Drug maker Novavax (NVAX) recently revealed a bit of good news that gave the stock an extra 3.4% boost in premarket trading last Thursday. The positive momentum did not last long, as the stock was seen drops approaching 6% in trading Thursday morning. The unexpected fluctuations in trading aside, I’m bullish on Novavax. There are some significant potential expansions ahead, and investors have an excellent opportunity to take advantage of these.

Novavax’s year in trading so far has been best described as “wildly erratic.” “Volatile” really doesn’t seem to touch a stock whose value has been sliding up and down between $112 and $320 for the last year. Novavax’s year started comparatively mildly, hovering down around the $130 level and making modest gains. That is, until January 27, when the share price roughly doubled in the space of two days’ time.

Gains continued from there, bringing the company to its 52-week high in early February. Those gains didn’t last, as is so often the case. Subsequently, the company lost around half its value in the space of a month. A series of wild ups and downs followed, with neither up nor down lasting more than a few weeks. This brings us up to the present day, where another post-spike dip cut about 20% of the share price with it.

The latest news should be more helpful than the market seems willing to accept. Novavax revealed that its COVID-19 vaccine is effective against the Omicron variant. However, as seems to be increasingly the case, the vaccine’s protective capabilities increase if you have recently had a booster shot. Trials show that the vaccine has around a 90.4% efficacy rate, which is good, given the number of variants that keep cropping up. Novavax didn’t rule out the possibility of targeted vaccines emerging later, though.

Novavax’s CEO, Stanley Erck, pointed out that Novavax’s COVID-19 vaccine comes with several advantages that vaccines made via messenger RNA (MRNA) do not. For instance, Novavax’s COVID-19 vaccine doesn’t require super-cold temperatures, like Pfizer’s (PFE) and Moderna’s (MRNA) need. This means it’s easier to transport and easier to store, and offers better shelf life. Erck also pointed out that the Novavax vaccine has fewer side effects than many of its competitors thanks to a “more benign profile.”

Wall Street’s Take

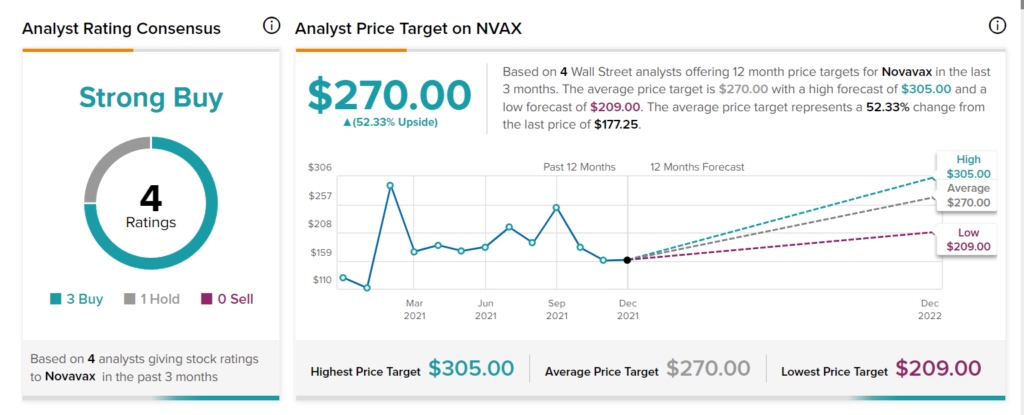

Turning to Wall Street, Novavax has a Strong Buy consensus rating. That’s based on three Buys and one Hold assigned in the past three months. The average Novavax price target of $270 implies 52.33% upside potential.

Analyst price targets range from a low of $209 per share to a high of $305 per share.

Crisis or Opportunity?

There’s an old saying that, in Chinese, the word for “crisis” is actually the same as the word “danger” and “opportunity” together. To a certain extent, this is true, though the complexity of the Chinese language requires a few caveats. Yet, if you take it at face value, that’s what’s going on with Novavax right now.

The company has a surprising amount of room to expand. Its COVID-19 vaccine was recently cleared for use in Europe. There are also some downsides to consider, as it might not be cleared for use in other countries where it applied for approval, such as South Korea. Thus, we have both danger and opportunity in the same package, as Novavax gains on some fronts and loses on others.

Moreover, we can look at the company’s extraordinarily volatile price history as a measure of its potential. We saw the company go from around $112 to $320 so far this year. With the highest and lowest price targets both already surpassed, the company can go just about anywhere from there. About the only bit of objectively bad news comes from Novavax’s dividend history. It doesn’t actually have one. That puts it quite a bit behind some of its competitors in the field.

Concluding Views

There’s a lot of good news connected with Novavax. That’s enough to keep me bullish overall. The company has made some great strides in opening up new markets. Its price history suggests that it could go anywhere. After all, it was over $300 per share once; why couldn’t it return to that level?

There are some problems with Novavax as well, though. For one, the fact that it doesn’t show up yet in the U.S. markets limits its sales potential. The company plans to apply for FDA approval soon, but its ability to receive said approval remains questionable.

Additionally, there are a significant number of competitors already in play, and COVID-19 is starting to decline in impact. A declined sense of urgency from potential shot buyers could be a problem for vaccine producers in general. Remember, South Africa largely stopped tracking the Omicron variant because there just wasn’t much going on there. Still, Novavax has been quite a ride so far. It may continue to be, for at least the near-term future.

Disclosure: At the time of publication, Steve Anderson did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates. Read full disclaimer >