An acute semiconductor shortage is being felt right now by companies around the world, across different sectors. It’s so much so, that it is impacting earnings, and why not? Semiconductors have become an integral part of our life as their applications range from 5G, data centers, Internet of Things (IoT), mobiles, and automobiles.

This has also brought into sharp focus wafer manufacturing companies as well as companies that manufacture processors and chipsets. According to Intel, the semiconductor market is likely to double to $1 trillion by 2030.

Using the TipRanks Stock Comparison tool, let us compare two such chip-making companies, Intel and AMD, and see how Wall Street analysts feel about these stocks.

Intel (INTC)

Intel has left investors disappointed with its Q3 results, which were a mixed bag. Adjusted revenues rose by only 5% year-over-year to $18.1 billion (excluding the NAND memory business, which is subject to a pending sale) but fell short of the consensus estimate of $18.24 billion.

However, encouragingly, Intel’s adjusted earnings came in at $1.71 per share, exceeding the company’s prior guidance by $0.61, and were up 59% year-over-year. Analysts were expecting earnings of $1.11 per share.

In addition, Intel’s CFO George Davis announced his retirement effective from May next year, saying that he will continue to serve in his role until Intel finds a suitable successor.

The company raised its outlook for FY21 and now expects adjusted earnings of $5.28 per share and a gross margin of 55%, while revenues are projected to be $77.7 billion. In Q4, INTC anticipates a gross margin of 51.4% on revenues of $19.2 billion, while earnings are expected to come in at $0.78 per share.

Earlier this year, INTC had unveiled a process and packaging technology roadmap – IDM (integrated device manufacturer) 2.0 strategy, which included the launch of Intel Foundry Services (IFS), a new foundry business, and a $20 billion investment in two new fabs in Arizona.

In alignment with this strategy, the company’s outgoing CFO, George Davis, announced on its Q3 earnings call that it expects capex to range between $25 billion and $28 billion in 2022. What’s more, the company’s rising investment in its foundry business also means that it anticipates gross margins to be “below current levels for the next 2-3 years before recovering but will remain comfortably above 50% as we continue to exercise financial prudence.” (See Top Smart Score stocks on TipRanks)

Mizuho Securities analyst Vijay Rakesh seems to disapprove of this strategy and thinks that it will add uncertainty “to its likelihood of catching up to leading-edge by executing on its core PC/Server roadmap and believe the GM [gross margin] reset to 51-53% (current 56%) over 2-3 years could be difficult to recover.”

Moreover, the analyst pointed out that the rise in capex is a “a significant ~100% jump from its F20-F21 Capex range at $14-$18B.” It would become “a capital drag, as it is difficult to both win in the foundry market and maintain attractive margins.”

Drawing comparisons between INTC and AMD, Rakesh emphasized that instead of Intel closing the gap with AMD on “10nm [nanometer]/7nm Sapphire Rapids/Granite Rapids” data centers, this gap could widen as Intel’s focus would be split between building its foundry capacity and “executing on the core product roadmap.”

As a result, the analyst downgraded the stock from a Buy to a Hold and lowered the price target from $70 to $55 (10.8% upside).

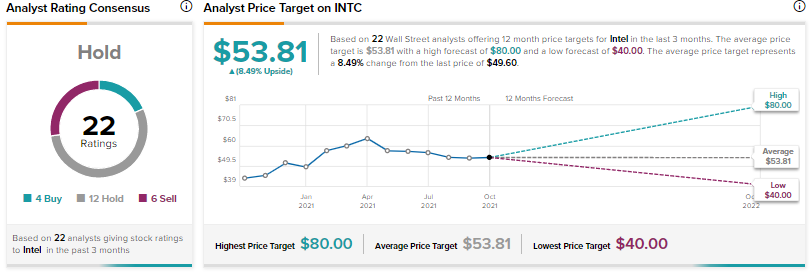

The rest of the Street echoes Rakesh’s view with a Hold consensus on Intel, based on 4 Buys, 12 Holds, and 6 Sells. The average Intel price target of $53.81 implies 8.5% upside potential to current levels.

