The coronavirus has had a negative impact on most but as luck would have it, some companies have benefited from the viral outbreak. Along with those catering to the stay at home climate, healthcare companies’ valuations have soared during the pandemic. You can add GenMark Diagnostics (GNMK) to the latter camp. The molecular diagnostics company has been no slouch in 2020, and shares are up by 288% so far.

The stock was on the rise again yesterday after the company released impressive pre-earnings sales results.

Specifically, GenMark expects Q2 revenue to come in at roughly $40 million, reflecting a 118% year-over-year increase and way ahead of the $31 million estimate. This is mainly off the back of the company’s ePlex SARS-CoV-2 test, which made up 48% ($16.9 million) of ePlex sales – compared to just 5% in Q1.

The medical device specialist anticipates ePlex revenue to be up 195% year-over-year on overall sales of $35.2 million and the placement of 71 ePlex analyzers (up by 48%).

In March, GenMark was granted Emergency Use Authorization (EUA) for its ePlex SARS-CoV-2 Test. Despite the strong demand, management has previously said that due to “manufacturing capacity constraints,” it does not expect revenue in 2020 to top $150 million. Nevertheless, Needham analyst Mike Matson expects GenMark to raise guidance when it reports earnings on August 3.

The 5-star analyst said, “We believe that the COVID-19 pandemic continued to drive demand for GNMK’s Respiratory Pathogen (RP) panel as a “rule-out” test and its separate COVID-19 test during 2Q20. GNMK launched its respiratory Pathogen Panel 2 (RP2) panel on 6/29/20, which added COVID-19 to the prior panel, so we expect the mix to shift back to its respiratory panel going forward… Given the strong ePlex placements and continued tailwind from COVID-19, we believe that GNMK can sustain strong growth throughout 2020.”

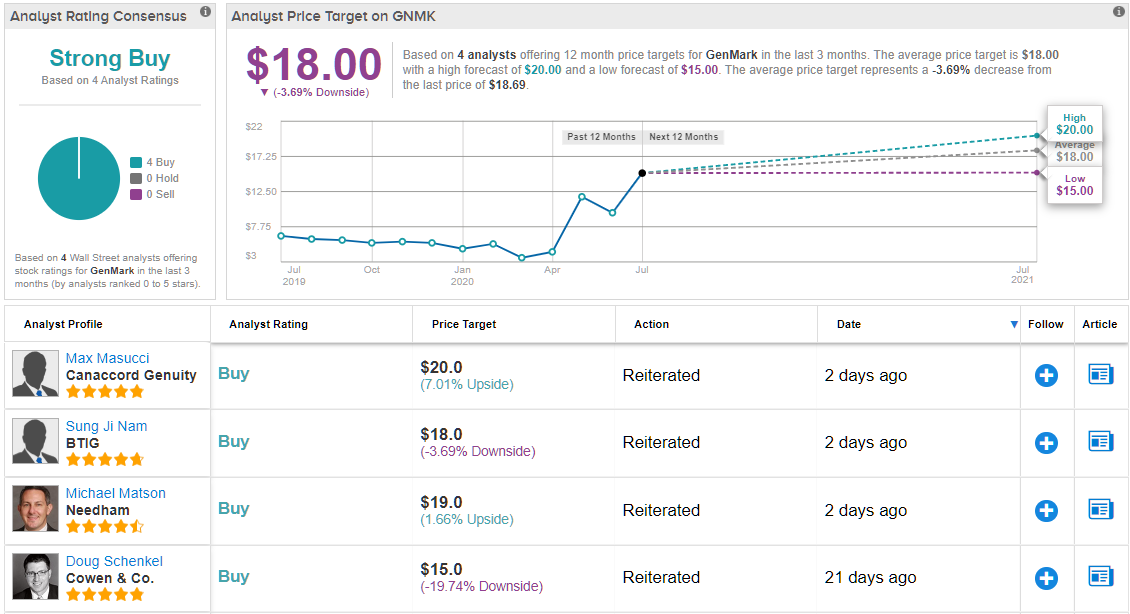

Accordingly, Matson keep his Buy rating on GenMark intact, along with a $19 price target. What’s in it for investors? A modest upside of 2% from current levels. (To watch Matson’s track record, click here)

Over the last 3 months, three other analysts have published a review of the diagnostics player’s prospects, all imploring investors to Buy. Yet, the average price target of $18 implies nearly 4% downside. (See GenMark stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.