We’ve seen a strong bull run in the stock market this year, with the S&P 500 and Nasdaq both gaining more than 20%. The gains have investors asking: Can the markets keep this up into next year?

Looking at the situation for Goldman Sachs, chief US stock strategist David Kostin writes, “Counter to the intuition of many investors, the stellar YTD return is not a good reason in itself to expect a weak return in 2022.”

Kostin reminds investors that one-year bull runs of 20% or more tend to be followed by another year of above-average market returns. Looking ahead to next year, Kostin sees 9% annual returns in the S&P 500, which would put the index at 5,100 by the end of 2022. Taking dividends into account, investors can expect a 10% return from a well-rounded portfolio, in the Goldman view.

Taking Kostin’s lead, the stock analysts at Goldman are running with his upside – and pointing out the stocks that show potential to seriously outperform the upside forecast.

In fact, the firm’s analysts are predicting more than 50% gains ahead for three stocks in particular. Using TipRanks’ database, we found out that each ticker has also received enough support from other Wall Street analysts to earn a “Strong Buy” consensus rating. Let’s take a closer look.

Sema4 Holdings (SMFR)

First up, Sema4 Holdings, brings AI and machine learning to bear on the healthcare industry. The company has introduced a health intelligence platform, Centrellis, that enables a multidimensional, longitudinal, dynamic model of human health, based on clinical and genomic data, with the aim of designing optimal, individualized understandings of disease and wellness. The company believes that patients are partners in the process, and that health data should be share openly between patients and practitioners.

Sema4 was founded in 2017, and entered the public trading markets in July of this year. The company went public through a SPAC transaction, with CM Life Sciences, and the SMFR ticker debuted on the NASDAQ on July 23. The combination brought some $500 million in new capital to Sema4.

Earlier this month, Sema4 released its second quarterly report as a public company, and some of the results should please investors. The company saw a 36% increase in test volume, and a 17% increase in revenue – compared to 3Q20. The top line came in at $43.2 million. At the bottom line, the company reported a 15 cent profit per share, a sharp turnaround from the 21-cent per-share loss reported in Q2.

Among the fans is Goldman Sachs analyst Matthew Sykes, who likes Sema4 for four reasons: “1) established $200mn germline business, 2) large untapped somatic testing market opportunity, 3) potential to achieve earlier detection through unparalleled high-resolution longitudinal data access to tens of millions of patients and 4) enterprise sales approach targeting health systems allows for broader uptake and accelerated adoption.”

Based on these reasons, Sykes rates SMFR a Buy along with a $12 price target. Investors could be pocketing gains of ~65%, should Sykes’ thesis play out as expected. (To watch Sykes’ track record, click here)

“SMFR has high market share in expanded carrier screening (ECS), and opportunities for growth in NIPT and hereditary cancer (HC) where they are a relatively new entrant. SMFR already has contracts with all large national payers covering about 250mn lives, and is currently renegotiating payer contracts to increase revenue predictability even further,” Sykes summed up.

With a background like that, it’s no wonder that SMFR has attracted rave reviews from other analysts as well. SMFR’s analyst consensus rating is a unanimous Strong Buy, with 4 analysts giving it the thumbs up in the last three months. Shares sell for $7.2, and the average price target is $12.50; this indicates a potential upside of ~73%. (See SMFR stock analysis on TipRanks)

Aris Water Solutions (ARIS)

The second Goldman pick we’re looking at is Aris Water Solutions, a midstream company in the Permian Basin hydrocarbon scene. This Houston-based firm develops and operates water infrastructure and recycling capabilities for the Permian’s oil and gas producers. The company’s ‘core focus’ is in the Texas-New Mexico border region, where it operates in the Delaware and Midland Basins of the larger Permian formation. Production companies will pump water into the ground, to release the oil and gas – Aris gathers this water afterwards for treatment and redelivery to the producers.

Aris took advantage of the bull market this year to hold its IPO. The company went public on October 22, putting 17.65 million shares up for sale. The initial price was $13 per share, and the company gained approximately $214 million in net proceeds from the IPO.

Just a few weeks after the public offering, Aris released its 3Q21 report, its first such release as a public company. Aris reported revenue of $59.5 million, and the free cash flow of $6.1 million helped bump the cash on hand to $36.4 million. The top line was up 40% yoy, and the company’s available cash was up from $8.3 million in 3Q20.

