Whether you’re a seasoned trader or a novice, the oldest piece of advice in economics still holds true: buy low and sell high. The challenge lies in determining the right time to purchase stocks that are undervalued or to sell those that are overpriced.

There are plenty of signs to crack that code, but one of the clearest is the insiders’ trading patterns. The insiders are corporate officers, companies’ higher-ups, whose positions put them ‘in the know.’ Therefore, monitoring their trades, especially when they’re buying in bulk, can provide valuable insights into the company’s potential direction.

The bulk trades always deserve a closer look, so we’ve opened up the Insiders’ Hot Stocks tool from TipRanks to find two stocks that have both been the subject of million-dollar-plus insider buys.

According to analysts, these stocks are Buy-rated and offer considerable upside potential. Additionally, they have been beaten-down in recent months, making them attractive investments for those looking to buy low and potentially profit from a rebound.

Enphase Energy (ENPH)

We’ll start with Enphase Energy, a leader in the residential solar power installation market. The company produces, sells, and installs a full range of small- to mid-scale solar installations for residential and commercial properties. Along with the solar installations, Enphase produces a full range of ancillary technologies needed to support solar power generation, from the power inverters that change photovoltaic panels’ direct current to grid-usable alternating current to ‘smart’ battery systems to store power for use after peak production times.

Enphase currently holds a huge market share advantage over its competition, and dominates some 86% of the residential solar market. The company cements its position with the advantageous technologies needed to make its small-scale solar projects viable. The tech solutions don’t stop with power inverters and smart batteries; Enphase’s customers can control power loads, and even the power distribution among household appliances or small-business machinery.

Despite Enphase’s strong product line and dominant market position, the company’s stock is down 38% so far this year. Much of the drop came after the release of the 1Q23 financial results. Although the top and bottom lines exceeded expectations, the company’s Q2 revenue outlook fell short of the Street’s estimates. Management projected Q2 revenue to be in the range of $700 million to $750 million, while analysts had anticipated $762 million. This disappointing guidance raised concerns among market watchers about a potential decline in demand for solar products.

Enphase’s sudden share decline did not seem to concern insiders or Wall Street analysts. In fact, Enphase board member Thurman Rodgers made two multi-million dollar purchases of ENPH since the Q1 release, totaling 60,800 shares and costing him over $10 million combined.

From the Street’s analysts, we can check in with Corinne Blanchard, of Deutsche Bank, who writes of Enphase: “We remain buyers of the stock, especially after the strong pull-off [last week], which we believe was overdone. We remain positive on the stock with strong growth in Europe, which would offset any potential softness in the US resi market, but more importantly we value the US manufacturing footprint.”

Blanchard’s comments come along with a Buy rating and a $240 price target that suggests a one-year upside potential of 46% for ENPH. (To watch Blanchard’s track record, click here)

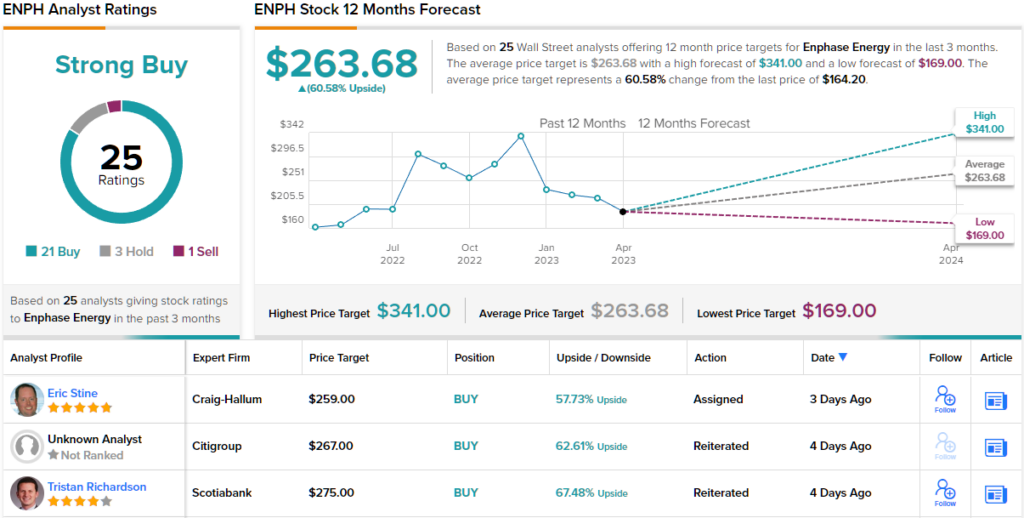

Overall, the bulls are definitely still running for Enphase, which has 25 recent analyst reviews – including 21 Buys, 3 Holds, and a single Sell. The shares are priced at $164.20, and their $263.68 average price target is even more bullish than Blanchard allows, and implies ~61% upside for the coming year. (See ENPH stock forecast)

Cleveland-Cliffs (CLF)

From solar power we’ll switch to the iron and steel industry. Cleveland-Cliffs is one of the largest producers of flat-rolled steel operating in the US steel-making industry, and it supplements the flat-rolled product with a diverse portfolio of other steel products. The company is well-known in the industry for its metal stamping, tooling segment, and tubular component production, and is a major supplier of steel products to the automotive industry.

