Battling multiple fronts including inflationary pressures and supply chain constraints, companies like Rivian, Tesla, Lucid, and General Motors have been battered this year. Year-to-date, these stocks have declined by 55.2%, 9%, 38%, and 27.7%, respectively. Russia’s war on Ukraine has only fueled these challenges as commodity prices have soared, forcing many EV makers to push costs onto consumers by raising prices.

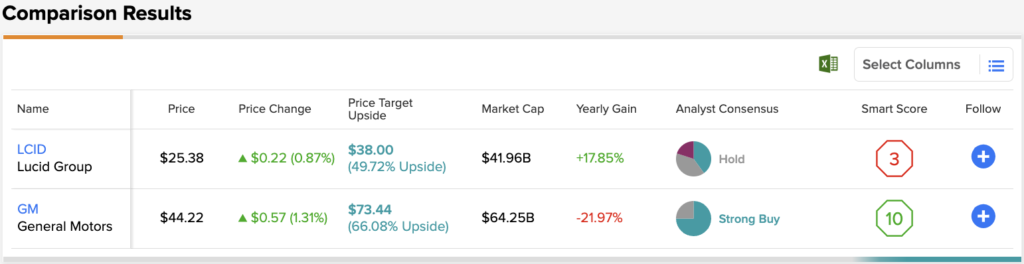

Using the TipRanks stock comparison tool, we compared two EV stocks, GM, a legacy automaker that has ventured into EVs in a big way, and Lucid, a relatively new EV entrant. We will also look at what Wall Street analysts are saying about these stocks.

General Motors (NYSE: GM)

Last week, GM announced that it would acquire SoftBank Vision Fund 1’s equity stake in Cruise, an autonomous vehicle company, for $2.1 billion, and will also make an additional $1.35 billion investment in Cruise.

GM Chair and CEO Mary Barra commented on the investment, “We are extremely pleased to announce GM is leveraging the strength of its balance sheet to capitalize on the opportunity to increase its equity investment in Cruise and advance our integrated autonomous vehicle strategy. We continue to believe our investment represents an extraordinary opportunity for creating long-term shareholder value.”

Besides autonomous vehicles, GM is also investing in a big way in EVs. In June last year, the company unveiled a plan to increase its EVs and autonomous vehicles (AVs) investment to $35 billion from 2020-25. This would be a rise of 75% from its initial commitment announced before the pandemic.

By 2025, GM expects to launch more than 30 EV models in North America and China. Furthermore, the company anticipates selling more than 1 million EVs on a global basis by 2025.

GM’s EV push also includes increasing the Ultium battery cell production in the U.S. and the commercialization of Ultium batteries and Hydrotec fuel cells made in the U.S.

In a move towards achieving this objective, the company expanded its EV supply chain in North America by announcing a new facility in Bécancour, Quebec, Canada that will produce cathode active material (CAM) for GM’s Ultium batteries. This facility will be part of GM’s joint venture with POSCO Chemical and is estimated to cost $400 million.

Besides this EV push, the company’s long-term revenue growth plans are impressive. This includes more than doubling company revenues from current levels to a range of $275-315 billion by 2030.

Additionally, higher margins are anticipated to grow to 12-14% by that same target year.

It is this “ongoing operational turnaround, and improving product cadence” that has left J.P. Morgan analyst Ryan Brinkman impressed. The analyst believes the shares are attractively valued currently and views two positive catalysts for the stock. This includes the company’s “use of excess cash to enhance shareholder return” which could lead to investors re-rating the shares.

Another strong catalyst for the stock is the “strong sales performance for recently refreshed full-size pickup trucks and SUVs, including success of GM’s three (pickup) truck strategy.”

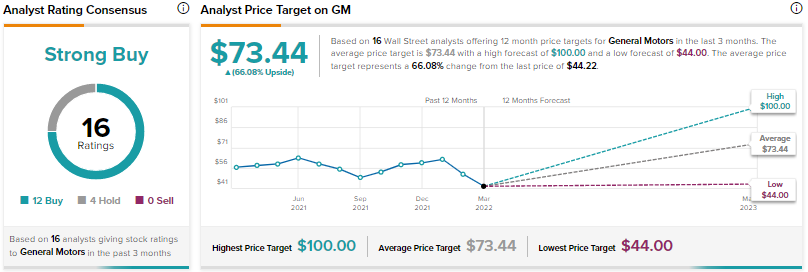

As a result, Brinkman is bullish on the stock with a Buy rating and a price target of $75 implying an upside potential of 69.6% to current levels.