Advanced Micro Devices (AMD)

Advanced Micro Devices investors are cheering, as the stock has soared 24.8% in the past month, fueled by strong financial performance in Q3. The chip giant’s revenues increased 54% year-over-year to $4.31 billion, beating analysts’ estimates of $4.12 billion. This was AMD’s fifth straight quarter of revenue growth of more than 50%.

Adjusted earnings came in at $0.73 per share, up 78% year-over-year and beating analysts’ expectations of $0.67 per share.

The company’s wide array of products includes graphics processing units (GPUs), semi-custom System-on-Chip (SOC) products and chipsets, x86 microprocessors (CPUs), and accelerated processing units that integrate microprocessors and graphics (APUs).

AMD has projected total revenue to range from $4.4 billion to $4.6 billion in Q4, an increase of 39% year-over-year, driven by growth across all businesses. Its stellar fiscal performance has also resulted in the company raising its guidance for FY21 and now expects its revenues to rise year-over-year to 65% from the prior growth rate of 60%.

Mizuho Securities analyst Vijay Rakesh noted the “strong” Q4 guidance was a result of “strength expected in Server and Gaming Consoles, with upside to previous expectations due to better procurement of wafer supply.”

The analyst is bullish with a Buy rating and raised his price target from $110 to $135 (approximately 8% upside) on the stock.

The company continues to see higher traction in its third generation EPYC processors, and AMD’s management stated on its Q3 earnings call that these processors “continue ramping faster than the prior generation and contributed the majority of our server CPU revenue in the quarter.”

Indeed, AMD’s rising revenues in Q3 were largely driven by a 69% growth in revenues when it comes to its Enterprise, Embedded, and Semi-Custom CPUs and chipsets.

Moreover, the company also expects revenues from semi-custom CPUs to rise in Q4 as gaming console demand remains strong. (See Insiders’ Hot Stocks on TipRanks)

Considering this strong demand, analyst Rakesh believes that “AMD’s supply constraints at TSMC [Taiwan Semiconductor Mfg. Co.] could continue to provide upside potential to estimates if AMD can secure additional 2022 supply.”

AMD’s President and CEO, Dr. Lisa Su, elaborated on this at its earnings call, saying, “I think we’re prioritizing in the most strategic segments. And we have invested significantly in capacity for additional capabilities, and we’ll see some of that come online as we go through 2022.”

Lastly, analyst Rakesh continues to see AMD as “well-positioned with a strong server roadmap and a XLNX acquisition ahead (we estimate ~$0.02 EPS accretion), with INTC potentially losing PC/Server ground by shifting focus to foundry.”

AMD continues to expect to close its $35 billion acquisition of Xilinx (XLNX) by the end of this year.

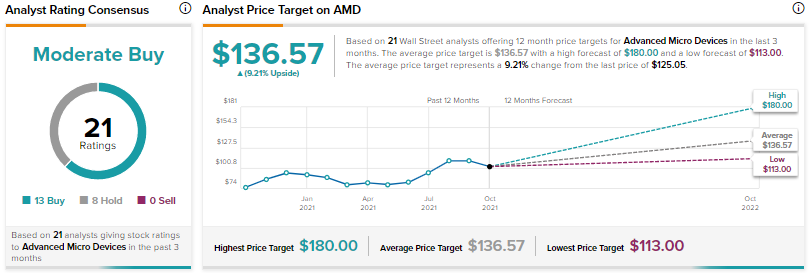

Wall Street analysts, however, are cautiously optimistic and the consensus is that AMD is a Moderate Buy, based on 13 Buys and 8 Holds. The average AMD price target of $136.57 implies 9.2% upside potential to current levels.

Bottom Line

While analysts seem to be in a wait-and-watch mode with Intel, they are cautiously optimistic about AMD. As analyst Rakesh noted in his research report, he remains concerned that “a combination of potential excess in-house Foundry capacity in the coming years, competitive AMD pricing pressures, and lagging-edge Foundry” could continue to pressure gross margins for INTC.

Furthermore, the analyst commented that the “recent accelerated foundry pivot could provide further share gains in Server for AMD.”

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.