People and pets eat every day. General Mills (GIS) helps fill people’s tummies by delivering baking products, cereals, dough and pastries, fruit, ice cream, prepared meals, organic and natural foods, pet foods, pizza, and much more. The company sells its products in over 100 countries across six continents, and its market cap is nearly $38 billion.

If you own General Mills shares, consider holding them. With the nation in recovery mode from the pandemic, I am bullish on food stocks and General Mills in particular. (See Analysts’ Top Stocks on TipRanks)

Sometimes, we are so familiar with a company and its brands that investors pay scant attention. The top eight GIS brands each generate more than $1 billion in retail sales worldwide.

Cheerios brands are the most popular cereal by revenue and units sold in North America. General Mills ranks twenty-first among worldwide fast-moving consumer goods companies. It also ranks eighth among the leading food and beverage companies in North America, and fourth among leading confectionery companies.

Food Can Be Pleasant

General Mills posted gains in market share over the last 34 consecutive months. This progress is due to marketing and product innovations. It’s not just success in cereal sales, though. Pillsbury refrigerated doughs sprang five points in market share over the past three years.

The company is spending almost three-quarters of a billion dollars on advertising and media worldwide in 2021 to boost its brands. Spending is about 28% greater than three years ago. Marketing platforms are changing. The focus is on data-led native advertising to attract new and younger customers.

The Board ordered a dividend payment of $0.51 on November 1, 2021. It represents 123 years of uninterrupted payments. The dividend growth is 13 years strong, and the forward yield is 3.3%.

In Fiscal Year 2021, GIS generated net sales of $18.1 billion besides the $1.1 billion generated from joint ventures. The share price hovered in the mid-$50s last spring, rose to above $64, and eased back to its current $61. In Q1 2022, GIS reported EPS of $0.99 versus the expected $0.89.

Sentiment Is No Substitute for Success

Despite slow ~1.8% revenue growth year-over-year, its gross profit margin is a healthy 35.3%, net income margin is nearly 13%, and return on equity is 25.7%. Also, earnings have grown 8% in each of the past five years. However, insiders own less than 0.25% of shares.

Bloggers are bullish on the company, but the TipRanks Smart Score ranks it as a 2 out of 10, indicating an Underperform rating. Investor sentiment is also very negative. Despite this, the technicals are positive, and the fundamentals are healthy.

Hedge funds and insiders are selling. Insiders bought many more shares between May and August of this year. Nonetheless, they began selling as the share price rose from about $58 to +$62 in September.

Wall Street’s Take

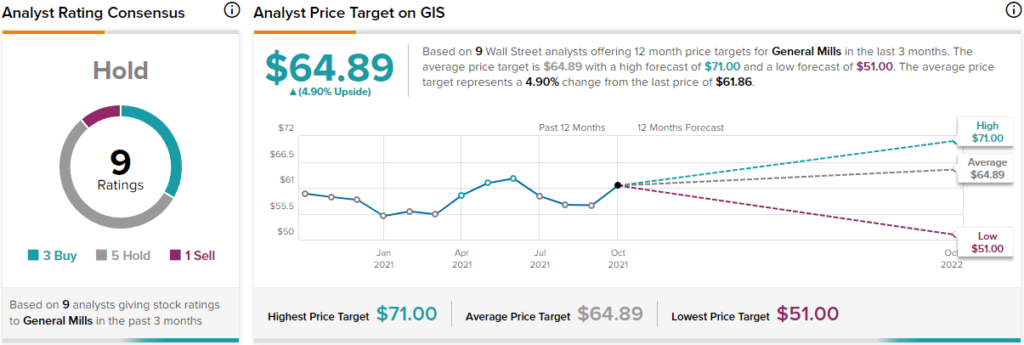

Turning to Wall Street, the consensus rating is a Hold, based on nine analysts’ forecasts. Three analysts rate it a Buy, five analysts rate it a Hold, and one analyst rates it as a Sell. The average General Mills price target of $64.89 per share implies 4.9% upside potential.

Bad News Bears are Overly Anxious

The risks of bad news are overblown, in my estimation. The talk about a global tax on multinational corporations will likely stall in the face of nationalistic self-interest. Hoarding is at a minimum.

A non-scientific study I conducted among shoppers in my family confirms that shortages are spotty. Empty shelves are due to restocking problems of labor shortages and some supply chain delays. There are plenty of alternative products to buy. Shoppers confirm some canned goods, poultry, cuts of beef, and pet supplies are spotty, here and there.

Snacks may be out-of-stock because kids are home more and work-from-home income earners are munching. Beverages are out-of-stock because cans and glass bottles are temporarily harder to source. These disruptions might affect corporate bottom lines over the next couple of reporting deadlines, but probably only slightly.

Consumer preference favors frozen and packaged foods. Convenience food purchases are trending higher. Inflation is not necessarily a deterrent to GIS’s profits either. Stores and online shopping sites are passing along price hikes to consumers.

While sales in retail grocery chains fell a bit, they rose significantly in pet foods and convenience stores across Europe, Australia, Asia, and Latin America.

The Bottom Line

I think it is reasonable to expect a 9% total annual return from GIS. General Mills reported that pet food sales increased 25% to $488 million in Q1 2022 after acquiring a pet treat business. The CEO told analysts, “Our pet segment now generates $2 billion in net sales, with attractive margins and significant growth ahead.”

GIS is less volatile than three-quarters of the U.S. stock market. Shares were lower this year than last year only 9% of the time. Shares are up nearly 4% since the last financial report.

I cannot dismiss existential risks off-hand. I am more cavalier having full confidence in management and brands, the digital marketing campaign, and innovations. I am bullish on GIS at around the $60 price range over the long term.

The Oracle tells investors to buy what they like. I like Cheerios and ice-cold milk, even at midnight.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.