HP (HP) was formed following the split of Hewlett-Packard Company in 2015, and is among the world’s top five personal computer manufacturers.

The company provides personal computing and other access devices, imaging and printing products, and related technologies, solutions, and services to individual consumers, small and medium businesses, and large enterprises.

HP is a mature company with a quantifiable competitive advantage trading at discount to intrinsic value. However, we’re neutral due to its limited number of growth catalysts.

Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating the earnings power value.

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value can be measured using total asset value. If the earnings power value is higher than the reproduction value, then a company is considered to have a competitive advantage.

The calculation is as follows:

- EPV = EPV adjusted earnings / WACC

- $74.6 billion = $5.373 billion / 0.072

Since HP has a total asset value of $38.9 billion, we can say that it does have a competitive advantage. In other words, assuming no growth for HP, it would require $38.9 billion of assets to generate $74.6 billion in value over time.

The second method to determine a competitive advantage is by looking at a company’s gross margin. This is because it represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a sustainable competitive advantage is present.

If an existing company has no edge, then new entrants would gradually take away market share, leading to a decreasing gross margin as pricing wars ensue to remain competitive.

In HP’s case, its gross margin has increased from around 18.4% in 2018 to 20.8% in 2021. As a result, its gross margin indicates that a competitive advantage is present in this regard as well.

Growth Catalysts

HP is a mature company that is expected to see low single-digit growth going forward. Because of this, catalysts for significant growth are unlikely to present themselves. Nevertheless, HP is a cash flow machine and trading at a price-forward cash flow multiple of 6.78x.

Therefore, the biggest growth catalyst for the stock going forward would be stock buybacks.

HP has been buying back shares aggressively over the past few years. Its trailing 12 months’ buyback yield is a whopping 17%. The benefit of this is that by reducing the share count, the earnings per share figure increases even if absolute earnings do not.

As a result, the growth in earnings per share (30.16%) has outpaced the growth in net income (21.11%) over the past five years.

Thus, if the market keeps the same valuation multiple going forward, the stock price would increase faster than it would without the buybacks.

Dividends

HP currently has a 2.49% dividend yield, which is above the sector average of 0.73%. When taking a look at its five-year average free cash flow figure of $4.7 billion, its $959-million dividend payment looks safe.

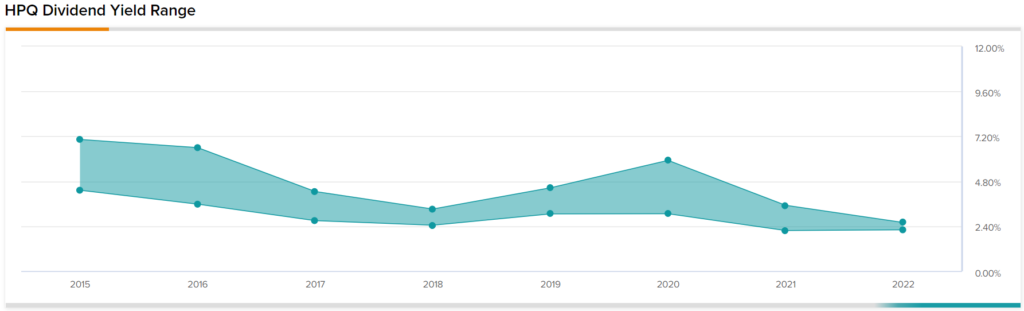

Taking a look at its historical dividend payments, we can see that its yield range has trended downwards in the past several years.

At 2.49%, the company’s dividend is near the low end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Valuation

To value HP, we will use a single-stage DCF model because its free cash flows are volatile and difficult to predict. For free cash flow, we will use the average from the past five years while also excluding the average stock-based compensation from the calculation.

In addition, we will assume no growth in free cash flows because analysts expect it to fall close to our calculated average of $4,717 million ($4,437.6 million when excluding stock-based comp):

Our calculation is as follows:

- Fair Value = Average FCF per share / Discount Rate

- $51.39 = $4.06 / 0.079

As a result, we estimate that the fair value of HP is approximately $51.39 under current market conditions.

Wall Street’s Take

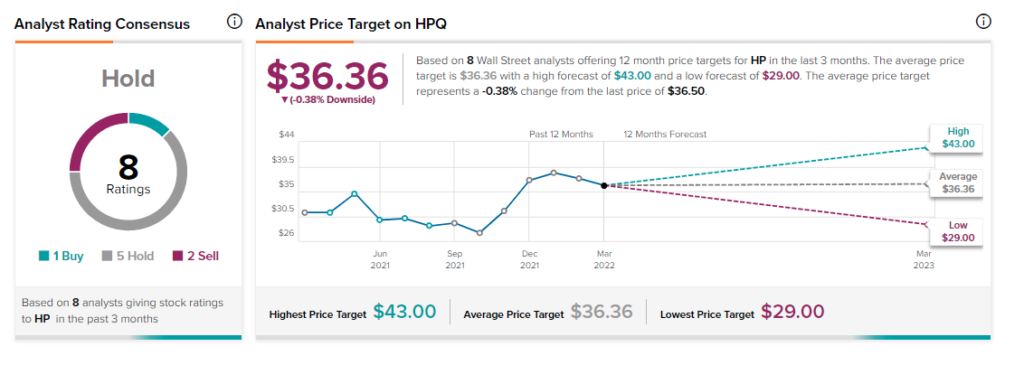

Turning to Wall Street, HP has a Hold consensus rating, based on one Buy, five Holds, and two Sells assigned in the past three months. The average HP price target of $36.36 implies 0.4% downside potential.

Analyst price targets range from a low of $29 per share to a high of $43 per share.

Final Thoughts

HP is a classic value stock that generates plenty of cash with a measurable competitive advantage. What the company lacks in growth, it makes up for with aggressive buybacks that help boost the earnings per share number.

Nonetheless, we remain neutral on the stock because we prefer to invest in companies with more predictable cash flows that have a clear growth trend. In addition, we aren’t convinced that HP will outperform the SPDR S&P 500 Trust ETF (SPY) over the long run.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure