It hasn’t all been smooth sailing for social media company Pinterest (PINS) since going public last spring. The company exited 2019 with shares below the $19 IPO price after failing to initially meet Wall Street’s expectations. Since May, however, the stock has rallied and it appears sentiment is changing fast.

In fact, Deutsche Bank analyst Lloyd Walmsley calls Pinterest his “favorite non-consensus fresh-money idea,” and implores investors to “take advantage of near-term uncertainty to add to long positions.”

So, what has piqued the analyst’s growing confidence?

For starters, with ad spend on the agenda these days, Pinterest’s improvements in ad tech “can help near-term ad spend.”

“We see new ad product setting the stage for a strong 2H as the company’s automated bidding for traffic objectives, which was rolled out in 1Q 2020, scales over the course of the year and the product rolls out for performance objectives,” Walmsley said.

An increasing focus on “shoppable products” has also improved the platform’s shopping experience. Whereas in the past, Walmsley argues, users were left “frustrated” by being an unable to make a purchase after finding a great product, this has now been rectified, with much of the user interface space focused on “products that are relevant to searches and composed of current season product uploaded by sellers directly.”

The recent deal with Shopify hasn’t hurt, either, and has resulted in a seamless “merchant-store integration.”

“We estimate that for every 10% of Shopify merchants that onboard and light up as advertisers, $117M could be added to Pinterest ad revenue, and we believe they could get 30% penetration over the next few years.”

Furthermore, Walmsley adds, sentiment among investors has changed, with “more and more calls from investors interested in digging into the Pinterest bull case.”

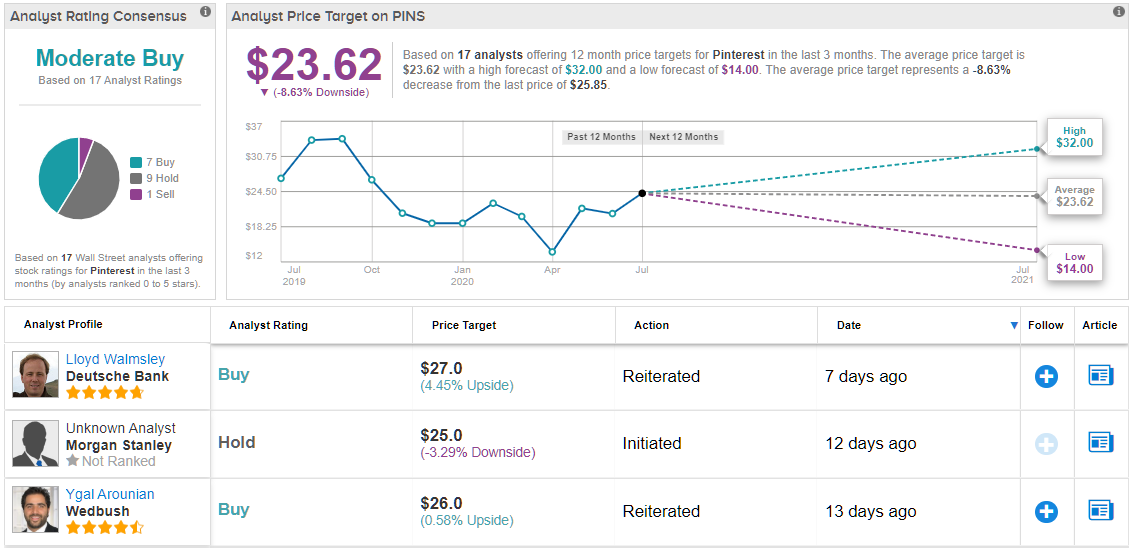

To this end, Walmsley rates PINS a Buy, while raising the price target from $20 to $27, which implies upside potential of 5%. (To watch Walmsley’s track record, click here)

Turning now to the rest of the Street, where based on 7 Buys, 10 Holds and 1 Sell, Pinterest has a Moderate Buy consensus rating. Overall, the analysts feel Pinterest’s current share price is fully valued — the $23.62 average price target implies nearly 9% downside from current levels. (See Pinterest stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.