Aerospace and technology leader Honeywell (HON) turned in its earnings report on Thursday. Investors reacted with excitement, as the stock is currently up 3.3% on the day.

I’m bullish on Honeywell. That’s thanks to its presence in several major technological sectors. Plus, it’s clearly devoted to building on its advantages in those markets. Honeywell is showing off a dynamic operation, and even if it doesn’t work, it’s still made progress. That’s hard not to like.

The last 12 months in trading haven’t been that good for Honeywell. It’s lost some significant ground over that time frame. However, it’s still within shouting distance of where it once was. This time last year, the company was challenging the $230 per share mark. Today it’s struggling to get back over $200.

The latest news, meanwhile, gives Honeywell a significant boost. The company’s earnings report turned in clear beats on both earnings and revenue. Honeywell posted $1.91 per share in earnings, readily beating the Zacks consensus of $1.86 per share.

It also beat the Refinitiv consensus of the same amount. Revenue beat as well, coming in at $8.38 billion against Refinitiv’s call for $8.29 billion.

Wall Street’s Take

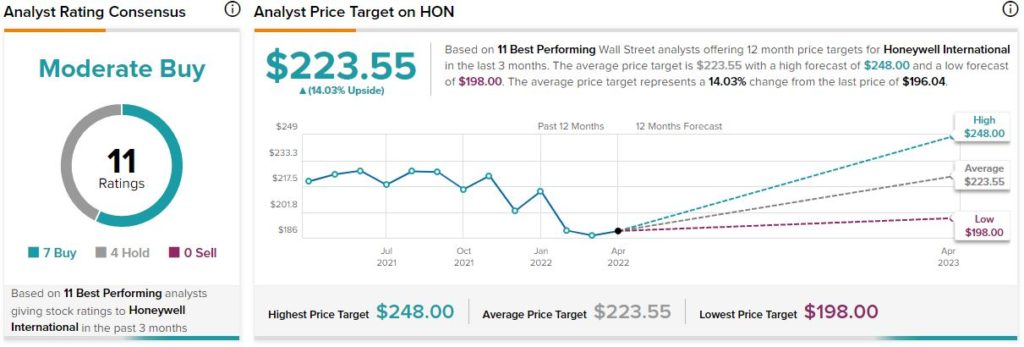

Turning to Wall Street, Honeywell has a Moderate Buy consensus rating. That’s based on seven Buys and four Holds assigned in the past three months. The average Honeywell price target of $223.55 implies 14% upside potential.

Analyst price targets range from a low of $196 per share to a high of $248 per share.

A Mixed Picture for Investor Sentiment

Investor sentiment starts getting very confusing around this point. There are positive and negative signs in almost equal measure. Some are downright aggressive in nature.

First, there’s the matter of hedge fund participation. The TipRanks 13-F Tracker reveals that hedge funds reduced their involvement with Honeywell, albeit slightly. This reduction comes after a slight adjustment upward seen between June 2021 and September 2021.

Much of that upward adjustment was lost with the latest reduction. Overall, though, hedge funds are more invested now than they were back in June of last year.

Then there’s the much more telling matter of insider trading. Insiders were clearly weighted toward buy transactions. Buy transactions led sell transactions 26 to eight in the last three months. The full year is even more clearly buy-focused. Buying transactions led selling transactions 47 to 18.

As for retail investors who hold portfolios on TipRanks, that indicator is surprisingly negative. While TipRanks portfolios that held Honeywell were up 1.1% in the last 30 days, they were down 4.1% in the last seven days.

Finally, there’s the matter of dividends. Honeywell’s dividend history is performing just how an income investor would like to see it. Dividends are paid regularly. They increase just about as regularly. Even during the pandemic, Honeywell kept up its dividend. That’s no small accomplishment.

Good Performance Today, Plans for a Brighter Tomorrow

The thing that catches me most about Honeywell is that it’s behaving about how a company should. There are no bet-the-company strategies at work here. There are no long-bomb hail-marys on untested technology or unproven systems. No, Honeywell just turned in a great earnings report. It’s set to follow that up with solid work in the technology sector.

Honeywell’s CEO, Darius Adamczyk, pointed out that several factors gave the company’s growth a boost, particularly “double-digit growth” in commercial aviation aftermarket parts. Building products and productivity tools also lent a hand. No part of that list will likely be subject to extreme downward pressure.

Yes, the housing market is eventually going to come down from its euphoric highs, and yes, commercial aviation is likely to take a bit of a blow from reduced disposable income and travel concerns. However, neither of these markets will dry up and blow away altogether.

Honeywell is already looking to ameliorate some of those likely losses with new investments. For instance, just about a week ago, word emerged that Honeywell was looking to sink $200 million into the Egyptian market.

Specifically, Honeywell is investing in the country’s petrochemical and green aircraft fuels markets. These are two key points of operation in general for Honeywell, so this move is a rational extension of its leading markets.

Additionally, Honeywell is looking to limit the hits taken by supply chain issues. It’s actively seeking out new suppliers to support development at Boeing (BA) and Airbus (EADSY), which will limit lost opportunity and the associated costs therein.

Opportunity costs are a huge problem for businesses. By actively working to make sure there are enough suppliers on hand to continue to supply parts and materials accordingly, Honeywell limits its potential losses from not being able to meet demand.

Concluding Views

Honeywell might seem like a shaky plan right now, especially looking at the mixed opinions generated by investor sentiment. Retail investors seem to not like Honeywell right now. Insiders are buying hand over fist. Hedge funds are turning just a bit negative, but not that much.

However, let’s remember that Honeywell is trading a lot closer to its lows than its high targets. There’s plenty of upside potential here. It’s got a very solid dividend history, and it’s got an equally solid plan going forward.

This is why I’m bullish about Honeywell. It’s not fancy or particularly flashy. It’s a stable company producing solid results. Better, it’s sufficiently diversified to work through the kind of recession that’s likely to hit markets soon.

There’s a lot to like here. For those looking for stability in their portfolio—and who don’t mind paying for it—Honeywell should serve as ground about as solid as you can get these days.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure