Alibaba Group Holding Limited (NYSE: BABA) is an online wholesale and retail giant in China. Its businesses also include cloud computing, digital media, consumer services, entertainment, and content platforms. It is headquartered in Hangzhou, China.

Of late, the $302.1-billion company is dealing with the adverse impacts of the revival in Covid-19 cases in the country. The American Depository Receipts (ADRs) of Alibaba have declined 3.6% year-to-date. The closing price was $116 on July 1 (Friday).

Despite the weak price performance, analysts on TipRanks are optimistic about the prospects of this Chinese company.

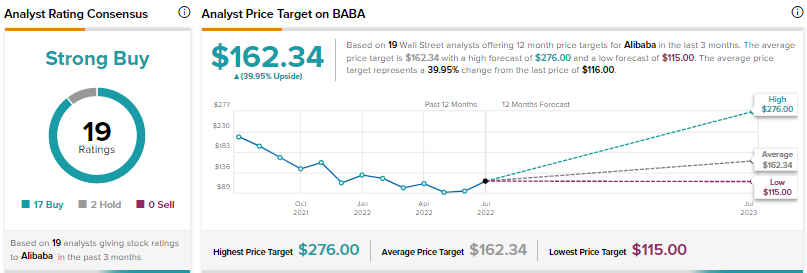

On TipRanks, Alibaba has a Strong Buy consensus rating based on 17 Buys and two Holds. BABA’s average price target is pegged at $162.34, reflecting upside potential of 39.95% from current levels. It scores a 9 out of 10 on the TipRanks Smart Score Rating system.

In May, Alibaba’s Chairman and CEO, Daniel Zhang, said, “Looking ahead, we will continue to execute on our multi-engine growth strategy by strengthening our digital infrastructure and focusing on quality growth to create long-term value for our customers, shareholders and other stakeholders across our ecosystem.”

Last week, the company’s digital technology unit, Alibaba Cloud, unveiled the Energy Expert platform. This new offering will help the company’s customers to assess their carbon footprint and take action to manage it effectively.

Also, Alibaba formed a new subsidiary, Lingyang Intelligent Service Co, last week. The new unit’s services (related to data intelligence) will equip enterprises to enhance their operational efficiency and decision-making abilities.

Wall Street’s Take

On June 29, 2022, Rob Sanderson of Loop Capital reiterated a Buy rating on BABA while increasing the price target to $185 (59.48% upside potential) from $170.

It seems that the company’s healthy prospects have attracted hedge funds and retail investors. TipRanks reveals that hedge funds holding in BABA has gone up by 1.1 million shares in the last quarter. Further, the number of retail portfolios with exposure to BABA stock has increased 1.3% in the past 30 days.

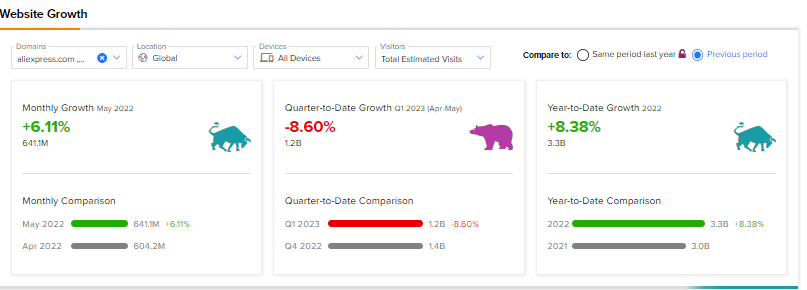

Most importantly, the TipRanks Website Traffic tools point out that the total traffic to the company’s websites is estimated to have increased 61.8% year-over-year in the fourth quarter of Fiscal 2022 (ended March 31, 2022).

The company’s website traffic is estimated to have increased 8.38% year-to-date, compared with 2021. However, the footfall on the company’s website has fallen 8.60% so far in the first quarter of Fiscal 2023 (ending June 2022) versus the fourth quarter of 2022.

The increase in the company’s website traffic trend underpins the company’s growing footprints and growth initiatives. However, the impacts of the pandemic and other macro issues are visible from the quarter-to-date fall in website traffic.

Conclusion

Despite near-term headwinds, investors may find Alibaba attractive, due to its global operations, innovation capabilities, and initiatives to strengthen prospects.

Read full Disclosure