With the benchmark S&P 500 (SPX) booming higher this year, targeting Sempra Energy (NYSE:SRE) might seem overly cautious. However, the Federal Reserve just might change everything for the public utility firm. With the central bank’s battle against inflation only yielding modest results, it might want to get serious. If so, Sempra’s permanently relevant business offers a possible safe haven. Therefore, I am bullish on SRE stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fed Policy to Lay the Groundwork for SRE Stock

At its core, Sempra benefits from a natural monopoly. Because the barriers to entry surrounding the utility space are so steep, would-be competitors don’t even bother. Therefore, Sempra can do its thing without much challenge. However, it also makes for a boring investment narrative, helping to explain its lackluster year-to-date performance. Still, Fed policy might lay the groundwork for surprising upside in SRE stock.

A brief background is necessary to understand the thesis. Following unprecedented monetary and fiscal stimulus programs to mitigate the impact of the COVID-19 crisis, a fresh dilemma materialized — skyrocketing inflation. To combat the threat of economic instability that soaring consumer prices posed, the Fed imposed benchmark interest rate hikes.

By raising borrowing costs, the central bankers aimed to gently cool the labor market. In some ways, the Fed achieved progress as multiple sectors – first with technology, then with other industries – announced mass layoffs. Still, throughout this year, the labor market has proven resilient.

Most recently, the June jobs report finally came in below economists’ consensus forecast. Nevertheless, the unemployment rate declined while wage growth remained robust and steady on a month-to-month basis. In other words, more dollars continue to chase after fewer goods, a classic inflationary backdrop.

Unfortunately, it might mean that the Fed must take the kiddie gloves off regarding its hawkish rate hike protocol. With more than a few analysts anticipating another round of rising borrowing costs, economic pain may be on the horizon.

That’s bad news for arguably most enterprises. However, it shouldn’t affect SRE stock too badly. It might even help its cause.

Sempra to Benefit from Cynicism and Migration Nuances

At its most basic, cynicism drives the case for SRE stock, especially if the Fed believes more cooling in the labor market is necessary. Almost certainly, an aggressively hawkish monetary policy would at least threaten the imposition of recessionary forces. However, for Sempra, people must pay their bills.

Not only that, but Sempra represents a top-shelf consideration in the family budget. While certain expenditures can be sacrificed, you can’t axe Sempra’s bill. Otherwise, consumers would be looking at no electrical power – an impossible situation in our digitally-connected economy.

However, skeptics of SRE stock might point to California’s much-discussed net migration out of the Golden State. With fewer people residing in the state, Sempra may suffer from a diminishing addressable market.

Nevertheless, context matters. While people are leaving California, it’s not a dilemma that impacts SRE stock. Firstly, those most likely to relocate are often found in rural areas. Second, the folks that have left tend to be lower and middle-income workers. In their stead, though, the Golden State has seen an influx of higher-income individuals with more education.

Also, these folks tend to move to the state’s crown jewel cities, such as San Diego, where Sempra is headquartered. So no, SRE stock probably won’t hurt from the migration dynamics. If anything, it should swing higher.

Financials Tell the Tale

While it’s not unusual to hear politically oriented podcasts and other content categories lament the future of blue states like California, for stakeholders of SRE stock, at least, the numbers don’t speak of imminent doom. Instead, they seemingly point to upside opportunity.

For instance, Sempra has consistently expanded its top line since the end of 2017, when it posted total revenue of $9.6 billion. Every year since, sales grew, accelerating noticeably in 2021 and culminating in a tally of $14.44 billion last year, per the company’s official press release.

In addition, Sempra posted diluted earnings per share of $6.62 last year, a significant boost from the EPS of $4.01 in 2021. Basically, whatever the Fed throws at the utility giant, it’s ready to adjust.

Is Sempra Energy Stock a Buy, According to Analysts?

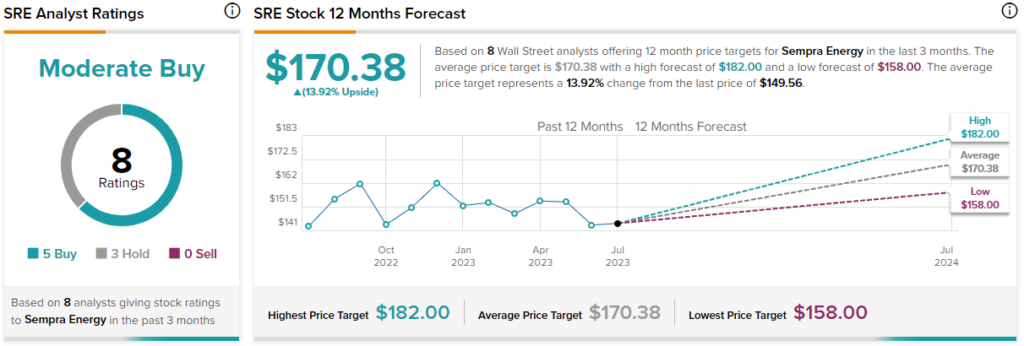

Turning to Wall Street, SRE stock has a Moderate Buy consensus rating based on five Buys, three Holds, and zero Sell ratings. The average SRE stock price target is $170.38, implying 13.9% upside potential.

The Takeaway: SRE Stock Offers a Predictable Safe Haven

With concerns rising about future monetary policy, investors ought to consider the narrative of SRE stock. No matter what happens – hawkish, dovish, or more of the same – people must pay their utility bills. Further, with Sempra enjoying an economically lucrative market that’s likely expanding in per-capita wealth, you can park your money here with relative confidence.