If Canopy Growth shares (NASDAQ:CGC) (TSE:WEED) seem a bit unsettled right now, it’s largely connected to the company’s plans to abandon the Canadian brick-and-mortar retail market. Canopy Growth is selling its Tweed and Tokyo Smoke stores—along with all the intellectual property around Tokyo Smoke— to OEG Retail Cannabis. Meanwhile, a set of five stores in Alberta will go to 420 Investments Ltd.

OEG Retail Cannabis, previously, was a licensee that operated all of the Tokyo Smoke stores in Ontario. Thus, this move will likely be a natural fit for OEG.

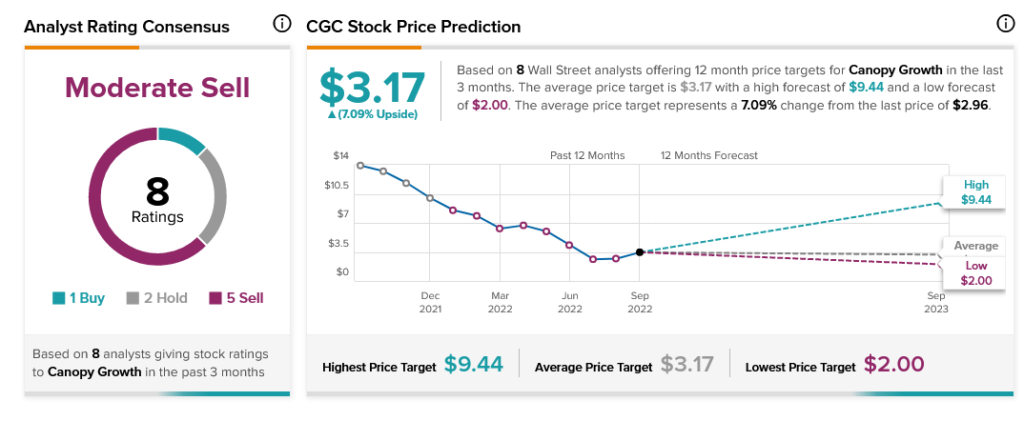

The last 12 months for Canopy Growth shares largely show a race to the bottom. The company started off last September just under $14 per share. Today, it’s just under $3. Though there was a bit of a rally that started in July, it didn’t go very far nor last very long.

I’m bearish on Canopy Growth right now. Despite the shockingly low share price, investors just won’t be getting very much for their buck. While it’s hard to pass up the notion of a heavily discounted stock, it looks like there’s a very good reason the company is as discounted as it is.

Investor Sentiment Offers No Positive Prospects for CGC Stock

Right now, investors aren’t very happy with Canopy Growth either. Currently, Canopy Growth has a 2 out of 10 Smart Score on TipRanks. That’s the second-lowest level of “underperform” and also represents the second-lowest score possible. This score suggests that it’s just short of almost certain that Canopy Growth will lag the broader market.

It’s quite clear that Canopy Growth insiders also feel there’s not much hope for the company. Insider trading at Canopy Growth featured multiple informative sales, including from non-executive Director Theresa Yanofsky.

The sales didn’t add up to much. All told, they came to a combined total of around C$33,800. However, it’s the fact that all the informative transactions in the last 11 months are sell transactions that’s particularly telling.

The aggregate figures, though, tell a slightly different story. While it’s not one that will likely change a lot of investors’ minds, it will offer pause for thought. In the last three months, there were two buy transactions and eight sell transactions staged by company insiders. All of those were back in June, and there have been no transactions of any kind recorded in either July or August.

Going back over the last 12 months, meanwhile, shows an even more dramatic sell-off. Insiders staged 14 buy transactions but staged 47 sell transactions.

Canopy Growth Likely Selling Stores at a Loss

Perhaps one of the biggest issues around Canopy Growth is just what the company got for selling off all those stores. While financial terms weren’t disclosed—at least, not yet—there are already those believing that the company didn’t get near what they paid for those stores. Owen Bennett, an analyst with Jefferies, is one of those who believes that Canopy Growth likely engaged in some fire-sale pricing on those storefronts.

Bennett referred to the retail stores as an example of “wasted capital” engaged in by previous management. Bennett also raised the point that, in general, Canadian retail is suffering. That’s the case all over the world, mostly, so making that connection isn’t out of line. Further, Bennett noted that the lack of clarity in financial terms on the deal suggests that Canopy Growth sold likely at a loss.

Just to round it out, Bennett also noted that the deal was more focused on cutting costs for Canopy Growth than it was on raising cash. OEG actually supported this notion, saying that the company now has 64 Tokyo Smoke stores in Ontario and is “…well-positioned for future success in the early stages of an emerging market.”

That leaves an interesting point; would those Tokyo Smoke stores have been successful had Canopy Growth held on to them longer? Or was the problem Canopy Growth’s management? Canopy Growth has an opportunity to prove as much.

Reports note that the company will continue with the Tweed brand. The Tweed brand will be applied to products, for the most part, like pre-rolled and ready-to-enjoy options.

There are certainly market opportunities available for Canopy Growth to pursue. After all, it’s part of the cannabis beverages market. That market could be worth over $19 billion by 2028, notes Fortune Business Insights.

With several major markets still set to come online—Thailand and Australia are among two of the biggest untapped markets herein—there’s still quite a bit of profit to be had.

The hard question, however, is if Canopy Growth is really in a position to take advantage of those new markets effectively. Given that just two weeks ago, Canopy Growth—along with Martha Stewart Edibles—found itself under fire for copyright infringement, some doubt would be healthy.

Is CGC a Good Stock to Buy?

Turning to Wall Street, Canopy Growth has a Moderate Sell consensus rating. That’s based on one Buy, two Holds, and five Sells assigned in the past three months. The average Canopy Growth price target of $3.17 implies 7.1% upside potential. Analyst price targets range from a low of $2 per share to a high of $9.44 per share.

Conclusion: Gains are Unlikely at This Point

The only good news that can be said for Canopy Growth is that it’s remarkably cheap. With shares running just above the lowest price targets—but not too far off from the average—picking up a hundred shares or so will be remarkably easy. There are some home theater components that cost more than 100 shares of Canopy Growth. That means any gains seen will be quick profit. The problem, of course, is that gains are fairly unlikely here.

It can’t go much lower without closing down completely. The idea of a complete shutdown—especially with Constellation Brands (NYSE:STZ) behind it—is unlikely to ever see reality.

However, there’s not much suggesting that this company can pull growth up. It only gets worse when the macroeconomic picture is considered. As much as people like cannabis products, when the choice comes down to food or weed, food will probably win out.

That’s what leaves me bearish on Canopy Growth. I can see picking up a few shares in case the outlying possibility of a big surge hits, but that’s not investing. That’s gambling. Right now, Canopy Growth is little more than a slightly more expensive lottery ticket with a little better chance of a light payoff.