Momentum trading is all the rage these days. That’s one way to explain the 22% gain in Hanesbrands (HBI) stock after it reported fourth quarter earnings on February 9.

This is not to say that the report wasn’t good. The company, known for its comfort apparel, delivered a comfortable beat on both the top and bottom lines.

With regards to revenue, Hanesbrands posted $1.8 billion, which surpassed expectations of $1.64 billion. And on the all-important bottom line, HBI delivered EPS of 38 cents, topping analysts’ projections of 29 cents. This also marks the third quarter, out of the last four, in which Hanesbrands beat earnings estimates.

On top of this, Hanes announced it was paying its quarterly dividend of 15 cents on March 9, 2021. While that is not an increase, it’s worth noting that the company has retained its dividend throughout the pandemic.

Hanes also delivered forward guidance, part of which was to say that personal protective equipment (PPE) would no longer be part of its growth plan. PPE made up a significant portion of the company’s revenue in 2020.

Management indicated that full-year guidance would be announced at its investor event in May. At this time, it offered a bullish first quarter outlook.

For Q1, management expects net sales to be between $1.48 to $1.51 billion. The midpoint of this guidance would represent 14% year-over-year growth. Meanwhile, adjusted operating profit is forecasted to land within the range of $150 to $160 million, partly due to an offset of last year’s manufacturing volume declines at the onset of the pandemic. Adjusted EPS could come in at 24 cents to 27 cents, which is well above the consensus estimate of 16 cents.

Priced for Perfection?

By virtually any measure, Hanesbrands delivered a stellar earnings report. However, HBI stock closed at $19.96 on Feb. 9, suggesting that investors are pricing in its full potential. That would fit in nicely with the company’s Full Potential plan to grow its business.

The Full Potential plan, as outlined by CEO Gerald Evans, has four pillars: building on the strength of the company’s Champion brand; retaining momentum for its innerwear category; strengthening its e-commerce presence and streamlining its global portfolio.

As Evans delivered his remarks, it was clear that the plan amounts to a common sense approach to reconfigure the Hanesbrands portfolio to focus on the key sales drivers. And no retail company is going to survive in 2021 without a strong e-commerce presence. Hanes did realize stronger digital sales during the pandemic and Evans noted that the company wants to build on that customer loyalty and ensure that the brand becomes sticky in a competitive space.

Now, however, Hanes must execute on the plan. Although they get high marks for providing bold first quarter guidance, as other companies may shy away from putting a target on their backs, that doesn’t mean the stock is not overvalued at its current price.

Analysts Weigh In

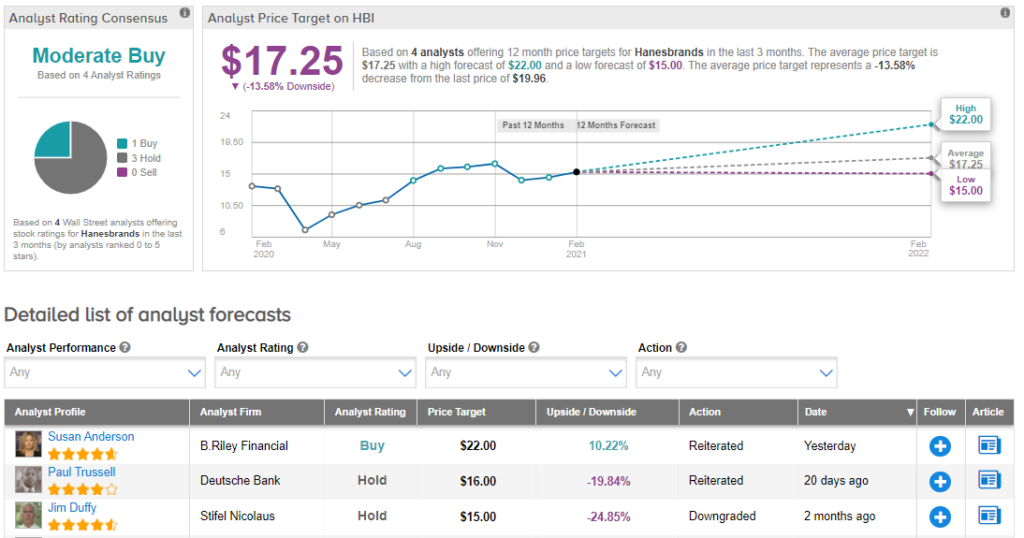

Turning now to the analyst community, HBI’s Moderate Buy consensus rating breaks down into 1 Buy and 3 Holds. Given its average analyst price target of $17.25, shares could decline 13.6% in the year ahead. (See Hanesbrands stock analysis on TipRanks)

Wait for a Better Entry Point

HBI is trading at a level that hasn’t been seen in over two years. And prior to the pandemic, the stock had been on a slow decline. Investors that are looking for momentum may find this to be an interesting trade.

That said, investors looking for capital growth over the long haul may be disappointed. However, if the stock tracks down to around $16, it could reflect a good buying opportunity.

Disclosure: On the date of publication, Chris Markoch did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.