In this piece, we used TipRanks’ Comparison Tool to have a closer look at three Strong-Buy-rated dividend stocks still capable of substantial upside over the year ahead.

Many dividend-paying stocks have suffered from Wall Street analyst downgrades in recent months, thanks in part to the negative momentum in the broader markets. Despite the trend of lowering the bar in the face of an economic slowdown, certain dividend stocks have bucked the trend and could continue to do so, even as evidence of a recession grows.

Some more defensive dividend stocks have been downgraded, not because of their fading fundamentals but due to their swelling valuations. The growth-to-value rotation has been quite notable in the first half.

While a second-half rotation back to growth stocks could bode poorly for resilient defensive stocks, I believe the following three “Strong Buy” dividend stocks seem well-equipped to continue powering forward.

Darden Restaurants (DRI)

Darden is a dine-in restaurant firm that got decimated during the 2020 stock market crash, as investors feared lockdowns would send revenues crashing toward zero.

Shares lost around 70% of their value from peak to trough before posting a full recovery to new all-time highs just over a year later, thanks in part to the broader economic reopening and the firm’s back-to-basics strategy. Undoubtedly, those who gave Darden the benefit of the doubt by buying the 2020 dip walked away with quick gains.

In the first half of 2022, the tides turned against DRI stock again, with shares steadily slipping back into bear-market territory. I don’t think Darden’s latest dip is the start of a repeat of the collapse that happened just over two years ago. The American economy is unlikely to return to lockdown, even if new COVID-19 variants or Monkeypox were to cause future outbreaks.

Darden has a strong lineup of brands (think Olive Garden and LongHorn Steakhouse, which comprise around 70% of sales). With exceptional stewards doing their best to maintain impressive operating efficiencies, Darden is likely to be quick to recover once the worst of recession fears are baked in and the new bull market readies to roar.

At writing, DRI stock trades at 14.9x trailing earnings, 1.5x sales, and 11.4x cash flow. The dividend yield sits at an impressive 4.2%.

The broader casual-dining industry is at risk of earnings pressure as we march toward a recession. That said, I think the modest valuation on DRI shares already bakes in much of the recession risk and demand destruction.

In any case, Darden has its foot on the gas, with up to 60 new restaurants and $500-550 million in capital projects expected for Fiscal Year 2023.

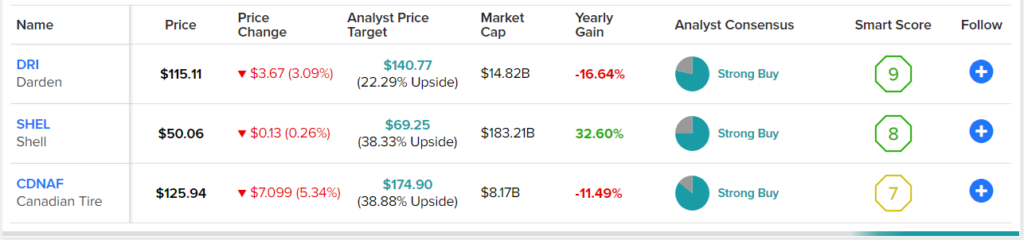

Wall Street is staying overwhelmingly bullish, with the average Darden stock price target of $140.77 implying 22.3% upside potential.

Canadian Tire (CDNAF) (TSE: CTC.A)

Don’t let the name of the firm fool you. Canadian Tire isn’t just a tire or automotive retailer anymore. It hasn’t been for decades now. It’s a diversified retailer with an impressive roster of exclusive brands spanning a wide range of industries, and it’s well-equipped to defend its turf in the Canadian retail market.

Canadian Tire sells auto parts, home appliances, sporting goods, pet food, toys, and a wide range of other discretionary items. Over the years, the company has done a spectacular job of staying relevant to Canadian consumers, even as big-league American retailers looked to take away the Canadian icon’s slice of the pie.

The company continues to fend off competition well, with a strong loyalty program named Triangle and the acquisition (and expansion) of exclusive brands. Canadian Tire has been busy wheeling and dealing over the years to improve its portfolio of branded products that Canadian customers can’t find anywhere else. In Canada, Canadian Tire is the go-to place to grab Party City (PRTY)-branded supplies or Petco (WOOF)-branded pet food.

Canadian Tire also has a deep roster of company-owned brands, including Mastercraft, Motomaster, and Yardworks. These are trusted brands in Canada and are key to keeping American rivals at bay.

On the sporting goods side, Helly Hansen and hockey-stick brand Sherwood are exclusive brands sold at Canadian Tire’s sporting-good subsidiary Sport Chek. Sport Chek is a dominant force in Canadian sports retail and accounts for around 15% of Canadian Tire’s total revenues.

Indeed, the Canadian retail landscape has been molded by e-commerce disruptors and increased competition from international retailers. Despite the pressures, Canadian Tire has been able to pivot effectively, thanks to its impressive brick-and-mortar presence and intelligent managers.

As Canadian Tire continues investing heavily in enriching the omnichannel experience, it will be tough to dethrone the Canadian retail giant, especially as it looks to expand further into new product categories (like toys and pet supplies).

At 0.6x sales, 6.6x cash flow, and 9x trailing earnings, Canadian Tire is a discretionary stock that may be worth traveling north of the border to buy. The stock yields 3.3%.

Wall Street is bullish, with the average Canadian Tire stock price target of $174.90 implying 38.9% upside potential.

Shell (SHEL)

Shell is a British (formerly Dutch) multinational oil giant that recently saw its oil-driven rally come to a plunging halt. The stock is now looking to stage a recovery from a quick 25% peak-to-trough drop.

At 8.75x trailing earnings, 0.6x sales, 4.2x cash flow, and 1.0x book value, the $184 billion energy behemoth is far cheaper than many of its peers. The discount may prove short-lived if management can effectively lower costs and improve its free-cash-flow performance.

The days of rampant capital spending may draw to a close as the firm focuses on efficiencies and a longer-term transition toward cleaner energy sources. The LNG (liquefied natural gas) business may also be a key stepping stone as the world looks to move from the filthiest fossil fuels to renewables.

While Shell has a growing Renewables and Energy Solutions business, the Upstream and Petrochemicals segments continue to be Shell’s biggest needle mover. In any case, Shell is one of few energy firms that’s focusing on the really long term, with a plan to become “net zero” by 2050.

Turning to Wall Street, analysts are bullish. The average Shell price target of $69.25 implies 38.3% upside potential. The stock has a 3.7% dividend yield.

Conclusion: Analysts are Most Bullish on Canadian Tire

Darden, Canadian Tire, and Shell are three 3.3%-4.2% yielders that Wall Street is sticking by, and it’s not hard to see why. Each firm is mildly-valued, with solid payouts and long-term fundamentals still intact. Wall Street expects the most upside potential from CDNAF stock of the three dividend stocks, although SHEL is not too far behind.