smart Score- 8

Greek dry bulk shipping service provider Star Bulk Carriers (SBLK, $20.25) is one of the most attractive dividend-paying stocks. Its quarterly common dividend of $1.2 per share boasts a current yield of a massive 32.44%.

The outlook for shipping companies is dimming, but SBLK’s lucrative dividend ensures investors satisfactory returns. The falling freight rates, coupled with slowing demand for cargo shipments, are taking a toll on shipping companies. Year to date, SBLK stock has gained 9.6% vis-à-vis growing over 100% (excluding dividend) in 2021, when the shipping sector witnessed excessive demand conditions.

Analyst Amit Mehrotra of Deutsche Bank names Star Bulk as one of his top picks for 2023 based on the thesis that the company is not over-reliant on cycle peaks but has a proven performance record across the cycle. He has a Buy rating and a $33 price target on SBLK, implying a massive 63% upside potential in the next 12 months.

“Shipping companies with good balance sheets and low break evens can take advantage of weak markets; while companies that rely too much on debt are vulnerable when the market inevitably turns, and the positive investment thesis relies almost entirely on the “hope” of a better market,” Mehrotra added.

On TipRanks, Star Bulk Carriers stock has a Strong Buy consensus rating with four unanimous Buys. The average Star Bulk Carriers price target of $28.25 implies 39.5% upside potential to current levels.

Chesapeake Energy (NASDAQ:CHK)

Market Value- $13.28 billion; Smart Score- 9

Another beneficiary of the war-led energy crisis is Oklahoma-based Chesapeake Energy Corp. (CHK, $99.16). The hydrocarbon exploration and production giant is experiencing a solid stock price upswing owing to the record high oil and gas prices. Year to date, CHK stock has exploded by 65.4%.

To add to that, the company undertakes regular share buybacks and pays a quarterly common dividend of $3.16 per share, reflecting a dividend yield of 2.06%, making the stock even more attractive for investors.

Jefferies analyst Lloyd Byrne is tremendously bullish about CHK stock and likes the company’s “valuation, well-positioned assets, solid shareholder returns, and continued progress on Haynesville strategy.” Despite the expected short-term volatility in natural gas prices in 2023, Chesapeake’s sale of the Eagle Ford asset next year promises solid cash flows to carry out share buybacks and reduce debt, Byrne added.

Considered one of the best energy picks by analysts, CHK stock has a Strong Buy consensus rating on TipRanks based on seven Buys and one Hold rating. Also, the average Chesapeake Energy price forecast of $142.88 implies a nearly 44.1% upside potential from current levels.

The five-star analyst, Byrne, has an even higher price target on CHK, pegged at $150 implying 51.3% upside potential in the next 12 months.

Northern Oil and Gas (NYSE:NOG)

Market Value- $2.51 billion; Smart Score- 9

This oil and gas major has witnessed its stock price appreciate by 52% so far in 2022 thanks to the macroeconomic factors detailed above. A prime beneficiary of the Russia-Ukraine war, Northern Oil and Gas (NOG, $32.29), continues to gain optimism from Wall Street analysts.

Raymond James analyst John Freeman recently named three top picks from the Oil and Gas sector, with NOG being one of them. Freeman is encouraged by NOG’s addition of wells in progress every quarter in 2022. Having said that, Freeman agrees that NOG is not insulated from the inflationary environment, but believes that a “5% increase in AFEs (Authorisation for Expenditure) from the last quarter stands up pretty well to industry peers.” Plus, NOG pays a regular quarterly common dividend of $0.30 per share, implying a yield of 2.12%.

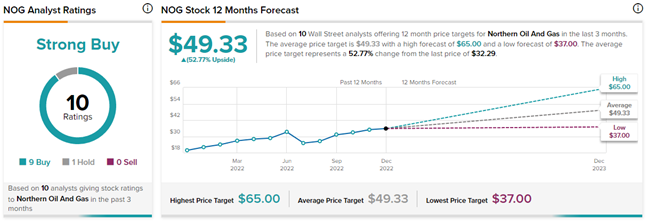

With nine Buys and one Hold rating, NOG commands a Strong Buy consensus rating. The average Northern Oil and Gas price target of $49.33 implies 52.8% upside potential to current levels. Notably, Freeman’s 12-month price target for NOG stock is a bit higher at $50.30, implying an upside of 55.8%.

Amazon.com (NASDAQ:AMZN)

Market Value- $934.27 billion; Smart Score- 9

The top stocks to buy list would be incomplete without America’s and possibly the world’s largest e-commerce giant, Amazon.com (AMZN, $91.58). 2022 has been a rip-off year for technology companies in general, owing to the macro headwinds. Year to date, AMZN stock has lost 46.3%.

In a recent e-commerce and retail landscape report, Wells Fargo analyst Ike Boruchow stated, “After witnessing a historic pull forward of e-commerce penetration in 2020 (we estimate a ~700bps increase, or ~4 years of penetration pull-forward), we’ve now rounded the worst on the e-commerce giveback – with the normalization not nearly as severe as we originally anticipated on the heels of AMZN’s 3Q GMV gains.”

As a result, Boruchow now expects e-commerce penetration to fall by 35 basis points rather than the 150 basis points previously predicted. Similarly, the analyst stated that e-commerce trends have started outperforming brick-and-mortar store trends and are expected to increase rapidly going forward.

Besides e-commerce, Amazon also boasts a strong online streaming presence, and subscriptions continue to add meaningful numbers to its top line.

Most importantly, its Amazon Web Services (AWS) segment leads the pack in cloud service offerings and has several customers from individuals, corporates, and government organizations. AWS contributed roughly 15% to Amazon’s top line and is primed for robust growth as the tech giant focuses efforts on accelerating the segment.

Amazon.com stock undoubtedly commands a Strong Buy consensus rating on TipRanks. This is based on 33 Buys and three Holds ratings. Also, the average Amazon.com price target of $140.50 implies 53.4% upside potential to current levels.