The COVID-19 pandemic has decimated the U.S. economy, yet the stock market is alive and well. Against the backdrop of a recession, the market actually had its strongest quarter in over 20 years, with the S&P 500 notching its largest quarterly gain since the last quarter of 1998, surging 20%. As for the NASDAQ, it climbed 31% higher during the quarter, marking its best quarterly performance since Q4 1999.

While certainly volatile, the quarter saw investors take an optimistic approach due to reopening efforts and unprecedented stimulus packages. That being said, going forward into Q3, plenty of uncertainty is lingering over Wall Street. So, how are investors supposed to lock in on compelling plays? The Street’s pros can provide some much-needed inspiration, namely those from investment firm Goldman Sachs.

Taking all of this into consideration, we used TipRanks’ database to learn more about three stocks backed by Goldman Sachs. As it turns out, the firm’s analysts projecting more than 30% upside potential for each. The rest of the Street is on the same page, with each ticker earning a “Strong Buy” consensus rating.

Myovant Sciences (MYOV)

Combining purpose-driven science, empowering medicines and transformative advocacy, Myovant Sciences wants to change the treatment landscape for both women and men. On the heels of its recent data readout, Goldman Sachs is even more optimistic about this healthcare name.

Covering this stock for the firm, five-star analyst Paul Choi tells clients that a key component of his bullish thesis is its relugolix asset. MYOV recently published positive Phase 3 data from its SPIRIT 1 study evaluating a once-daily relugolix combination therapy in women with endometriosis. This data supported the data from the previously reported SPIRIT 2 study.

Looking more closely at the results, 74.5% of patients saw a clinically meaningful reduction in dysmenorrhea compared to 26.9% of women in the placebo group, with the placebo-adjusted difference landing at 47.6%. Choi notes that Orilissa, the currently approved therapy for moderate to severe pain caused by endometriosis, demonstrated a 27%/21% (two trials) placebo-adjusted difference for its 150 mg once-daily therapy and a difference of 56%/50% for its 200 mg twice daily dose.

However, Orilissa can cause hypoestrogenic symptoms including hot flashes and loss of bone mineral density. Choi pointed out, “To avoid this, physicians can co-prescribe progestin and/or estradiol (add-back therapy). However, physicians emphasized that the once-daily, fixed-dose pill containing relugolix and add-back therapy would more readily convince a physician to prescribe it instead as the dosing schedule of Orilissa can be confusing, even for the prescriber.” MYOV’s candidate produced significantly fewer hot flashes, making Choi even more confident.

“In addition to the side effect profile and simple dosing schedule, physicians called out that many OBGYN offices were not equipped to handle the prior authorizations required for use. MYOV has focused efforts here to ensure that the proper tools are delivered to support prior auth requirements,” Choi added.

As updated data from the Phase 3 open-label extension study (LIBERTY) evaluating relugolix combination therapy in women with uterine fibroids (UF) was also promising, the deal is sealed for Choi.

To this end, the analyst maintained a Buy rating along with a $28 price target, suggesting 40% upside potential. (To watch Choi’s track record, click here)

Most other analysts also take a bullish approach. MYOV’s Strong Buy consensus rating breaks down into 3 Buys and only 1 Hold. Additionally, the $27.33 average price target puts the upside potential at 36%. (See MYOV stock analysis on TipRanks)

Southwest Airlines (LUV)

