In the iconic Martin Scorsese film Casino, sports handicapper and Mafia associate Sam “Ace” Rothstein – played by Academy Award winner Robert De Niro – bemoaned that Las Vegas would “never be the same.” He links its modern imagery to that of a famous theme park. Rather than facilitating a pure avenue for games of chance, Sin City went corporate, becoming a vacation spot for pensioners and families with small children.

Prior to the COVID-19 pandemic, gambling mecca Wynn Resorts (WYNN) was riding high on its Macau-based properties, where patrons take their wagers very seriously. However, the global health crisis has now forced Wynn to rely more on its Las Vegas operations, which is a troubling recipe. I am neutral on WYNN stock.

Though the film came out in 1995, De Niro’s voiceover in the final scenes perfectly encapsulates the woes impacting WYNN stock. Before the COVID-19 pandemic, the gaming resort relied heavily on its Macau properties to deliver the goods. In the first quarter of 2021, Wynn posted revenue of $1.65 billion, with its Macau resorts accounting for nearly 76% of sales.

Fast forward three years later, in Q1 2022, and Macau properties only account for 31% of Wynn’s $953.3 million in revenue. With Vegas now the key revenue generator (at 46% of total sales), WYNN stock is dependent on the U.S. market to keep the lights on.

Unfortunately, this is where De Niro’s parting words in Casino really hurt.

WYNN Stock and the Culture Shock

Given the vast distance between Las Vegas and Macau, it’s not surprising that gambling aside, these two regions feature significant cultural differences. Interestingly, these differences are quite stark in how patrons view gambling resorts, leading to an under-discussed headwind for WYNN stock.

Primarily, Macau gamblers go to Wynn properties to do precisely that, gamble. In Q1 2018 and Q1 2019, casino revenues represented the overwhelming majority of total revenue (averaging 72% between the aforementioned quarters). While Wynn’s non-casino business segments are significant money makers, in Asia, gambling is king.

On the other hand, in Vegas, revenue per segment is much more evenly distributed. In Q1 2019, casino revenue accounted for only about 28% of total revenue at Sin City. Further, in Q1 2022, this allocation was little changed at a bit over 28%. Indeed, for the latest quarter, Food and Beverage, along with Rooms, were the top revenue generators, confirming the De Niro character’s point.

Las Vegas did change: it’s no longer about the gambling but all the glitz, glamour, and entertainment that goes along with visiting the desert oasis. This is fine for WYNN, so long as it has its Macau properties running at full steam.

Unfortunately, that’s just not the case.

COVID-19 Holds Wynn Hostage

As much as Wynn’s management team would love to kickstart tourism in Macau, it’s entirely dependent on the Chinese government, specifically its COVID-19 protocols. If the pandemic cooperates, WYNN stock could be off to the races. So far, though, Beijing is running a tight ship regarding the global health crisis – to the detriment of Wynn’s Macau properties.

For now, the framework implies that China’s COVID-19 protocols will remain extremely strict compared to U.S. standards, which doesn’t put WYNN stock in a favorable circumstance. Again, the cultural differences between western and eastern market gamblers play a meaningful role.

Basically, Wynn’s revenue breakdown by segment is mainly distributed to fixed sales generators. As mentioned above, in Q1 2022, Food and Beverage and Rooms represented the leading revenue generators, but these are mostly one-off benefits. For instance, a lobster can only be eaten once, while a room can only be rented to a single guest or group at a time.

In contrast, a slot machine can potentially generate multiple income postings per every hour, which is part of the reason why they remain the most important money-making component for casinos.

Sure, renting out rooms is always nice, but unless the guests order in-house food delivery services every hour, the sales productivity profile is mostly one room, one night.

Wynn Resorts Stock Analysis

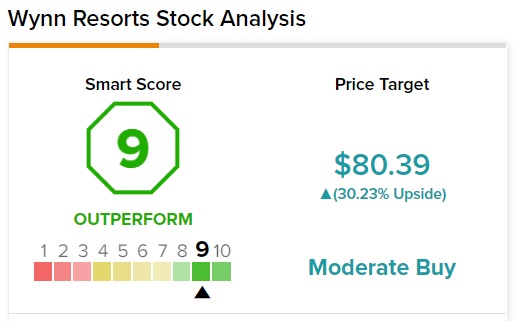

On TipRanks, WYNN has a 9 out of 10 Smart Score. This indicates a moderate potential for the stock to outperform the broader market.

Wall Street’s Take on Wynn

Turning to Wall Street, WYNN is a Moderate Buy based on four Buys, five Holds, and no Sells assigned in the previous three months. The average Wynn Resorts price target is $80.39, implying 30.23% upside potential.

Not Entirely Doom and Gloom

Despite the negative near-term outlook for WYNN stock, presenting an entirely bearish framework may be misleading. Yes, Macau gamblers want to spend most of their time in Wynn resorts playing games of chance. However, China’s harsh COVID-19 restrictions prevent Macau properties from fully actualizing their revenue and profitability potential.

At the same time, if COVID-19 goes away or if China decides that its restrictions are too detrimental to its economy, then Macau can truly flourish. That’s why WYNN stock may be a “sideline” investment now. Still, speculators may want to eyeball an entry at some point, depending on how the pandemic and international COVID policies play out.