Global Medical REIT (NYSE: GMRE) and Medical Properties Trust (NYSE: MPW) are two of the highest-yielding healthcare REITs. Their substantial payouts and unique qualities are likely to tag them as more attractive investments during the current, highly uncertain market environment compared to their sector peers. However, I believe that the growth prospects of both companies are rather soft, which could weaken their stocks’ long-term total-return potential despite their safe, high dividends.

As a result, I am neutral on both stocks.

What Makes Healthcare REITs Attractive in the Current Environment?

Healthcare REITs have historically attracted limited investor attention. The most likely reason, in my view, is that their growth prospects are somewhat restricted. When it comes to residential, commercial, and industrial properties, investors can expect better rent and asset value growth prospects due to their more dynamic nature.

Instead, healthcare properties have a very specific purpose (e.g., a hospital), which means they can’t really be utilized for anything other than what they were built for. Additionally, with operators in the space seeking stability, these properties are usually leased under long-term leases, thus limiting their rent growth prospects.

However, precisely due to these traits, healthcare REITs also feature several qualities, with the most important being resilience and reliable cash flows. With healthcare providers like hospitals, clinics, and relevant parties offering essential services, REITs in the space face minimal counterparty risks. Issues such as rent collections are much less frequent in this field. Additionally, due to their over-extended leases, medical REITs can plan far ahead for the future and also attract low financing costs.

This setup has resulted in healthcare REITs featuring low-growth, high-payout investment cases; Global Medical and Medical Properties Trust are no different. GMRE shares trade at the same levels they did back when the company IPO’d in 2016, while MPW shares trade close to the same levels they were hovering at in 2006. Thus, investors have, in general, enjoyed no capital gains. Yet, both stocks offer quite massive dividend yields, currently at around 8.3% and 8.9%, respectively.

Are GMRE’s and MPW’s Massive Yields Sustainable?

When it comes to sizable yields, the first thing investors usually consider is whether they are sustainable – and the dividends of these two companies do seem sustainable. In the case of GMRE, management is well-aware of the company’s limited growth prospects and has thus been prudent with dividend hikes to ensure payouts remain covered.

In fact, GMRE’s dividend per share stayed unchanged between 2017 and 2020 at an annualized rate of $0.80. This was because the underlying AFFO/share could hardly cover the dividend at the time. For context, AFFO/share came in at $0.76, $0.75, and $0.88 in 2018, 2019, and 2020, respectively. Only when AFFO/share exceeded the underlying DPS in 2020 did the company raise its annual payouts. Following two sequential two-cent hikes in 2021 and 2022, the annualized dividend now amounts to $0.84.

You may correctly reason that payouts appear covered by a razor-thin margin. Still, you have to remember that medical REITs feature multi-year leases that essentially guarantee revenues for years ahead. In the case of GMRE, the weighted average lease term for its portfolio was 6.7 years as of its most recent quarterly results.

However, again, this comes with growth limitations, as its properties also feature a weighted average annual rental escalation rate of just 2.1%, which doesn’t even account for inflation under normal trading conditions. Safety comes at a high price.

Regarding MPW, the company did cut its dividend back in the Great Financial Crisis from a quarterly rate of $0.27 to 0.20. The dividend then remained unchanged until 2013 and has since grown annually, now numbering nine years of consecutive annual hikes. However, similar to GMRE, any hikes have been trivial, usually by a cent each year. This is due to MPW also featuring similar leasing characteristics.

For Fiscal 2022, the trust forecasts normalized FFO/share to be between $1.78 and $1.82. At the midpoint, it implies a payout ratio stands close to 63%, which suggests that the stock’s massive yield is well-covered. Again, however, this comes at the expense of limited growth prospects, as indicated by the uninspiring pace of dividend growth.

What are the Price Targets for GMRE and MPW Shares?

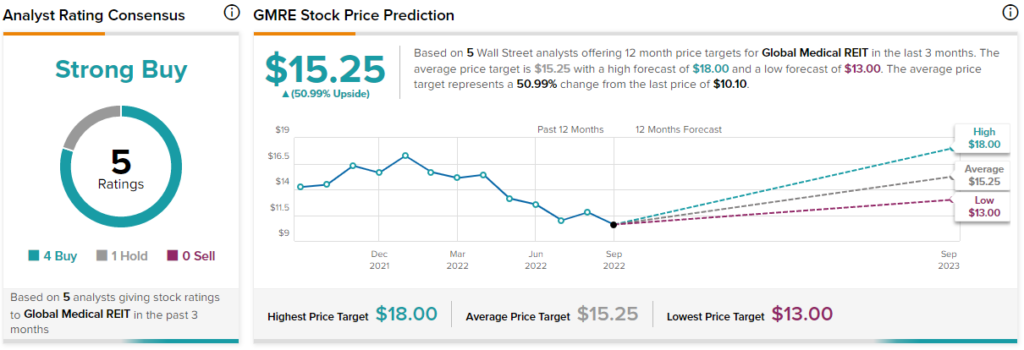

Turning to Wall Street, Global Medical REIT has a Strong Buy consensus rating based on four Buys and one Hold assigned in the past three months. At $15.25, the average Global Medical REIT stock forecast implies 51% upside potential.

Significant upside ahead is also projected for Medical Properties Trust. The stock has attained a Moderate Buy consensus rating based on eight Buys and five Holds assigned in the past three months. At $18.38, the average Medical Properties Trust stock forecast suggests 41.6% upside potential.

Conclusion: Massive Dividends with Limited Growth Potential

Global Medical and Medical Properties may be proven worthwhile investments in the current market environment. Their multi-year leases should translate to no unpleasant surprises regarding their cash flows, which, in turn, should protect their sizeable yields. That said, investors should have little to no expectations when it comes to their growth prospects.

Both companies could freeze dividend growth for years, as was the case with GMRE a while back. Additionally, while a cut appears quite unlikely based on their underlying financials, dividends should not be blindly trusted. Rising expenses amid inflation against below-inflation rate hikes could still pressure the bottom line and, thus, lead to a dividend cut. Accordingly, proceed with caution.