In addition to finished steel, Cleveland-Cliffs also has its hands in iron mining and iron ore. The company has land and mine holdings in Michigan’s Upper Peninsula and in Northern Minnesota that are active producers of iron ore, and another mining site in West Virginia produces industrial-grade coking coal, a vital ingredient in the steel-making process. Additional facilities for turning raw coal into usable coke, are located in Ohio, West Virginia, and Pennsylvania. The full product line from Cleveland-Cliffs has applications in multiple industries, including appliances, autos, industrial equipment, construction, energy, manufacturing, and packaging.

Last week, Cleveland-Cliffs reported its earnings results for Q1 of 2023. The company’s revenue was $5.3 billion, which was 11% lower than the previous year but exceeded forecasts by $90 million. In non-GAAP terms, earnings per share were a loss of 11 cents, a significant drop from the previous year’s EPS of $1.50. However, the Q1 earnings beat forecasts by one cent and showed improvement over Q4 2022, which had a loss of 41 cents per share.

Despite beating the forecasts in that last earnings report, CLF’s shares are down 32% from their March high point. Headwinds pushing against the stock include worries of a recession later this year. On the plus side, the company is currently looking at high demand for its core lines of hot-rolled, cold-rolled, and coated steel products – demand that has been high enough to support a price increase on the order of $100 per net ton.

With this background, we can turn to the insider trades, where we find that multiple board members have been making six-figure purchases. The most notable purchase, however, came from board chairman Lourenco Goncalves, who bought 100,000 shares for just over $1.496 million.

In the eyes of Argus’ 5-star analyst David Coleman, the current low share price is an opportunity for investors. He writes: “CLF has a history of outperforming the market and the industry, and is led by an experienced management team. However, Cleveland-Cliffs, along with its peers, has seen its share price drop substantially amid falling metals prices and weaker global economic conditions. However, we expect steel demand to pick up as the automotive sector recovers… We think that CLF shares are attractively valued at current prices near $15…”

Quantifying his stance, Coleman rates CLF shares a Buy, and his $20 target price indicates his belief in a 30% upside potential heading out to the next 12 months. (To watch Coleman’s track record, click here)

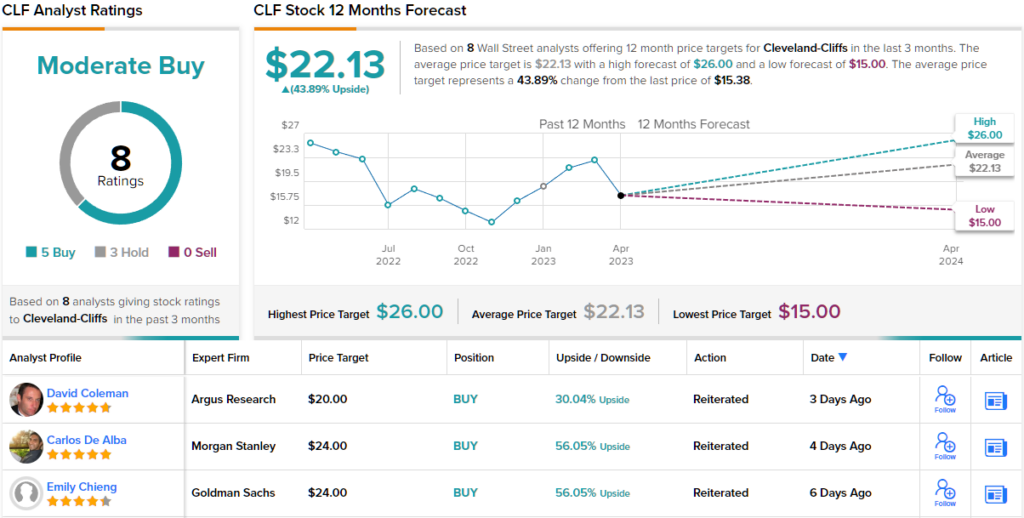

Overall, the 8 recent analyst reviews on CLF include 5 Buys and 3 Holds, for a Moderate Buy consensus rating. The shares are priced at $15.38 and the $22.13 average price target suggests ~44% upside potential on the one-year time frame. (See CLF stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.