There is no doubt investors have taken to the EV (electric vehicle) story. Tesla’s (TSLA) valuation has surged far above any well-known car manufacturer even though its sales are nowhere near the top-end of the market. Other players who have entered the market – Nikola (NKLA), Nio (NIO) – have accrued large valuations at odds with those of depressed legacy auto makers.

Which brings us to General Motors (GM). The stock is down by 17% year-to-date even after reporting solid Q2 earnings. Deutsche Bank analyst Emmanuel Rosner argues the auto giant can capitalize on the shift in consumers’ tastes.

Rosner said, “We reiterate our strong view GM should spin off its electric vehicle operations and capabilities into a stand-alone company which could force the market to recognize its robust EV technology and upcoming lineup and (a) unlock considerable shareholder value, (b) give the new entity large access to cheap capital to fund expected growth and (c) provide ability to attract and retain high-caliber talent.”

The idea isn’t one at disconnect from reality. CEO Mary Barra’s response to Rosner’s probing on the issue during the company’s 2Q earnings call suggests to Rosner that “GM is actively evaluating the option.” However, Rosner also argues investors do not “view a spinoff as likely to happen, which offers an attractive setup for the stock.”

Rosner’s point is further bolstered by the fact GM already has all the required infrastructure and boasts “strong EV capability and upcoming product plans.” That said, Rosner notes perception remains part of the problem. The massive capital being showered on new EV set ups indicate to Rosner the challenge lies in “how to get investors to recognize the value of electrification technology within large legacy organizations.” A spin off then, could unlock this value.

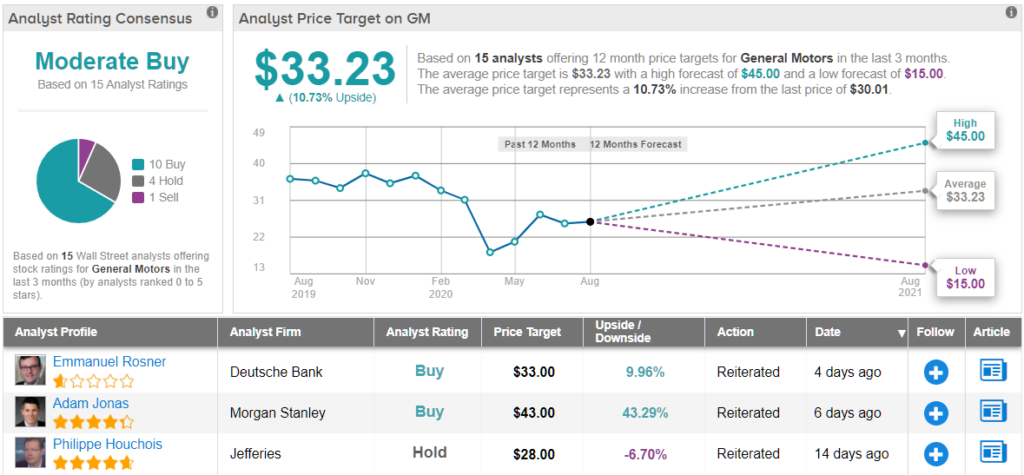

Accordingly, Rosner reiterated a Buy on GM shares. The $33 price target stay put for now, although an “EV spinoff could boost it considerably further.” Still, upside from current levels comes in at 18%. (To watch Rosner’s track record, click here)

The rest of the Street’s outlook for GM tells a similar story. With 10 Buys, 4 Holds and 1 Sell, the auto giant has a Moderate Buy consensus rating. The average price target is almost identical to Rosner’s, and at $33.23, implies possible upside of 19%. (See GM stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.