Two Canadian-based gold stocks, Barrick Gold (NYSE:GOLD) (TSE:ABX) and Franco-Nevada (NYSE:FNV) (TSE:FNV) outshined analysts’ expectations in their recently-reported quarterly results. Both companies reported their second quarter Fiscal 2023 results on August 8, which beat EPS estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While gold prices have gained over 6% year-to-date, the precious metal has been under pressure lately, but it’s currently slightly higher on the day following the latest CPI report, which was more or less in line with expectations. Notably, gold prices fell to their lowest levels in almost two weeks on August 9 in anticipation of the CPI report.

Furthermore, China slowly approaching deflation also puts pressure on gold as China is one of the major consumers of the precious metal. The current strength in the U.S. Dollar and steadily rising bond yields are also adding pressure to gold prices, as they are negatively correlated.

With this background in mind, let’s look at the two gold stocks and what the future holds for them.

Barrick Gold (NYSE:GOLD) (TSE:ABX)

Barrick Gold engages in the production and sale of gold and copper as well as related activities such as exploration and mine development. GOLD stock has lost 4.7% so far in 2023.

Last week, GOLD reported adjusted earnings of $0.19 per share, better than analysts’ estimates of $0.17 per share. Although Barrick’s adjusted earnings came in 21% below the year-ago comparative period’s figure, sequentially, the figure jumped 36%.

Moreover, revenues of $2.83 billion declined by 1% year-over-year but fell short of expectations. On a sequential basis, Barrick’s revenue grew 7% compared to Q1 2023.

Remarkably, gold production during the second quarter rose 6% to over 1 million ounces compared to the previous quarter. Likewise, copper production rose 22% to 107 million pounds in Q2.

Based on the continued momentum in production and mining activities, Barrick Gold expects gold and copper production in the second half of 2023 to improve modestly over the first half. This will be achieved by the improved performances from the Carlin, Kibali, and Lumwana mines. GOLD’s full-year Fiscal 2023 gold production is forecasted to be between 4.2 million and 4.6 million ounces. Copper production is projected to be between 420 million and 470 million pounds.

Barrick Gold also announced a quarterly common cash dividend of $0.10 per share to be payable on September 15 to shareholders of record on August 31.

Is Barrick Gold a Good Stock to Buy, According to Analysts?

Encouraged by Barrick’s Q2 print, Cormark analyst Richard Gray upgraded the stock to a Buy rating from Hold. Gray set a price target of $22.43 on GOLD stock, implying 33.3% upside potential.

With four unanimous Buy ratings from top-rated analysts, Barrick Gold stock comes in as a Strong Buy on TipRanks. The average Barrick Gold price forecast of $26.09 implies 55% upside potential from current levels.

Franco-Nevada (NYSE:FNV) (TSE:FNV)

Franco-Nevada is a gold-focused royalty and streaming company with a focus on precious metals such as gold, silver, and platinum group metals. The company even engages in Energy mining, including oil, gas, and natural gas liquids. Year-to-date, FNV stock has gained 2.2%.

In its Q2-2023 results, FNV posted an adjusted profit of $0.95 per share, higher than the consensus estimate of $0.89 per share but lower than the prior-year figure of $1.02 per share. On a sequential basis, adjusted earnings improved from the Q1 figure of $0.79 per share.

On the other hand, revenues of $329.90 million fell 6.4% year-over-year and came in marginally lower than the consensus of $333.74 million. On a quarter-over-quarter basis, revenues jumped by 19%.

The decline in revenue was driven by lower commodity prices from its diversified assets, which more than offset the increase in revenue from precious metal assets. Notably, gold contributes to 64.8% of its total revenue.

During the quarter, FNV sold 132,033 gold equivalent ounces (GEOs) from precious metal assets, marginally higher than the prior-year quarter’s GEOs.

Franco-Nevada also announced a regular quarterly common dividend of $0.34 per share, payable on September 28 to shareholders of record on September 14.

Is Franco-Nevada a Good Buy, According to Analysts?

Following FNV’s Q2 print, BMO Capital analyst Jackie Przybylowski cut the price target on FNV stock to $173.48 (23.5% upside potential). Nonetheless, the analyst maintained her Buy rating on the stock.

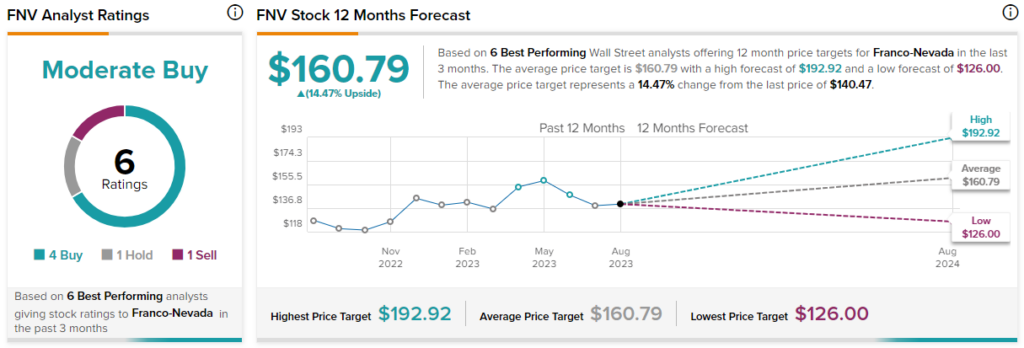

Overall, Franco-Nevada stock has a Moderate Buy consensus rating based on four Buys, one Hold, and one Sell rating assigned by top-performing analysts in the past three months. The average Franco-Nevada price target of $160.79 implies 14.5% upside potential from current levels.

Ending Thoughts

Both Barrick Gold and Franco-Nevada outperformed EPS expectations in their second-quarter results. However, year-over-year comparisons are still challenging, even as quarter-over-quarter growth improves.

It is worth noting that both GOLD and FNV are on track to meet their full-year 2023 targets, which would show a steady improvement over the first-half performance. Among the two, Barrick Gold remains a slightly better option, according to analysts, and also carries a higher upside potential for the next 12 months.