No being is spared from the supply chain woes, pets included. Or maybe more accurately, sellers of pet products are feeling the brunt of the current supply constraints too.

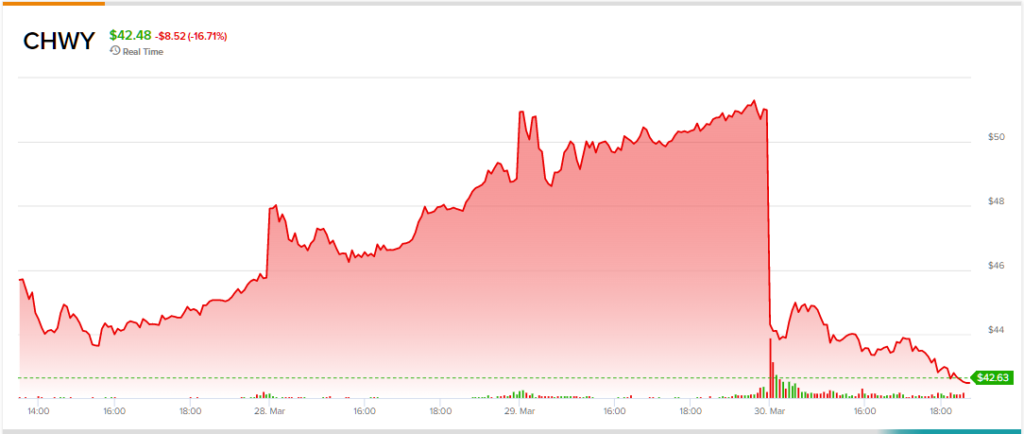

That was evident in the latest earnings report from Chewy (CHWY). The company said it is seeing “strong demand” but the aforementioned headwinds were behind the below par performance. Investors showed little sympathy, however, turned around and disappeared through the cat flap in the subsequent session.

The company missed both on the top-and bottom-line. Although revenue climbed by 17.2% year-over-year to reach $2.39 billion, the figure fell short of the guided range of $2.4 billion to $2.44 billion, while also coming in under the Street’s $2.42 billion forecast.

The company also dialed in a third consecutive quarterly loss, as EPS of -$0.11 missed consensus expectations of -$0.08.

Completing the triptych of disappointment, the outlook was a letdown too. For the April quarter (FQ1), Chewy anticipates revenue between $2.4 billion to $2.43 billion; Wall Street was looking for $2.51 billion. And for the full fiscal year, sales are expected to come in the $10.2 billion to $10.4 billion range, also below the consensus estimate of $10.6 billion.

Surveying the print, Jefferies’ Stephanie Wissink concedes that she has misread the company’s positioning in the current environment. However, the analyst is still on Chewy’s side.

“We’ve been dead wrong on the stock as growth has moderated from 20% to mid-teens% & the market discount has increased,” the analyst explained. “We see half of the revision as transitory and half as structural. Our thesis still hooks to +DD% growth, looks beyond Q1 into the Q2+ normalization period plus the rollout of high-margin value streams incl: ad platform, membership fee model, and service marketplace.”

Accordingly, Wissink sticks with a Buy rating, although the price target is lowered from $90 to $60. Nevertheless, the figure still implies ~41% upside potential from current levels. (To watch Wissink’s track record, click here)

Overall, most analysts remain in CHWY’s corner but not all are convinced; the stock’s Moderate Buy consensus rating rests on 10 Buys, 6 Holds and 1 Sell. There are still decent gains projected here; at $64.5, the average price target indicates shares will climb ~49% higher over the one-year timeframe. (See Chewy stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.