After the market action comes to a close on Wednesday (December 7), GameStop (GME) will step up to deliver its fiscal 3Q22 (October quarter) results.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite the video game retailer’s ongoing transformation efforts, Wedbush’s Michael Pachter notes that these have “missed the mark so far, leaving it to rely on a challenged core business.”

Continued hardware constraints, the effects of employee turnover, the slow start to its NFT marketplace, and ongoing cash burn are all “short-term headwinds.” Not that Pachter considers the long-term prospects to be much better; “potential liquidity challenges and changing gamer preferences,” are set to make their impact felt. Furthermore, through FY23, Pachter foresees “significant cash burn” which will eventually force the company to issue more equity.

As for expectations for the quarter, the analyst is calling for net sales of $1,410 million (an 8.7% year-over-year increase) and EPS of $(0.35). Consensus has $1,355 million and $(0.28), respectively.

Revenue wise, the company’s inventory investment efforts around new-gen hardware might prove beneficial, although going by recent trends, the NFT marketplace “likely had only a small revenue impact.” At the other end of the equation, Pachter notes that the company managed to reduce SG&A spend by around 14% sequentially in 2Q22, but wonders “how much more spend can be eliminated.”

GME stock has shed 31% on a year-to-date basis, but considering the shares are still benefiting from last year’s meme stock mania – which was led by GME – Pachter considers them to still be “at trading levels that are disconnected from the fundamentals of the business due to irrational support from some retail investors.”

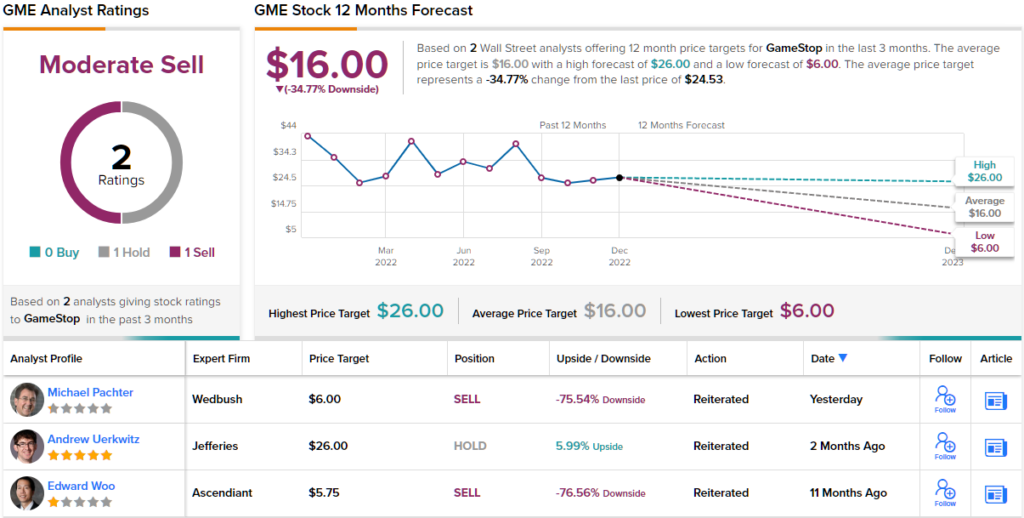

Accordingly, ahead of the print, Pachter rates the stock as Underperform (i.e., Sell), while his $6 price target suggests ~75% drop is in the cards for the next year. (To watch Pachter’s track record, click here)

One other analyst has chimed in with a GME review over the past 3 months and they have a more forgiving take; However, the additional Hold provides the stock with only a Moderate Sell consensus rating, while the average target of $16 implies the shares will be changing hands for a ~35% discount in 12 months’ time. (See GameStop stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.