Canada-based Nutrien Ltd. (TSE:NTR) (NYSE:NTR) has been a treat to watch due to its impressive run on the bourses. The upside has been largely contributed by the company’s solid global production assets, strength in operating performance, and favorable market fundamentals.

Nutrien is a leading provider of crop inputs and services. It produces and distributes roughly 27 million tonnes of potash, nitrogen, and phosphate products across the globe. NTR stock has gained around 66% in the past year.

Now, let’s take a look at the factors that make this stock look appealing.

Key Growth Catalysts

In the recently reported second quarter of 2022, Nutrien Ag Solutions’ (Retail) business saw a record adjusted EBITDA. In fact, the adjusted EBITDA was up 38% year-over-year in the first half of 2022, largely on the back of solid sales and high gross margin levels led by favorable market conditions.

Nutrien has delivered an earnings beat in almost all quarters in the last couple of years, except one. If the trend continues, NTR stock will get a further boost.

Management remains upbeat about the company’s domestic business and expects to see demand rising for its crop nutritional products, fungicides, and insecticides in the third quarter of 2022.

Nutrien also boasts of a solid cash flow generating capacity on the back of which it is on track to successfully conclude a 10% share repurchase program this year.

In a bid to boost its Retail operations in Brazil, Nutrien has entered into agreements to buy Brazilian companies Casa do Adubo S.A. and Marca Agro Mercantil. The buyout is expected to provide support to Nutrien in beating its goal of achieving $100 million annual adjusted EBITDA in Brazil by 2023.

Furthermore, Nutrien aims to enhance its manufacturing capacity of potash to 18 million tonnes by 2025.

Is Nutrien a Good Stock to Buy?

Nutrien looks like a great stock to grab now. Wall Street is optimistic about the prospects of NTR stock and has a Strong Buy consensus rating based on 10 Buys, one Hold, and one Sell. Nutrien’s average price target of C$136.49 implies 6.9% upside potential.

According to TipRanks, NTR stock has a ‘Perfect 10’ Smart Score, which highlights its potential to outperform the market.

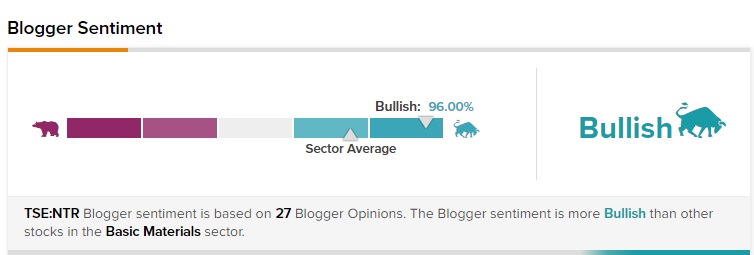

Further, financial bloggers are 96% bullish on NTR stock, compared to the sector average of 75%.

Final Thoughts

An impressive cash flow position, strong operational performance, earnings momentum, and favorable market fundamentals should keep Nutrien on the growth path, thereby increasing the investment appeal of its stock.

Read full Disclosure