Governments around the world are focusing on environmentally friendly initiatives to counter climate change and reduce their greenhouse gas emissions.

In August this year, U.S. President Joe Biden signed an executive order that intends to make 50% of all new vehicles sold in the United States electric by 2030. Biden’s administration also proposed new vehicle emission standards aimed at reducing pollution through 2026.

Using the TipRanks stock comparison tool, let’s compare two automobile companies that are going electric in a big way, General Motors and Ford Motor Co., and see how Wall Street analysts feel about these stocks.

General Motors (GM)

Investors seem to be bullish about General Motors, as the stock has risen 8.8% in the past month. However, the company seems to be struggling with the issue of chip shortage and the recall of its Chevrolet Bolt EV due to manufacturing defects.

The chip shortage woes were reflected in the company’s sales update for Q3 provided earlier this month. In Q3, the company delivered 446,997 vehicles in the U.S., a decline of 218,195 units from the same period a year back.

The company also warned that its wholesales volume in the United States in the second half of this year would decrease by about 200,000 units as compared to H1, “largely because of supply chain disruptions in Malaysia caused by COVID-19, with most of the impact occurring during the third quarter.”

However, GM still expects that its financial outlook will be within its guidance for the calendar year of 2021. (See General Motors stock chart on TipRanks)

Steve Carlisle, EVP and President, GM North America, commented, “The semiconductor supply disruptions that impacted our third-quarter wholesale and customer deliveries are improving. As we look to the fourth quarter, a steady flow of vehicles held at plants will continue to be released to dealers, we are restarting production at key crossover and car plants, and we look forward to a more stable operating environment through the fall.”

Wedbush analyst Daniel Ives was of the view that the Street remains “skeptical” about GM’s success when it comes to EVs, due to rising competition from Tesla (TSLA) and other upcoming players like Ford (F). However, Ives remained bullish about the stock.

The analyst commented, “Our bullish thesis on GM over the next few years is predicated on its ability to gain more share in the EV market and successfully convert 20% of its installed base to EVs by 2026.”

The analyst has a Buy rating and a price target of $85 (approximately 60% upside) on the stock.

Back in June, GM had unveiled a plan that focused on increasing investment in EVs and autonomous vehicles (AVs) to $35 billion from 2020-25, a rise of 75% from its initial commitment, announced before the pandemic.

GM’s EV push also included increasing the Ultium battery cell production in the U.S. and the commercialization of Ultium batteries and Hydrotec fuel cells made in the U.S.

Ives is upbeat about GM’s EV prospects and believes that “as GM proves out its EV vision over the coming years the stock will be re-rated more as a disruptive technology and EV play, rather than its traditional auto valuation. We believe GM on both a SOTP [sum-of-the-parts] and incremental EV/services opportunity will result in a much higher multiple over time.”

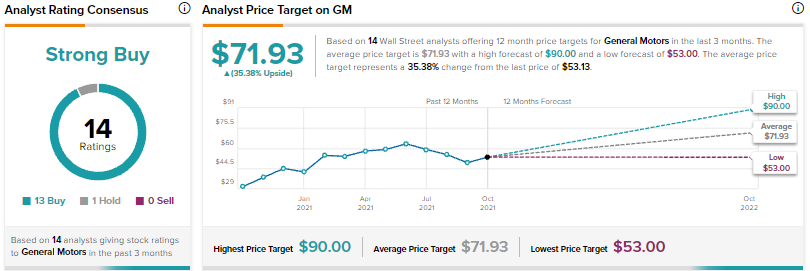

Turning to the rest of the Street, Wall Street analysts are bullish about General Motors, with a Strong Buy consensus rating, based on 13 Buys and 1 Hold.

The average General Motors price target of $71.93 implies 35.4% upside potential from current levels.

Ford Motor Co. (F)

Ford is another automobile giant that is going electric in a big way. Late last month, the company announced a partnership with battery maker SK Innovation to build the largest, most advanced EV manufacturing campus in the company’s 118-year-old history.

Ford, along with SK Innovation, plans to invest $11.4 billion to build the EV manufacturing campus, which will include twin battery plants. They will also manufacture the new generation F-Series trucks, and advanced lithium-ion batteries.

Following this announcement, Morgan Stanley analyst Adam Jonas noted that Ford’s $7 billion investment in the production of battery cells was equivalent to Ford’s capex for one year. The analyst thinks that while the company’s EV business “may be undervalued,” its internal combustion engine (ICE) business could be “overvalued.”

Jonas expects that EVs will be an “extremely low margin business,” and a rise in battery electric vehicles (BEV) volumes is unlikely to offset ICE volumes.

The analyst has a Sell rating and a price target of $11 (22.3% downside) on the stock.

On the other hand, Wells Fargo analyst Colin Langan is bullish on Ford.

Similarly to GM, the chip shortage has also affected Ford, but it seems the situation is improving for Ford. (See Ford Motor stock chart on TipRanks)

According to Langan, by his estimate, Ford’s production could have declined by only 200,000 in Q3 versus 570,000 in Q2. However, the analyst believes that the company’s guidance for adjusted EBIT for FY21, which is between $9 billion to $10 billion, is at risk. The risk is due to the added production cuts and the “rising semi supply issue.”

As a result, Langan has reduced the “production outlook to reflect only a 13% increase from H1. This would imply ~300k fewer units for the year.” The analyst has also lowered the EPS estimates for 2021 and 2022, as he expects a “slower recovery in 2022.”

While Langan remains bullish on the stock with a Buy rating, he has reduced the price target from $18 to $17 (20.1% upside) on the stock.

While analysts seem to have differing views when it comes to the stock, it seems how Ford handles the chip shortage is the key. Besides, it still remains to be seen how Ford’s push to go electric works out in the long run.

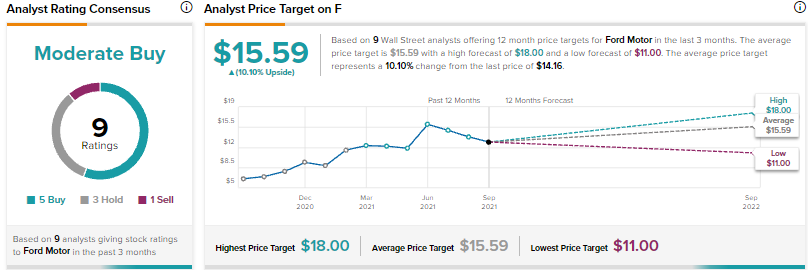

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about Ford Motors, with a Moderate Buy consensus rating, based on 5 Buys, 3 Holds, and 1 Sell.

The average Ford Motor price target of $15.59 implies 10.1% upside potential from current levels.

Bottom Line

While analysts are bullish about General Motors, they are cautiously optimistic about Ford. Based on the upside potential over the next 12 months, GM does seem to be a better Buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.