Following the extraordinary devastation of the COVID-19 pandemic, few other consumer-facing industries have desired to return to normal quite like cineplex operators. While the relaxing of restrictions has resulted in people swarming back to the box office, the volume isn’t quite up to snuff against pre-crisis levels. Still, a bright spot in the sector could be Imax (IMAX), a leader in immersive film projection systems. I am bullish on IMAX stock.

A few years before the global health crisis, Imax represented a frustrating investment. Throughout much of 2017-19, IMAX stock meandered in a sideways consolidation pattern, only offering occasional opportunities for swing traders. Otherwise, the narrative lacked directional fortitude, in large part because of the competition that streaming services imposed.

After collapsing in 2020 due to severe government mandates aimed at stopping the spread of COVID-19, IMAX stock initially poked its head above water in early 2021. However, the momentum was rather short-lived, with shares again fading into another consolidation pattern. While people were eager to regain control of their normal activities, Imax struggled in the mad rush for consumer dollars.

However, as the resounding success of Top Gun: Maverick demonstrated, people are eager to pay a nice premium for escapism, so long as the underlying product warrants it. Given that the Top Gun sequel reflects wider changes in the cineplex industry, Imax’s unique immersive projector technology could turn out to be a bright spot in the segment over the long run.

Imax Stock Analysis

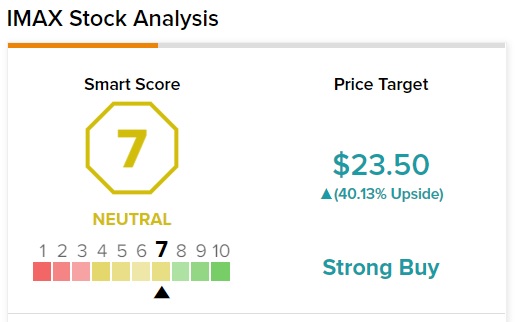

On TipRanks, IMAX has a 7 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

Shifting Tides in the Cineplex Scene

On the surface level, investors might be tempted to believe that streaming services have forever changed the game when it comes to broadcasted entertainment content. In some ways, they would be correct. With more companies piling into the space, from the consumer’s perspective, no shortage of options exists. Nevertheless, one shouldn’t assume that IMAX stock is irrelevant. Indeed, the shifting tides in the cineplex operator industry embolden this opportunity.

Primarily, the nature of big-ticket Hollywood fare has changed dramatically over the last several years. For instance, the top billings for the domestic box office in 2000 featured a wide variety of genres. In fact, How the Grinch Stole Christmas actually beat out the much-hyped Mission: Impossible II, coincidentally another Tom Cruise-starring hit.

From action to comedies to horror to family-friendly entertainment, the top 10 films of 2000 had it all. Perhaps most conspicuously, Erin Brockovich – a biopic of the namesake American activist – provided the caboose in the diverse offerings of Hollywood’s best for that year.

Contrast this diversity with the domestic box office for 2019, the year before the pandemic. While there were a few family-oriented names like Frozen II, the main takeaway is that the big dogs like Disney (DIS) dominated sales with their marquee comic-book or science-fiction franchises.

Put another way, the big screen still knows how to churn out big sales. However, consumers no longer go to the cineplex for genres like comedies or human-interest pieces. Instead, if they do go to the box office, they want to be entertained with something from the Star Wars franchise or its ilk.

Fortunately, that’s really where IMAX stock and its underlying advanced projector business come to life.

Consumers Will Spend If They Have Reason to Do So

People are willing to open their wallets. Yes, inflation — even with the latest reduction in the consumer price index to 8.5% from 9.1% — is still high. Households have made painful spending cuts to stay afloat. Nonetheless, consumers saved a lot of money during the worst of the pandemic, helped in large part by government stimulus checks. People will spend money. They just need a compelling reason to do so.

For the travel sector, its organic marketing message was that families could finally take the vacation they were dreaming about after being locked down by the pandemic. Put another way, demand for unique experiences soared. No matter how much e-commerce shopping people did, the itch to enjoy new experiences never faded.

In the same vein, IMAX stock could benefit as the underlying company fills a major opportunity gap. For instance, moviegoers flocked to the Top Gun sequel not necessarily for its storyline but for the cinematic experience – representing one of the most ambitious projects in Hollywood history.

While any big screen can deliver a rousing experience relative to a home-based TV, nothing compares to the immersive attributes of Imax-powered projection technologies. Therefore, as the moviemaking industry focuses almost exclusively on the thrills-and-spills genre, IMAX stock can really stand above the rest.

Focusing on IMAX’s Financials

While the narrative for IMAX stock may be compelling, investors must conduct a deep dive into the financials before making their decision. Here, the company presents somewhat of a mixed bag. On the pessimistic side of the spectrum, following several consecutive years of positive net income, the COVID-19 pandemic imposed a devastating blow on the projector firm, leading to a net loss of $143.8 million in 2020. In 2021, the net loss picture improved, with Imax “only” being $22.3 million in the red.

Still, critics will point out that even with the fanfare of major Hollywood releases, Imax’s second quarter of 2022 report disclosed a net loss of $2.9 million.

However, on the optimistic front, Imax’s growth trek (relative to the pandemic-related disruptions) is impressive. In Q2 2022, sales of $74 million represented a year-over-year lift of 45%. Moreover, its trailing-12-month revenue of $299.2 million is within 25% of its 2019 sales.

Yes, it’s got some ways to go to reach parity. Nevertheless, it’s a realistic goal, not some absurd fantasy.

Is IMAX Stock a Good Buy?

Turning to Wall Street, IMAX stock has a Strong Buy consensus rating based on five Buys assigned in the past three months. The average IMAX price target is $23.50, implying 39.1% upside potential.

Takeaway – IMAX Stock is an Interesting Idea for Patient Investors

It must be said that any investment related to the cineplex operator sector is risky, again in large part to the streaming competition. However, it’s also clear that today’s moviegoers desire escapism and a compelling experience. Imax can easily provide that over the standard box office fare, making IMAX stock an interesting idea for patient investors.