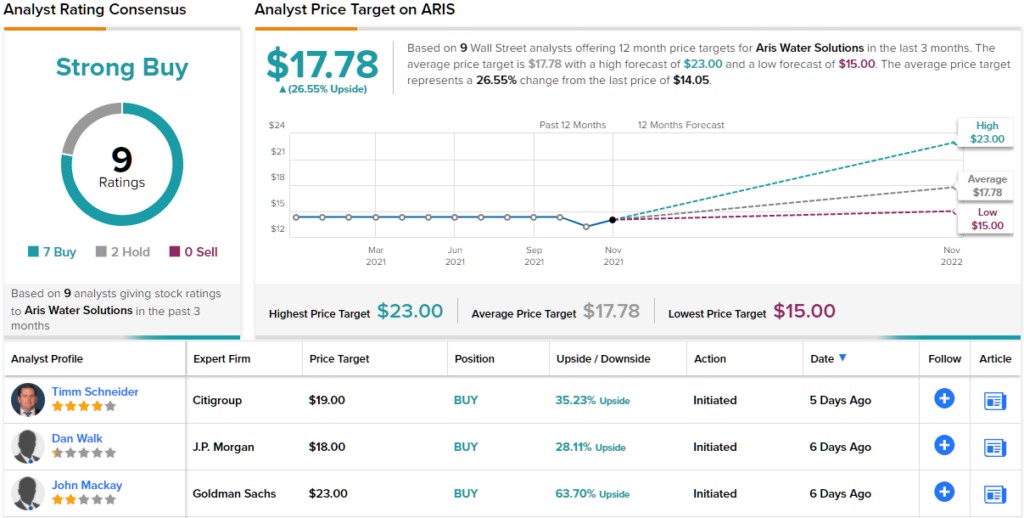

Goldman’s John Mackay reviewed this new stock, and opened his coverage with a bullish outlook: “We see tailwinds not only from strong underlying activity levels, but also from an increasing focus on ESG metrics by its blue-chip E&P customer base — supporting growth on its produced water pipeline and recycling footprint… While we believe earnings execution will be a major focus over the next several quarters and capital allocation plans will need to firm up over the longer-term, we see considerable upside from current levels…”

Quantifying that upside, Mackay sets a $23 one-year price target, implying an upside of ~64%, and rates the stock a Buy. (To watch Mackay’s track record, click here)

Overall, there are 9 analyst reviews on record for this stock and they break down 7 to 2 in favor of Buy over Hold, for a Strong Buy consensus rating. The average price target of $17.78 indicates potential for ~27% share growth from the current price of $14.05. (See ARIS stock analysis on TipRanks)

Horizon Therapeutics (HZNP)

Last but not least is Horizon Therapeutics, a biopharma company engaged in research on new treatments for rare diseases, especially autoimmune and severe inflammatory diseases. In addition to an active research program, Horizon has a portfolio of approved medications on the market, providing a steady income stream.

Horizon’s approved portfolio includes 11 products, for the treatment of thyroid eye disease, stomach ulcers secondary to pain reliever use, and pain symptomatic of osteoarthritis, among others. In recent weeks, Horizon has released several updates on its approved meds. On November 12, the company released a ‘real world’ adherence analysis of Tepezza (treatment for thyroid eye disease), showing 90% adherence to the treatment regimen. That study followed 1,101 patients for over one year.

On the same day, Horizon released news that the European Medicines Agency (EMA) Committee for Medicinal Products for Human Use had taken a positive stance on marketing for Uplizna. The drug already had an Orphan designation from the European Commission; this new opinion clears the way for its use as a monotherapy in adult patients with neuromyelitis optica spectrum disorder who are anti-aquaporin-4 immunoglobulin G seropositive (AQP4-IgG+).

And finally, early this month, Horizon released its 3Q21 financials. The company showed $1.04 billion in top line revenues, a company record, based on total product sales. Tepezza revenue reached $616.4 million, and Krystexxa sales were $158.1 million; both of these products’ sales were at record levels. The company’s total revenue was up 63% yoy. EPS, at $1.75, was flat yoy, and up 8% sequentially. The company reported having $1.07 billion in cash on hand at the end of the quarter.

Covering Horizon for Goldman, 5-star analyst Madhu Kumar points out the commercialized drug portfolio as the key point for investors.

“We consider Horizon’s blockbuster asset Tepezza in TED as a primary value driver with optimism for Krystexxa in chronic refractory gout and Uplizna in NMO/NMOSD to also provide considerable growth to HZNP top-line revenue growth. Our view is supported by several clinical studies supporting increased patience compliance for Krystexxa with early success already demonstrated and the potential for Uplizna to be best-in-class in NMO/NMOSD,” Kumar opined.

To this end, Kumar rates Horizon stock a Buy, and his $168 price target indicates room for ~58% one-year upside. (To watch Kumar’s track record, click here)

All in all, there are 6 analyst reviews on record for this stock and they are all positive, making the Strong Buy consensus unanimous. The shares are selling for $105.85 and the $146.67 average price target implies an upside of ~38% in the next 12 months. (See HZNP stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.