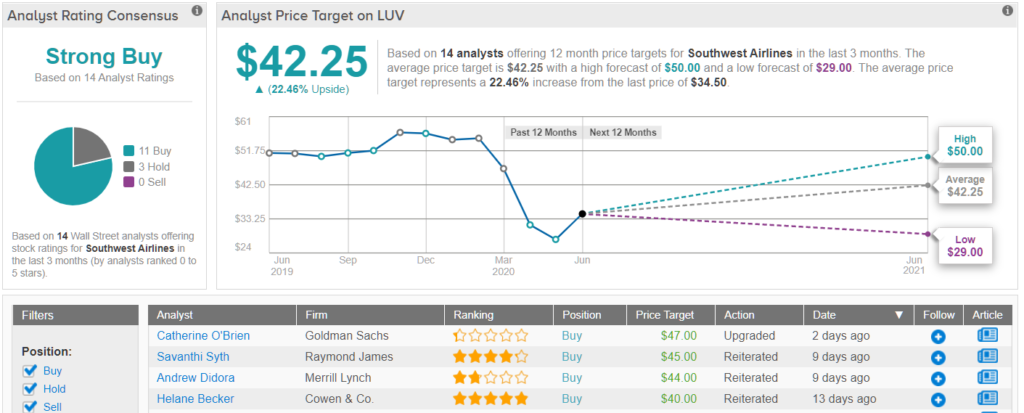

It’s no secret that COVID-19 has dealt the travel industry a swift blow. That being said, as passenger volumes have started to recover from the low point hit in April and market trends improve, Goldman Sachs is turning more bullish on Southwest Airlines.

Representing the firm, analyst Catherine O’Brien doesn’t dispute the fact that since LUV was added to the Americas Sell List on February 19, shares have plummeted 40% compared to the S&P 500’s 8% loss.

Singing a different tune now, O’Brien argues that given the airline industry’s focus on driving a rebound from the pandemic-induced lows, “Southwest’s primarily domestic network and industry leading balance sheet will drive a faster-than-industry recovery in profitability.”

Specifically looking at the latter, the analyst commented, “Additionally, given that liquidity remains a concern for the industry, balance sheet strength is currently of even more importance than it typically is, in our view.”

It should also be noted that LUV shares have historically experienced less turbulence than other players in the space. Therefore, while it boasts less upside potential than some of the firm’s other Buy-rated stocks, the level of upside here is enough to convince O’Brien to stand squarely in the bull camp.

As a result, O’Brien just gave LUV a thumbs up, upgrading her rating from Sell to Buy. If that wasn’t enough, the price target also gets a lift, from $35 to $47. Should the target be met, a twelve-month gain of 37% could be in store. (To watch O’Brien’s track record, click here)

In general, other analysts also like what they’re seeing. 11 Buys and 3 Holds add up to a Strong Buy consensus rating. Based on the $42.25 average price target, the upside potential comes in at 23%. (See LUV stock analysis on TipRanks)

ServiceNow (NOW)

As for Goldman Sachs’ third pick, ServiceNow offers software that delivers digital workflows designed to improve productivity. Given the strength of its technology, the firm sees big things in store for the tech company.

After looking at the space as a whole, four-star analyst Christopher Merwin goes so far as to deem NOW a best idea. Expounding on this, he wrote, “We believe the resiliency of the sector throughout COVID underscores the criticality of many software categories as businesses adjust for more distributed workforces and therefore require modernized cloud systems. With sector multiples at all-time highs, we favor stocks where we see compelling relative value.”

According to Merwin, NOW is set to be a “key beneficiary of digital transformations as enterprise customers increasingly focus on leveraging a select few strategic platforms that can deliver could-based solutions with ease, agility, and integrations.” Citing its product development, the analyst believes its approach is “best-in-class”, with the company continuing to expand into new areas like financial operations management and DevOps.

“We believe this rich product roadmap, and ongoing momentum for ITSM, ITOM, HR, and CSM, will all help to sustain 28%-plus subscription revenue growth through FY22E,” Merwin commented. Going forward, its efforts to re-invest in new products in order to increase the addressable market and runway for growth should help NOW reach its long-term revenue target of $10 billion, in the analyst’s opinion.

Merwin added, “As software valuations continue to move higher across the space, we believe NOW stands out as an attractively valued stock – particularly on a growth-adjusted FCF, trading at 45.5x our CY21E FCF, relative to FCF growth expectations of 35%.”

It should come as no surprise, then, that Merwin stayed with the bulls. In addition to keeping a Buy rating on the stock, the analyst gave the price target a boost, from $403 to $538, which brings the upside potential to 33%. (To watch Merwin’s track record, click here)

Do other analysts agree with Merwin? As it turns out, most do. With 19 Buys and 4 Holds assigned in the last three months, the word on the Street is that NOW is a Strong Buy. However, at $396.32, the average price target does indicate 3% downside potential. (See ServiceNow stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.