Despite many industries struggling in the current trading environment, some companies have instead flourished. Specifically, aerospace & defense behemoths such as Northrop Grumman (NOC) are currently enjoying tailwinds driven by the ongoing geopolitical tensions. As a result, shares of NOC have trended higher. When considering the critical role that Northrop Grumman plays in the world, I find its shares reasonably valued despite their most recent rally. I am neutral on the stock.

What Does Northrop Grumman Do?

Northrop Grumman Corporation is among the greatest aerospace & defense contractors in the market. It has a wide footprint in supplying a comprehensive breadth of products and services to the United States forces and its partners.

The company’s vast range of operations strives to aid in accomplishing national security priorities while supplying its customers with the capabilities they require to safeguard and advance society.

Its core business comprises the supply of space designs, state-of-the-art aircraft, missile protection, a number of different weapons, and other mission-critical assets, such as A.I., cutting-edge computing, and cybersecurity.

Why Does the Market Currently Love NOC Stock?

Aerospace & defense contractors Northrop Grumman are currently receiving increased investor attention driven by the ongoing tragic war in Ukraine. As Western governments keep providing Ukraine with all sorts of weaponry and appropriate equipment, the company is enjoying phenomenal levels of demand for its products and services.

On top of that, due to Western allies eventually needing to replenish their arsenal following the endless weapons deliveries, the result will be an expanding backlog for defense goliaths like Northrop Grumman. Therefore, Northrop Grumm is well-positioned to continue producing reasonably predictable and growing revenues in the coming years.

Another tailwind arising from the ongoing global geopolitical turmoil for the company is that the DoD’s R&D budgets are expected to increase moving forward. This trend has been in place for a while, with Northrop Grumman’s company-sponsored R&D expenditures rising from $639 million in 2017 to $1.1 billion last year. Thus, the rise in investor interest in the stock is quite justifiable.

Northrop Grumman Q2 Results: Robust Backlog despite Softer Sales

Northrop Grumman closed the first half of Fiscal Year 2022 with robust operating results, despite the ostensibly weaker revenues compared to last year.

In Q2, Northrop Grumman’s sales fell 4% to $8.8 billion. Breaking this down, sales from Aeronautics Systems fell 13% to $2.5 billion compared to last year, mainly as a result of lower volumes in both Manned Aircraft and Autonomous Systems, comprising restricted programs, F-35, Global Hawk, and the NATO AGS program.

Defense Systems’ sales also fell 9% to $1.3 billion, mainly due to the completion of a Joint Services support program and the lower scope of an international training program. Sales from Mission Systems also came in weaker year-over-year, dipping 3% to $2.5 billion. The decline was primarily due to lower volumes on Navigation, Targeting, and Survivability programs.

Finally, revenues from Space Systems grew 8% to nearly $3.0 billion. Higher revenues in the segment were driven by increased sales in the Launch & Strategic Missiles business area due to the ramp-up of development programs.

Despite what initially looks like a weak quarter from a top-line development standpoint, revenue growth is barely a fitting indicator for a defense contractor. Northrop Grumman’s backlog and net income growth prospects are much more noteworthy.

Specifically, during Q2 alone, the company booked $13 billion in net awards, resulting in its total backlog reaching $80.0 billion. For context, in the previous quarter, the backlog ended at $75.8 billion. This portrays north of two years’ worth of future sales (book-to-bill) for the company. Hence, its performance over the medium term should remain potent.

Further, in Q2’s conference call, management reiterated that revenue growth should pick up next year. Therefore, the benefits (unfortunately) surfacing from the lasting war will show up from 2023 onwards.

Dividend Growth Prospects Remain Attractive for NOC Stock

Due to its sizeable backlog, Northrop’s prospective revenues should be somewhat predictable moving forward. Thus, the company’s strong dividend growth track record should remain in place.

As a reminder, Northrop has raised its dividend-per-share for 19 straight years. Specifically, its 10-year CAGR (compound annual growth rate) hovers at 12.3%. The dividend-per-share growth rate is quite remarkable, considering how ripe the company is.

In its Q2 results, Northrop restated its Fiscal Year 2022 outlook, forecasting sales to land between $36.2 billion and $36.6 billion. Adjusted EPS is also expected to land between $24.50 and $25.10.

The midpoint of Northrop’s adjusted EPS guidance ($24.8), along with the current DPS run-rate ($6.92), implies a moderately restful payout ratio of around 28%. Thus, there should be enough space for management to keep delivering double-digit dividend growth in the coming years.

Is NOC Stock a Buy?

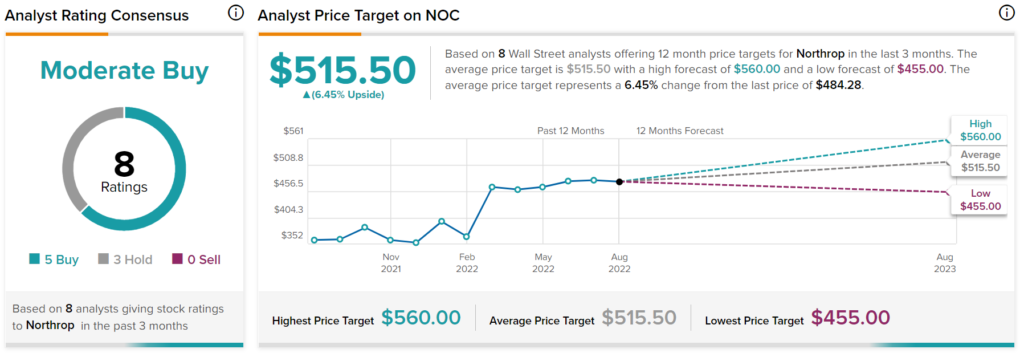

Regarding what Wall Street analysts are expecting, Northrop Grumman Stock has a Moderate Buy consensus rating based on five Buys and three Holds assigned in the past three months. At $515.50, the average Northrop Grumman stock price forecast suggests 6.5% upside potential.

Takeaway – NOC Stock is a Reasonably Valued Mission-Critical Company

In my view, Northrop Grumman is a quality aerospace & defense giant in the sector, displaying a decades-long track record of superior shareholder value creation. With shares currently trading at 19.4x the midpoint of management’s guidance, Northrop Grumman is not cheap but reasonably valued considering its mission-critical position in the current market environment.

The upcoming benefits from the war in Ukraine should continue strengthening the stock’s investment case as well, especially considering the conflict doesn’t seem to be ending anytime soon, unfortunately.