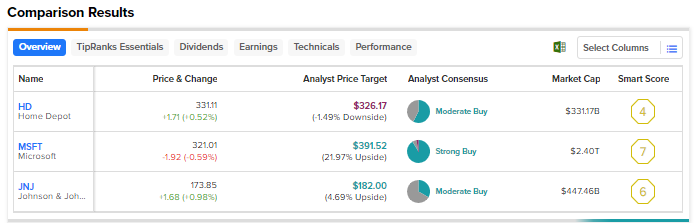

Investors looking for attractive investments amid the ongoing volatility in the stock market and persistent macro challenges could consider certain blue chip stocks for their portfolios. Blue chip stocks are stocks of large, well-established companies that have a solid financial position and a good track record of thriving despite macro challenges. Using TipRanks’ Stock Comparison Tool, we placed Home Depot (NYSE:HD), Microsoft (NASDAQ:MSFT), and Johnson & Johnson (NYSE:JNJ) against each other to find the most attractive blue chip stock as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Home Depot (NYSE:HD)

After enjoying pandemic-induced demand, Home Depot has been under pressure due to a weak housing market. In May, the home improvement company announced mixed fiscal first quarter results, with earnings exceeding expectations and revenue falling short of estimates. The company’s top line declined 4.2%, as customers postponed large projects and bought fewer big-ticket items due to macro pressures.

Further, unfavorable weather and declining lumber prices also impacted fiscal first-quarter sales. Following the weak Q1 FY23 performance, the company lowered its full-year sales guidance. It expects sales to fall by 2% to 5%.

Home Depot is scheduled to announce its Q2 FY23 results on August 15. Analysts expect the company’s sales to decline 3.6% to $42.2 billion. Adjusted EPS is expected to fall about 12% to $4.46.

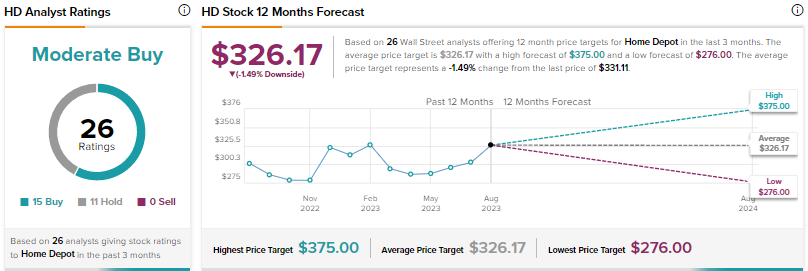

Is HD a Good Stock to Buy?

Ahead of the Q2 FY23 results, Telsey Advisory analyst Joseph Feldman downgraded Home Depot and rival Lowe’s (NYSE:LOW) to Hold from Buy. The analyst expects the two companies to face a slightly steeper slowdown due to the weak housing market trends, cautious consumer spending, and continued normalization following solid COVID-19 and government stimulus-related gains.

Feldman noted that HD stock outperformed the S&P 500 from 2019 to 2022, fueled by superior EPS growth. Nonetheless, Feldman feels that the stock might not maintain its outperformance in the near term, with the analyst now expecting EPS to decline 11% before growing 7% in 2024. While Feldman downgraded HD stock, he maintained his price target at $315.

With 15 Buys and 11 Holds, Home Depot stock scores a Moderate Buy consensus rating. The average price target of $326.17 implies a possible downside of 1.5%. Shares have risen about 5% year-to-date.

Microsoft (NASDAQ:MSFT)

Microsoft shares have risen 34% year-to-date, as the company is being viewed as one of the frontrunners of the generative artificial intelligence (AI) wave. Microsoft’s huge investment in ChatGPT creator OpenAI, the integration of AI in its tools and applications, and other AI initiatives are expected to drive future growth.

Coming to recent performance, Microsoft’s second-quarter results surpassed Wall Street’s expectations. However, investors were concerned about the company’s third-quarter guidance that fell short of analysts’ estimates due to weak demand for its products in the PC market.

Is Microsoft a Buy or Sell Now?

Earlier this month, Tigress Financial analyst Ivan Feinseth raised the price target for MSFT to $433 from $411 and reaffirmed a Buy rating. Feinseth stated that the company is at the forefront of the AI revolution, thanks to the continued integration of increasing AI functionality across all aspects of its business and product lines.

Feinseth thinks that MSFT’s increasing position as a dominant AI service provider will continue to fuel revenue growth and stock price gains.

Microsoft earns Wall Street’s Strong Buy consensus rating based on 32 Buys, two Holds, and one Sell. At $391.52, the average price target implies about 22% upside.

Johnson & Johnson (NYSE:JNJ)

Healthcare giant Johnson & Johnson has been under pressure due to the massive liabilities related to lawsuits alleging that the company’s baby talc powder was contaminated with asbestos and caused cancer. While this matter poses a major risk for the company, it continues to streamline its operations and focus on growth areas.

JNJ recently completed the spin-off of its consumer division into a separate company called Kenvue (NYSE:KVUE). The company took this step to direct its resources toward its pharmaceutical and medtech businesses.

Meanwhile, the company reported better-than-anticipated second-quarter results due to strong sales of its MedTech division. The rebound in non-emergency procedures, which were postponed during the pandemic, drove the MedTech division’s sales in the second quarter. The company raised its full-year sales and EPS guidance to reflect the better-than-expected Q2 2023 results.

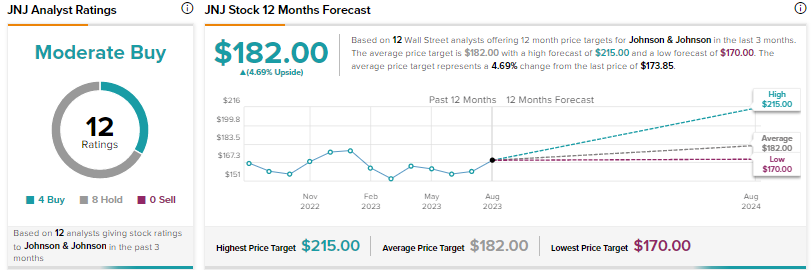

Is JNJ a Buy or Sell?

Following the company’s upbeat Q2 2023 results, Barclays analyst Matt Miksic increased his price target for JNJ stock to $175 from $171 and maintained a Buy rating. The analyst raised his sales and EPS estimates to reflect the Q2 2023 performance and improved outlook.

Miksic also delayed the projected decline in the revenue of JNJ’s blockbuster immunology drug Stelara from 2024 to 2025, given the intellectual property settlements announced by the company.

Wall Street’s Moderate Buy consensus rating on Johnson & Johnson is based on four Buys and eight Holds. The average price target of $182 implies about 5% upside. Shares have declined about 2% since the start of this year. JNJ is a dividend king and offers a dividend yield of 2.8%.

Conclusion

Wall Street is highly bullish on Microsoft but cautiously optimistic about Home Depot and Johnson & Johnson. Analysts see more upside in Microsoft stock compared to the other stocks due to optimism about the company’s prospects in generative AI.