UBS (NYSE: UBS) analysts just gave General Motors (NYSE: GM) stock a downgrade and a price target cut, and some traders are dumping their shares. However, the pessimism seems overstated, and there’s a good long-term opportunity for contrarian investors, so I am bullish on General Motors stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

General Motors is a renowned American automaker that your parents and grandparents might have invested in. Yet, even a safe bet can turn sour, especially when macroeconomic conditions are turbulent.

One particular analyst firm’s downbeat assessment is only adding to investors’ anxiety about General Motors. This is unfortunate, as it may cause some traders to unnecessarily dump their GM shares. On the other hand, enterprising investors can buy the shares that nervous folks are selling now and hold them for potentially-powerful gains.

Ford’s Getting the Attention, but Don’t Forget About General Motors

Much of the buzz in the financial media on Monday was about the share-price decline of Ford (NYSE: F) stock. Granted, a 6% single-session price plunge is noteworthy. Yet, let’s not ignore the damage done to GM stock, which should be of great interest to contrarian investors.

General Motors shares started off 2022 near $65, only to reach the low $30s recently. On Monday, GM stock lost an additional 3.96%. So, what happened?

It’s not hard to connect the dots between high inflation and diminished consumer demand for cars and trucks. Supply-chain constraints have also made it difficult for U.S. automakers to sell vehicles since they can’t fulfill orders if they don’t have the necessary parts.

Apparently, though, the demand destruction is getting so severe that there’s actually a threat of surplus vehicle inventory. This seems to be the thought process as UBS analyst Patrick Hummel observes “rapidly deteriorating” consumer demand in America’s automotive sector.

Hummel had Ford in his crosshairs when he made that observation, but General Motors wasn’t spared the analyst’s downbeat assessment. Indeed, Hummel and other UBS analysts downgraded GM stock from a Buy to a Hold rating while also drastically reducing their price target on GM shares from $56 to $38.

UBS’s Concerns are About the Automotive Market in General

It might feel like the UBS analysts are picking on General Motors in particular, especially if you’re invested in the company. Be assured, though, that the firm’s concerns are primarily directed at the U.S. automotive industry in general.

First of all, the UBS analysts feel that U.S. automakers’ three-year run of “unprecedented” vehicle pricing and profit margins will abruptly come to an end. They also anticipate an oversupply of vehicles to emerge soon, possibly even three months from now.

Evidently, UBS analysts see a near-term decline in vehicle sales as inevitable. “Demand destruction is no longer a vague risk but has started to become a reality,” they warned.

Of course, inflation has a role in all of this, as UBS analysts expect consumers to downgrade their vehicles. The analysts are also concerned that growing vehicle inventories will make it impossible for automakers to pass inflationary pressures on to the customers.

Extreme Pessimism Signals That GM Stock is near a Bottom

There’s no way to accurately predict the exact moment when a stock will find its bottom. However, a telltale sign of a bottoming process is that both retail traders and Wall Street experts are extremely pessimistic – and that’s what we’re witnessing right now with General Motors stock.

It’s funny how analyst firms will pile on a stock or a sector at the same time with downbeat forecasts. While the UBS analysts issued a warning about Ford and General Motors stocks, RBC (NYSE: RY) Capital Markets analyst Joseph Spak similarly cautioned that 2023 estimates for the automotive sector need to “move materially lower.”

How much lower do they really need to move, though? General Motors’ trailing 12-month P/E ratio is already a rock-bottom 6.14x. The company’s market cap has been pushed below $50 billion. Moreover, GM stock is down 45% year-to-date.

What more do they want? Do they expect GM to become a penny stock before it’s investable? The market is quite efficient and has undoubtedly already priced in the automotive sector’s problems. Besides, the UBS price-target cut is a self-fulfilling prophecy, as it has already induced a day of panic selling. If this doesn’t qualify as a “buy the fear, sell the greed” moment for contrarians, then I don’t know what would.

What is the Prediction for GM Stock?

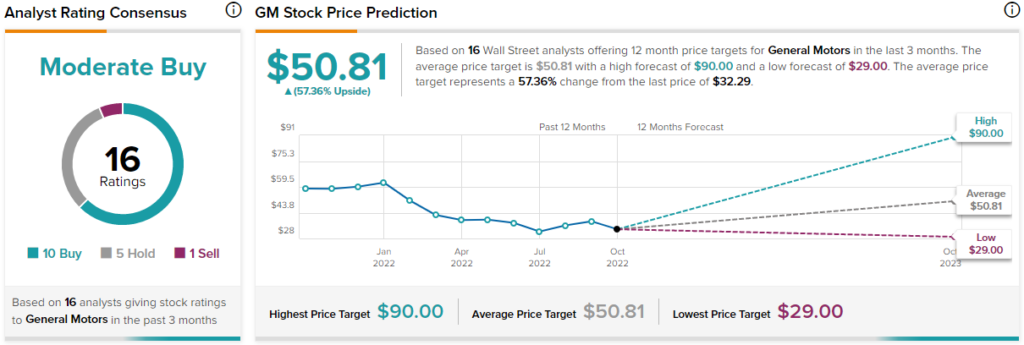

Turning to Wall Street, GM is a Moderate Buy, based on 10 Buys, five Holds, and one Sell rating. The average General Motors price target is $50.81, implying 57.4% upside potential.

Conclusion: Should You Consider General Motors Stock?

With analysts’ and retail traders’ expectations for U.S. automakers being so low now, this is a prime setup for an earnings beat and future upgrades. Sure, it’s emotionally difficult to buy when others are selling, but that’s what it means to be a true value investor.

So, don’t be fearful if you’re planning to scoop up a few cheap shares of General Motors stock. Frankly, analysts likely did you a favor by making already-cheap GM shares an even more compelling bargain.