The prospect of a recession is real, and many financial experts think one could be lurking around the corner. Truist analyst Youssef Squali is one of them, believing there is now a “greater probability for a mild recession in 2023.”

This, along with “growing headwinds” from FX are why the 5-star analyst thinks it’s time to make some adjustments to his Amazon (AMZN) model.

Squali has lowered his FY23 estimates, but more in the here and now, in Q3, Squali expects the e-commerce giant to deliver revenue of $125 billion, below his prior forecast for $126.7 billion and at the low end of management’s guidance of $125-130 billion. The Street is calling for $127.9 billion.

Despite the lowered expectations, Squali expects a strong performance from the North America region, boosted by “sustained consumer demand.” There should also be the benefit of Prime Day taking place in Q3 this year compared to Q2 last year. As such, Squali still sees North America’s revenue growing by 20% year-over-year to $78.3 billion, just a touch above consensus at $77.4 billion.

The problem, however, is from the anticipated performance of the International segment. On account of the macro and FX headwinds, Squali sees revenue here falling by 12% year-over-year to $25.7 billion, some distance below the Street’s forecast for $29.4 billion.

Squali expects AWS to keep on outperforming, rising by 30% from the same period last year to $20.9 billion, roughly the same as consensus at $21.1 billion. Lastly, the analyst sees operating income coming in at $2.8 billion, “slightly below” consensus at $3 billion.

Elsewhere, Amazon’s efforts to reduce spending should keep bearing fruit; in 2Q22, the company cited a total of $4 billion in “elevated costs,” improving from $6 billion in Q1 and hitting Street expectations. “Importantly,” says the analyst, “management estimates that these costs will further drop to $2.5B in 3Q22.”

Despite the difficult market conditions, along with GOOGL, Squali believes Amazon is “best positioned to withstand current turbulence and emerge stronger from it.”

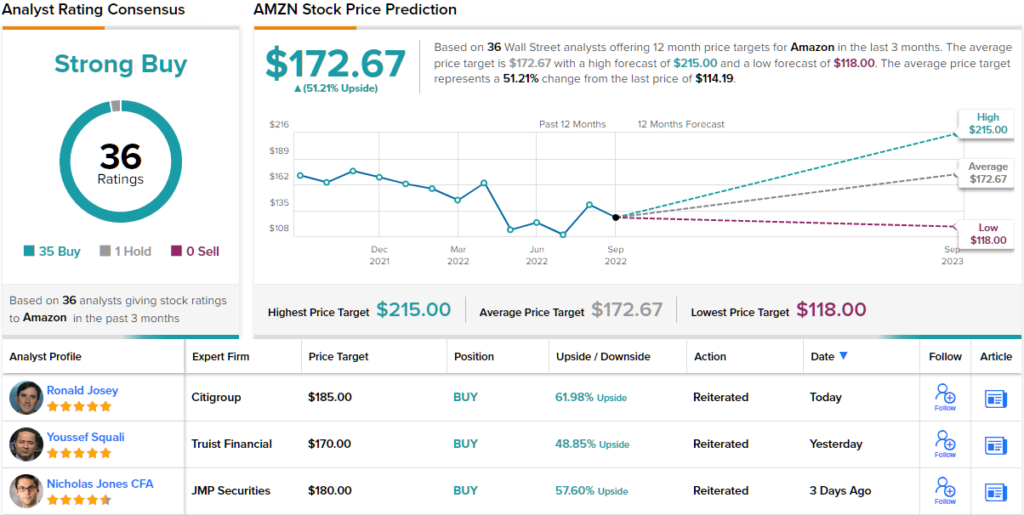

Nevertheless, the lowered forecast results in a reduced price target; the figure drops from $180 to $170, implying shares will now climb 46% higher over the coming year. Squali’s rating, however, stays a Buy. (To watch Squali’s track record, click here)

Amazon still has almost all of the Street on its side. One analyst remains on the fence, yet all 35 other recent reviews are positive, all culminating in a Strong Buy consensus rating. Going by the $176.79 average target, the shares have room for 51% growth in the year ahead. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.