Lululemon Athletica (LULU) kept the buzz for its brand in Q2 by reporting strong financial results last week that beat analyst estimates.

I am bullish on LULU stock. (See Lululemon Athletica stock charts on TipRanks)

Q2 Solid Results and Upbeat Guidance

On Wednesday afternoon, the Vancouver, British Columbia-based athletic gear maker surprised Wall Street with Q2 solid financial results and upbeat guidance for the rest of the year.

Gross profit jumped 72% to $842.7 million, and gross margin rose 390 basis points to 58.1%. In addition, net revenue increased 61% to $1.5 billion. Company-operated stores’ net income grew 142% to $695.1 million. Meanwhile, the operating margin increased 630 basis points to 20%.

Meghan Frank, Chief Financial Officer, credited the strong Q2 performance to innovative product offerings and higher productivity across stores. “Our performance in Q2 was driven by a strong response to our product offering, improving productivity in our stores, and sustained strength in e-commerce,” she said. “While we continue to navigate the COVID-19 environment, including supply chain headwinds, I’m excited with our momentum as we head into the second half of the year and pleased to be able to increase our guidance.”

Quo Vadis President John Zolidis believes that Lululemon is well-positioned to ride the growing demand for athletic apparel around the globe. “We believe LULU remains very well positioned to take advantage of the demand for athletic and casual apparel and to continue to grow on a global basis,” he said. “We also believe that the Lululemon brand remains strong.”

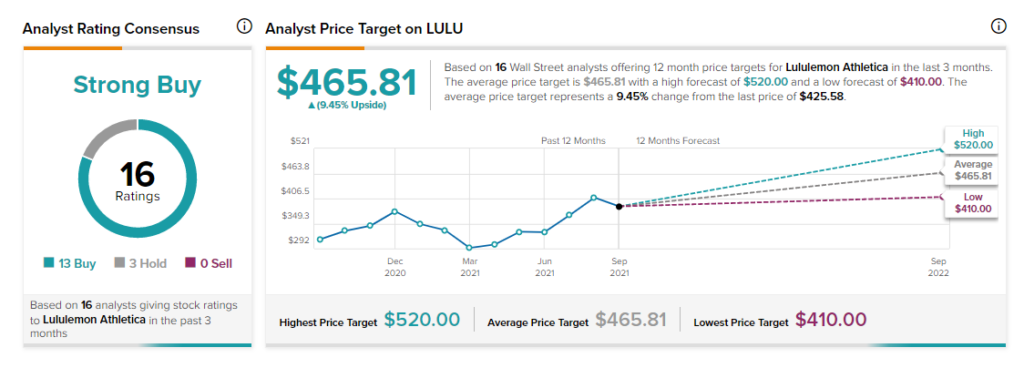

The analyst community rates Lululemon a strong buy, with an average price for the next 12 months of $465.81 with a high forecast of $520.00 and a low forecast of $410.00. The average Lululemon price target represents a 9.45% change from the last price of $425.58.

Apparently, Lululemon is doing several things right to keep the hype for its products alive.

Right Priorities

One of the critical factors in order to win, in every industry, is getting priorities right and determining how resources should be allocated to deliver value to customers. In athletic apparel and fashion products, these priorities must include the fueling and maintaining of buzz for the brand.

Lululemon’s leadership seems to be doing just that, with its Power of Three growth plan and Impact Agenda commitments, as explained by its CEO Calvin McDonald. “Our second-quarter results demonstrate the continued momentum across the business and how we are living into our Power of Three growth plan and Impact Agenda commitments,” he said. “We launched exciting new products, experienced strength across channels and geographies, and announced new partnerships that will allow us to become a leader in product sustainability.”

Launched a couple of years ago, the Power of Three growth plan includes Product Innovation– introducing new product lines supporting yoga, running and training, an office/travel/commute category, and pursuing new opportunities, such as self-care.

Then there is Omni guest experiences – the offering of an integrated guest experience across channels, inspiring, provoke and celebrating guests living a healthy and mindful lifestyle. “Lululemon is purpose-driven and is positioned well to continue to inspire guests living the sweatlife across multiple experiences,” McDonald added. “We believe we are operating from a position of strength as we invest in creating dynamic experiential moments for our communities to connect and come together.”

Additionally, the company is focusing on Market Expansion, reaching out to fast-growing international markets like China, the APAC and EMEA regions, and online markets in North America.

Summary and Conclusions

Few companies have managed to keep the buzz for their brand alive for a long time. Lululemon is one of them, thanks to the introduction of new products that inspire people to live a healthy lifestyle and reach new markets.

Disclosure: Panos Mourdoukoutas owns shares of Lululemon.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.