Social media companies have long relied on advertising revenue to keep the lights on, but unfortunately, ad revenue has been plunging across the board. Even Meta Platforms (NASDAQ:META) has seen its ad revenue fall this year, so it’s no wonder that alternative social media companies like IAC (NASDAQ:IAC) and Sprout Social (NASDAQ:SPT) are struggling. While both companies have different levels of focus on social media, neither would be considered a pure play. In this piece, we compared the two stocks related to social media to see which one is better. A closer analysis reveals that IAC could be deeply discounted.

IAC (NASDAQ:IAC)

Unfortunately, IAC’s net income has plummeted over the last 12 months, dipping into the red for the last two quarters as it continues to trend downward. However, its revenue continues to rise, providing a glimmer of hope in an otherwise dark time for media companies. Additionally, IAC owns a long list of media companies and has a track record of successful spinoffs, suggesting a long-term bullish view may be appropriate.

While many consider IAC a social media stock, the company’s primary focus isn’t on social media. It owns a wide array of media brands in multiple countries, including Angi, Better Homes & Gardens, Care.com, Dotdash Meredith, Food & Wine, HomeAdvisor, and People. IAC has spun off some of its more social-oriented companies, including Match Group (NASDAQ:MTCH) and Vimeo (NASDAQ:VMEO), although many still classify it as social media.

IAC has grown its revenue steadily year after year, even as it spun out some of its most successful companies. IAC’s P/E is negative because it has slipped into the red, but its trailing P/S multiple is down to 0.8x.

This valuation accounts for IAC’s 16.5% stake in MGM Resorts (NYSE:MGM), Dotdash, and the company’s roughly $1 billion in cash, giving investors all of the company’s numerous other brands for “free.” IAC also enjoys an extremely healthy balance sheet with more than $10 billion in assets and about $4.1 billion in liabilities. With the stock down 64% year to date, it looks like the long-term trend can only be up.

What is the Price Target for IAC stock?

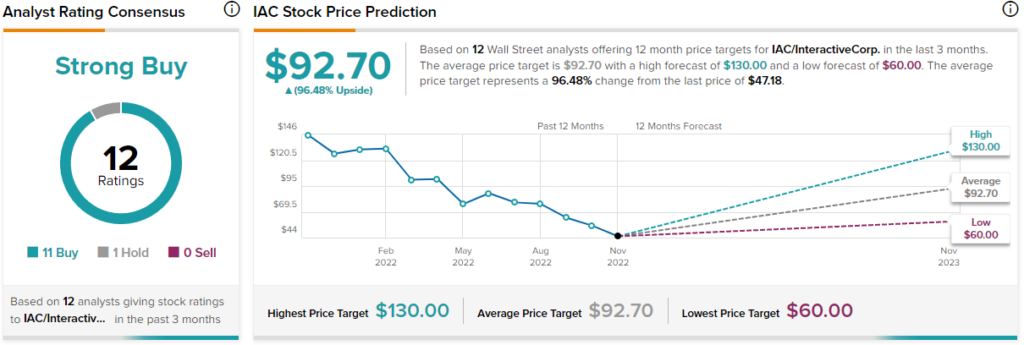

IAC has a Strong Buy consensus rating based on 11 Buys, one Hold, and zero Sells over the last three months. At $92.70, the average price target for IAC implies upside potential of 96.5%.

Sprout Social (NASDAQ:SPT)

A closer look at Sprout Social raises multiple concerns. One of the biggest issues is that the company’s insiders continue to unload shares, including more than $7 million worth of Sprout stock over the last three months. Another problem is that Sprout Social has never been profitable and shows no signs of ever becoming profitable. Thus, a bearish rating seems appropriate.

Some may consider Sprout Social to be more of a software stock, given that its focus is on a platform that enables customers to track their social media accounts. However, Sprout makes its money from social media.

Insider selling does raise concerns for companies, but in Sprout Social’s case, the problem is endemic. Insiders have been dumping Sprout shares for years, including in and around capital raises. In August 2020, Sprout Social sold another $43 million in new shares and $145 million worth of shares from insiders, possibly allowing them to cash in at what was a high price then. A review of the company’s insider sales shows few times in its history when no one was selling.

Additionally, Sprout Social has been growing its revenue steadily in recent years, but its net income has remained in the red. One has to wonder how much the company will have to make to turn a profit, especially since its losses have been widening over the last four quarters while its revenue has appeared healthy due to its growth.

What is the Price Target for SPT stock?

Sprout Social has a Strong Buy consensus rating based on 10 Buys, one Hold, and zero Sell ratings over the last three months. At $68.60, the average price target for Sprout Social implies upside potential of 6.7%.

Conclusion: Bullish on IAC, Run from SPT

Neither IAC nor Sprout Social is a typical social media stock, but they have both captured revenue in the space in recent years. From an investing standpoint, these companies are total opposites. Despite its track record of earnings and revenue beats, there just isn’t anything to like about Sprout Social, and insiders don’t even like it either. On the other hand, IAC looks cheap right now based on the sum of its parts. The bull thesis for IAC may take time to play out due to the current bear market, but it looks attractive from a long-term perspective.