If immediacy bias represents an upside catalyst for publicly-traded securities, Alibaba (NYSE:BABA) deserves special attention. Against both wider fundamentals as well as company-specific tailwinds, BABA stock appears poised for significant gains following a rough year. However, the damage that its home nation of China inflicted regarding its zero-COVID policy may be too much for Alibaba to overcome. Thus, investors should consider selling BABA stock into strength.

For those that plan on exiting the Chinese e-commerce giant, they’re going to need to think quickly. The company will disclose its results for its fiscal second quarter on November 17. As TipRanks reporter Amit Singh mentioned, “Alibaba has exceeded analysts’ earnings estimates in the last three consecutive quarters. As for Fiscal Q2, analysts expect Alibaba to post earnings of $1.67 a share.”

To be fair, though, Singh also acknowledged the rough road BABA stock encountered this year. Nevertheless, certain circumstances shifted positively for the underlying business. Specifically, “TipRanks’ Website Traffic screener shows that the number of visits to alibaba.com and its two other websites (aliexpress.com and taobao.com) increased 36.4% (sequentially) for the September ending (Q2) quarter.”

Further, the “impact of improving traffic is also reflected in Alibaba’s strong performance during the 11.11 Global Shopping Festival [Singles Day]. The company announced that its GMV (Gross Merchandise Volume) performance was in line with the prior year despite macro concerns.”

On a wider level, China recently relaxed its draconian zero-COVID policy. Unlike most other countries, China remained aggressively committed to subduing COVID-19 breakouts rather than attempting to live with the pandemic through vaccinations and localized mitigation measures. However, the severe response to the global health crisis also damaged its economy.

Unfortunately, the damage may have long been done to BABA stock, making its investment proposition speculative.

On TipRanks, BABA stock has a 3 out of 10 Smart Score rating. This indicates moderate potential for the stock to underperform the broader market.

BABA Stock May Provide a Temporary Upside Window

Should Alibaba exceed expectations for Q2, the subsequent backdrop should yield a very positive outcome for BABA stock. Even if the company doesn’t quite hit targets but is in the neighborhood, BABA could still rise. So long as results from its Singles Day shopping event meet expectations, this might buoy sentiment for a brighter future.

However, astute investors might not want to stick around for Q3 results. At the very least, stakeholders should probably consider trimming excess exposure. Fundamentally, no one event will likely change the entire narrative of BABA stock. Whether that’s an outstanding earnings report or favorable government-related news, an embattled business like Alibaba’s probably needs multiple tailwinds to right the ship.

Worryingly, though, this is exactly where some circumstances could go awry for BABA stock. Not only might Alibaba not receive multiple tailwinds but the main one – robust Singles Day sales – may not materialize. It’s speculation, but still, Alibaba refused to provide numbers for last Friday’s shopping event.

At a time when both company and country suffer from severe headwinds, it’s only natural to believe that if good news exists, it would be disseminated from the top of every mountain. That this isn’t happening raises major concerns.

Also, stakeholders of BABA stock need to be cautious and realistic about COVID-19’s impact on China’s business ecosystem. For instance, global tech titans disclosed how the nation’s lockdowns adversely affected operations. These lockdowns didn’t just materialize yesterday. Instead, they’ve long been a component of Beijing’s no-nonsense approach to eradicating COVID-19.

Therefore, the news that China only recently relaxed its COVID-19 rules should not be interpreted as necessarily an upside catalyst. Rather, it really means that eroding businesses will erode less quickly than before.

Besides, the Chinese government can always change its mind about relaxing its COVID measures. Thus, BABA stock is hardly out of the woods.

Is BABA Stock a Buy, According to Analysts?

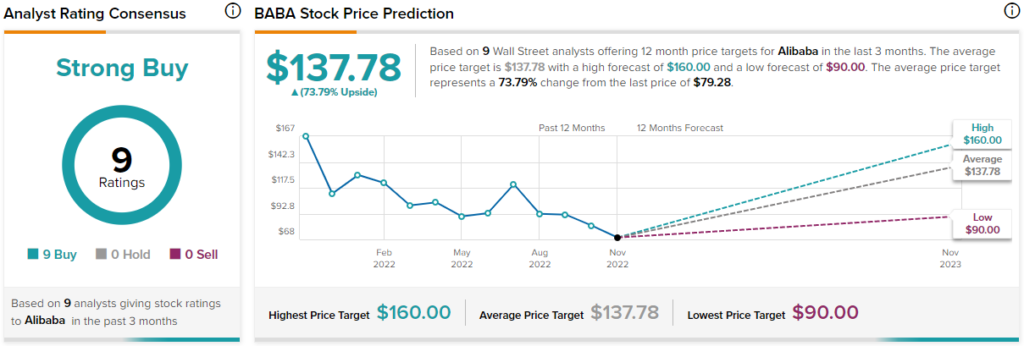

Turning to Wall Street, BABA stock has a Strong Buy consensus rating based on nine Buys, zero Holds, and zero Sell ratings. The average BABA price target is $137.78, implying 73.8% upside potential.

The Quantitative Data Tells a Deceptive Tale

On paper, BABA stock might appear as a solid investment based on its quantitative data. For instance, the underlying company enjoys a cash-to-debt ratio of 3.05x, ranked better than nearly 80% of its competitors. Also, Alibaba features a three-year revenue growth rate of 32.1%, above 90% of its rivals. However, the information presented may be somewhat misleading.

True, Alibaba enjoys a solidly stable balance sheet. Certainly, with a strong cash position, those who attempt to short BABA stock will be incurring significant risks. Still, buying shares may not be so prudent.

For instance, while its longer-term revenue growth trajectory entices investors, it’s worth noting that in the previous quarter, Alibaba posted a 4.12% year-over-year loss in sales. Moreover, a Bain & Co survey revealed that 34% of shoppers planned to spend less during Singles Day this year than last.

Therefore, moving forward, China’s consumer economy may be far less attractive than analysts believe. Logically, then, the aforementioned impressive growth rate could come down in a hurry, again drawing skepticism for BABA stock.