Founded in 2013, DoorDash Inc. (NYSE: DASH) provides food ordering and delivery services through its online platform.

With a per-share price of $102, the company went public in December 2020. Remarkably, its shares surged a solid 85% on the first day of trading. However, since then, the stock has declined 63.9% to $68.48.

Recent Developments

In its recently released annual Restaurant Online Ordering Trends report, the company said, “Ordering delivery remains a consumer preference with 83% of consumers ordering delivery as much or more than they did last year and 86% reporting order takeout/pickup as much or more than last year.” This reflects well on DASH’s near-term performance.

On May 18, 2022, to reduce share dilution, the company’s board of directors approved a buyback program of up to $400 million of its common stock.

Earlier in May, DoorDash reported its first-quarter 2022 results. The company was successful in recording a 23% year-over-year jump in total orders.

Monthly active users (MAUs) and DashPass members grew to record high levels. Adjusted EBITDA grew 25.6% year-over-year to $54 million and revenues were up 35% from the year-ago period to $1.5 billion.

Near-Term Prospects

DoorDash continues to make investments to expand into new markets and enter new delivery categories.

According to bringg.com, online food delivery sales is expected to increase to $220 billion by 2023 and make up 40% of total restaurant sales. We expect this to bode well for DoorDash’s bottom line.

On the flip side, rising gas prices and costs related to the purchase and maintenance of vehicles may continue to impact DoorDash’s profitability. Not only this, money spent on advertising, including discounts and coupon offers, could put pressure on profit margins.

Analysts’ Take

Recently, Wolfe Research analyst Deepak Mathivanan maintained a Buy rating on DoorDash but lowered the price target to $90 from $110. The new price target implies 17.48% upside potential from current levels.

On May 6, Needham analyst Bernie McTernan maintained a Buy rating on the stock with a price target of $140, implying 82.62% upside potential from current levels.

Overall, the stock has a Moderate Buy consensus rating based on 11 Buys versus six Holds. DoorDash’s average price target of $125.71 implies upside potential of 63.45% to current levels.

TipRanks’ Data

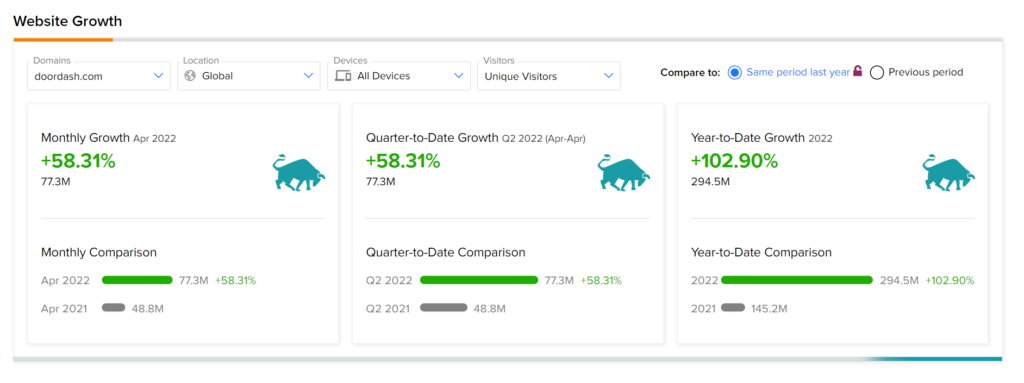

According to the TipRanks’ Website Traffic tool, doordash.com recorded a 58.3% monthly increase in global unique visits in April, compared to the previous year. Further, the footfall on the company’s website has grown 102.9% year-to-date against the same period last year.

This data also indicates that the company’s performance in the upcoming quarter may remain promising.

Meanwhile, TipRanks’ Insider Trading Activity tool shows that the confidence in DASH is currently Neutral. In the last three months, corporate insiders have bought shares worth $192.1 million.

However, TipRanks’ Hedge Fund Trading Activity tool shows that the confidence of hedge funds in DoorDash is currently Very Negative, as the cumulative change in holdings across all 15 hedge funds that were active in the last quarter was a decrease of 3.1 million shares.

Closing Note

The future prospects of DoorDash seem to be bright, as the food ordering habit among consumers is here to stay. Also, the acquisition of Wolt, which is likely to close in this quarter, is expected to support DoorDash’s further growth. However, rising costs and stiff competition remain major drags for the company.

Read full Disclosure