British recruiter Hays’ (GB:HAS) posted impressive quarterly performance amid a booming employment market, with growth in net fees around 23% for the quarter ended June 30, 2022.

The company also said full-year operating profits are expected to be around £210 Million, which is at the top end of the guidance range.

Shares of the company have been swaying for the last two years, but have bounced back after the quarterly update. Overall, the stock is down by 22% YTD.

Breaking records

The company, which provides its recruitment services in 33 countries, saw its fees go up by a record 29% in Germany. The growth in the company’s was due to high demand for contractual and permanent staff.

The company has raised its prices due to high demand, and as a result, 15 countries showed record levels of fee income.

Sector-wise, the company’s biggest sector, technology, generated £300 million in fees. The company plans to increase its consultant headcount by 1-2% in high-growth sectors such as technology, to further enhance consultant productivity.

Hays’ chief executive Alistair Cox said, “While macroeconomic uncertainties are increasing, we have a clear strategy and our key markets continue to be characterised by skill shortages. Our fee growth is also supported by improved margins and wage inflation globally. Looking ahead, we are focused on leveraging the investments we have made and increasing consultant productivity to drive profitable growth.”

View from the city

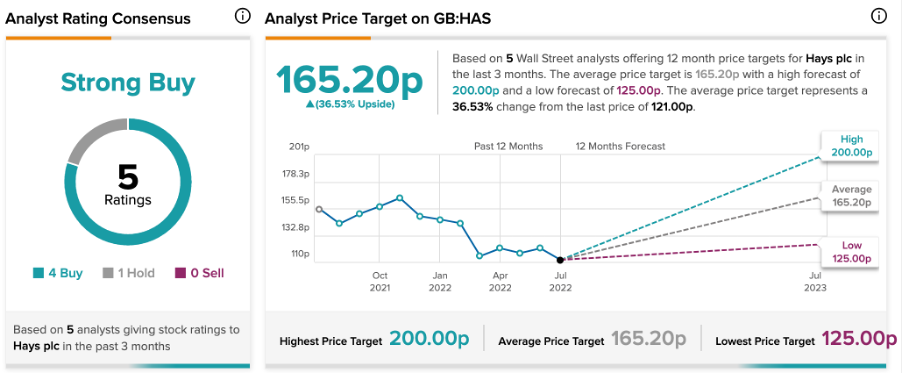

According to TipRanks’ analyst rating consensus, Hays’ stock is a Strong Buy. That’s based on five ratings from the analysts, which include four Buy, and one hold recommendations.

The average price target of 165.2p implies upside potential of 36.5%. Analyst price targets range from a low of 125p per share to a high of 200p per share.

Conclusion

The share price is volatile, but the numbers are strong and the outlook looks optimistic. The company’s net cash position in June 2022 is £295 million and the shareholders can look forward to special dividends and buybacks.