The crypto market has crashed terribly this year as investors have shifted their focus from risky assets to safer bets amid rising interest rates and a tough macro backdrop. The situation has been quite tense for crypto mining companies as their financials have been significantly hit by declining prices of Bitcoin (BTC-USD) and other cryptocurrencies, with higher energy costs making matters worse. Here we will discuss what Wall Street analysts think about two of the leading crypto mining stocks – Hive Blockchain (NASDAQ:HIVE) (TSE:HIVE) and Marathon Digital (NASDAQ:MARA).

In a recent research report, Valkyrie Investments, which focuses on digital assets, cautioned investors that while some crypto mining stocks could be value plays following the steep pullback, others might turn out to be value traps and could see their prices decline further. Valkyrie’s report emphasizes that crypto miners with a strong profitability track record, the lowest debt levels, and the highest assets and liquidity will be well-positioned to navigate the crypto winter.

HIVE Blockchain Technologies (NASDAQ:HIVE)

The Canadian crypto mining firm HIVE produced 290.4 BTC in August, with an average hash rate of 2.07 Exahash of bitcoin mining capacity. It produced 3,010 Ether (the native token of the Ethereum (ETH-USD) blockchain) last month, with an average hash rate of 6.19 Terahash of Ethereum mining capacity. The hash rate measures the computational power used by a cryptocurrency network to process transactions.

There have been concerns that the Etherium network upgrade (called the Merge), which will transition the blockchain from a proof-of-work mechanism to an energy-efficient proof-of-stake system, is going to adversely impact HIVE. It’s worth noting that HIVE’s Ethereum mining operations have historically delivered three to four times higher revenue per megawatt than bitcoin mining.

Once Ethereum completes its upgrade, miners like HIVE will have to think of other ways to use their Ethereum mining capabilities. In its production update, HIVE mentioned that it is exploring the mining of other GPU (graphics processing unit)-mineable coins with its fleet of GPUs.

What Is the Forecast for HIVE Stock?

Following HIVE’s Q2 update last month, H.C. Wainwright analyst Kevin Dede opined that with Ethereum’s transition to proof-of-stake, “ETH mining may no longer be an opportunity, placing HIVE’s fate in the hands of BTC exclusively, or some undetermined alternative use of its GPU cards.”

Dede cautioned that in the worst-case scenario, if HIVE mines bitcoin only, then the company’s revenue could fall to $134.3 million. The analyst acknowledged that the Ethereum Merge could be a disadvantage to HIVE. That said, Dede highlighted that the company continues to expand its BTC mining capacity and could enhance its hash rate to 4.6EH/s (Exahashes per second) by March 2023.

Dede reiterated a Buy rating for HIVE stock and increased the price target to $7 from $6 based on “continued confidence in execution.”

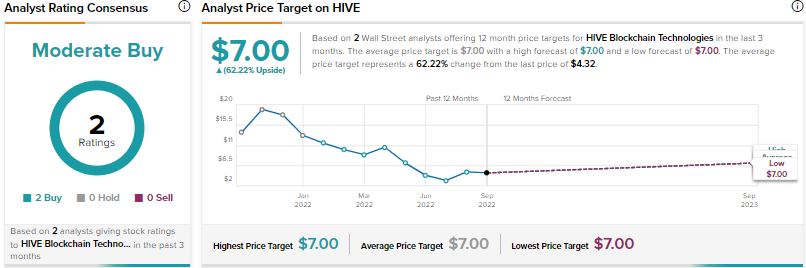

Overall, HIVE scores a Moderate Buy consensus rating based on two recent reviews. The average HIVE price target of $7 implies 62.2% upside potential from current levels.

Marathon Digital (MARA)

Marathon Digital is one of the leading bitcoin mining companies. The company produced 184 bitcoin in August, bringing the year-to-date production to 2,222 bitcoin. The hash rate as of August-end came in at nearly 3.2 EH/s.

Based on the progress Marathon has made in installations and construction of new facilities, the company is confident about reaching its target capacity of about 23 EH/S by mid-2023. The company believes that once it reaches this target, its operations will be “not only among the largest, but among the most energy efficient on a per terahash basis.”

Is MARA Stock a Buy or Sell?

Recently, Cowen analyst Stephen Glagola increased his price target for Marathon stock to $9 from $7 but maintained a Hold rating. The analyst lowered his full-year revenue and adjusted EBITDA estimates following the company’s disappointing second-quarter results. Marathon cited “Energization delays, maintenance and weather issues in Montana,” and the fall in bitcoin prices as the reasons for its weak performance.

Glagola feels that Marathon continues to face execution risk with regard to achieving its goal of reaching a hash rate of 23.3 EH/s due to its dependency on third-party suppliers and lack of infrastructure control.

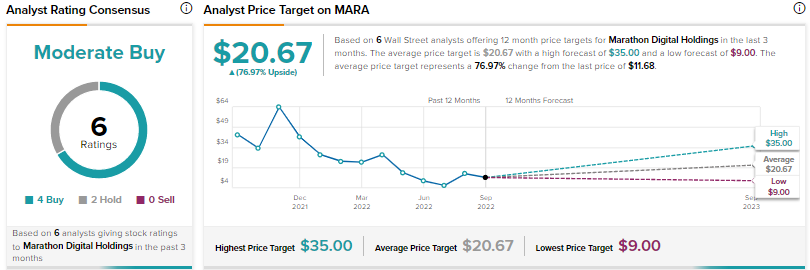

Overall, with four Buys and two Holds, Marathon scores a Moderate Buy consensus rating. At $20.67, the average MARA stock price prediction implies 77% upside potential from current levels.

Final Thoughts

Crypto mining stocks have tumbled due to the crash in bitcoin and the prices of other underlying cryptocurrencies. Many mining companies reported huge losses in the second quarter. They were forced to sell some of their bitcoin holdings to cover expenses and even had to write down the value of their holdings. While Wall Street analysts believe in the long-term potential of HIVE Blockchain and Marathon Digital, they are currently cautiously optimistic about these crypto miners due to the ongoing macro challenges.