The rest of the analysts on the Street echo Brinkman, resulting in a Strong Buy consensus rating on the stock based on 12 Buys and four Holds. Meanwhile, the average GM stock prediction is $73.44, implying an upside potential of 66.1% to current levels.

Lucid Group (NASDAQ: LCID)

Shares of Lucid Group have seen a pullback as the EV company is battling multiple difficulties including supply chain constraints and inflationary pressures, resulting in weaker-than-expected Q4 results. It doesn’t look like the EV maker’s woes are going to end anytime soon.

Earlier this month, Lucid Group’s CEO, Peter Rawlinson stated in an interview with Reuters, that the company was contemplating raising the prices of its future models due to “huge inflationary pressures.” Rawlinson was referring to the soaring nickel prices after Russia launched its war on Ukraine.

Other EV makers including Rivian (RIVN) and Tesla (TSLA) have also raised the prices of their cars, citing inflation.

The CEO also attributed supply constraints from suppliers when it came to windshield glass, exterior trim parts, and carpeting, in addition to the already scarce semiconductors and other necessary components.

Moreover, Rawlinson questioned whether its competitor, Rivian, could make a profit on its pickup trucks without raising prices considering the rising costs of battery packs. The CEO stated, “I don’t think even we could, with the best technology in the world, make an affordable, practical pickup.”

The company is targeting the luxury EV market with multiple prototypes and new technologies. The company designs, engineers and builds electric vehicles, EV powertrains, and battery systems in-house. Lucid’s flagship product is a state-of-the-art luxury sedan, the Lucid Air, Dream edition.

Continuing with the theme of inflation woes and supply chain issues, the company has also slashed its production guidance of 20,000 units in 2022 to between 12,000 and 14,000 vehicles. In addition, in order to scale up its business, Lucid has forecasted a capex of $2 billion this year, a five-fold rise in capex as compared to 2021.

Considering this scenario, is Lucid stock still worth investing in? Rawlinson tried to reassure investors on its Q4 earnings call, commenting that, “In some limited cases, we are evaluating additional opportunities to move production in-house to drive further efficiencies. We believe we will move past the key bottlenecks we’re experiencing in the next few months with further improvement in the second half.”

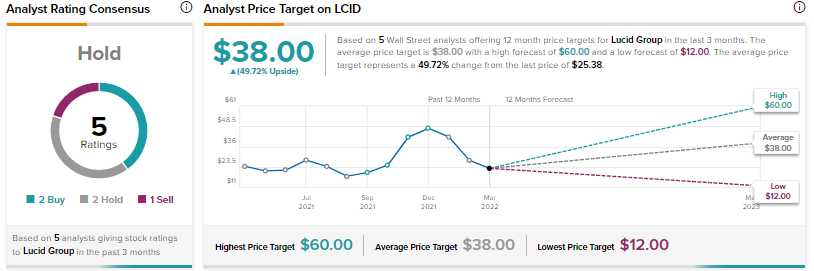

While optimistic overall, Citigroup analyst Itay Michaeli lowered his price target to $45 from $57, implying an upside potential of 77.3% at current levels. While the analyst approved of Lucid’s Q4 loss of $0.64 per share which came in better than the analyst’s estimate, Michaeli remained concerned about LCID’s reduced production estimate and the delayed launch of Project Gravity.

Project Gravity is the company’s luxury sports utility vehicle (SUV) that is now expected to launch in the first half of 2024 instead of the end of 2023.

Other analysts on the Street are, however, sidelined about the stock with a Hold consensus rating based on two Buys, two Holds, and one Sell. Meanwhile, the average LCID stock prediction is $38, implying an upside potential of 49.7% to current levels.

Bottom Line

Wall Street analysts are bullish about GM and sidelined about LCID. It certainly appears that GM is better poised to deal with macroeconomic headwinds, and has more production capacity. Even based on the upside potential over the next 12 months, GM certainly seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.