International Business Machines, more commonly referred to as IBM (IBM), has been one of the biggest names in computing for decades. When PCs really started to catch on among individual users, they were even referred to as “IBM clones.” Yet even as the landscape shifted, IBM pivoted with it and produced some exciting new possibilities.

The latest possibility involves a powerful new ally, and it makes IBM that much more attractive by comparison. I’m moderately bullish on IBM, thanks to its skillful pivot and its growing value in the commercial sector.

The last 12 months for IBM may seem volatile, but that volatility is taking place within a fairly tight range. The company’s range over the last 52 weeks is between $114 and $153, and it didn’t spend long down around that lower range. It’s held fairly well between $120 and $130 per share. Given the broader market picture, that kind of reliability is hard to come by.

The latest news should help hold those price levels. IBM recently established a new deal with Amazon (AMZN) Web Services. The new deal, a Strategic Collaboration Agreement, calls for IBM to offer up a wide range of software options on Amazon Web Services.

The software will be available on a Software-as-a-Service (SaaS) basis, allowing for short-term use as well as long-term operations. The software available will include automation help, security and sustainability operations, and data and artificial intelligence systems.

Wall Street’s Take

Turning to Wall Street, IBM has a Moderate Buy consensus rating. That’s based on five Buys and four Holds assigned in the past three months. The average IBM price target of $152.11 implies 15.8% upside potential.

Analyst price targets range from a low of $135 per share to a high of $166 per share.

Investor Sentiment is Much More Volatile

IBM has always been regarded as one of the biggest names in computing. Thus, seeing it with a Smart Score of 8 out of 10 on TipRanks is no surprise. The bulk of the information available suggests it can outperform the market from here.

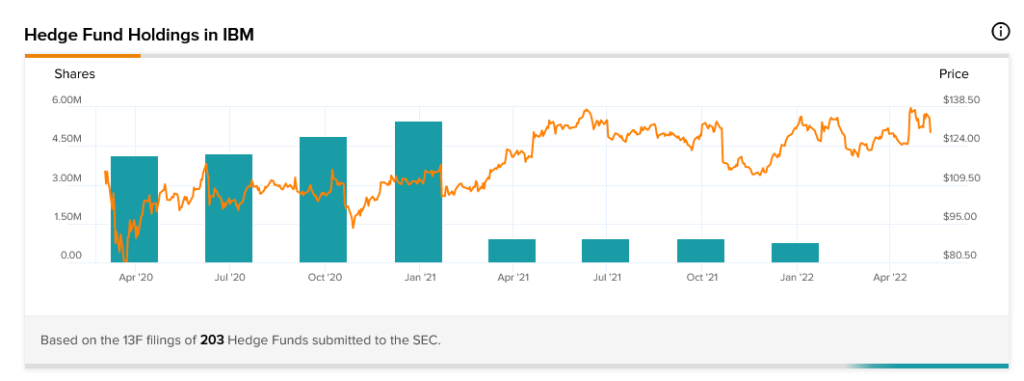

Hedge fund involvement, as measured by the TipRanks 13-F Tracker, shows that hedge funds are continuing to reduce their positions in IBM. After a steady climb throughout 2020, that immediately turned south in 2021. It shows little sign of turning around in 2022, either.

The bottom fell out of hedge fund involvement in March 2021, when it went from around 5.49 million shares to just over 944,000 shares. Much smaller reductions followed, and right now, just over 778,000 shares are currently held by hedge funds.

Retail investors, at least those who hold portfolios on TipRanks, are slightly more mixed. While portfolios containing IBM were up 1% in the last 30 days, they’re down 0.5% in the last seven days.

Insider trading is mixed as well. There have been no transactions from insiders at all, sell or buy, since January 2022. Even then, it was an even split of seven buy and seven sell transactions. Going back into the last 12 months shows much more buying interest than selling; buy transactions led sell transactions by 23 to eight.

Finally, there’s IBM’s dividend history. IBM’s dividend history is tailor-made for income investors. It’s not only solid, but it also increases regularly. The increases haven’t been large, certainly, but they have been as regular as any could ask for. The dividend has grown at a CAGR of 2.4% over the past three years.

The Value of a Good Pivot

IBM has been steadily reducing its profile in hardware operations for years. As far back as 2014, IBM has been winnowing down its hardware operations and laying off accordingly. It’s what IBM focused on instead, though, that makes it such a great potential winner: applications.

Perhaps the leader in these developments is the Watson AI. Back in 2013, IBM famously pitted Watson against two of the biggest names in Jeopardy history: Ken Jennings and Brad Rutter. Watson beat both Jeopardy champs handily, bringing in $77,147 against Jennings’ $24,000 and Rutter’s $21,600.

From there, Watson expanded outward, handling a range of duties from medical diagnostics to customer service, and that was just the start of what IBM had to offer. Some, as recently as March 2021, thought IBM was “fighting the future.” However, IBM’s move to offer its services increasingly through cloud-based operations suggests otherwise.

It doesn’t stop there, either; IBM—rather, a subsidiary of the same—is working with General Motors (GM) to create an open-source Linux operating system specifically for vehicles. A new wrinkle in IBM’s partnership with SAP is producing fruit as well, as “RISE with SAP” is offering new help to cloud-based operations.

Also, lest anyone think IBM has bowed out of hardware altogether, the new Kookaburra processor will address that. Kookaburra is a quantum processor that represents a major advance forward.

Concluding Views

Take all of these points together, and IBM starts looking attractive. Add in the extremely stable and constantly rising dividend, as well as the fact that IBM offers impressive upside potential, and it adds up to a prospect worth taking seriously. IBM is even trading under its lowest price targets right now, which certainly suggests a buy-in point.

IBM doesn’t seem to be “fighting” the future much at all. Rather, it’s working hard to change and modify its operations according to needs on the ground. Just ask any of the former hardware engineers laid off from IBM in the last 20 years or so.

Going from an AI that can win against game show greats to a range of software options and even a little bit of hardware on the side makes IBM impressively diversified. Given that it only took 10 years to pull all this off, that’s even better. In fact, it’s impressive by any scale, and it explains why I’m bullish on IBM, a big name that even comes with some room to grow.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure